Robotics suppliers are making it easier for Asian businesses to earn about warehouse automation. In April, AutoStore opened a new office in Singapore to serve local partners and clients in the Asia-Pacific region.

“AutoStore sees strong growth in automation in the region,” said Philipp Schitter, vice president of business development for APAC at AutoStore. “Two of our partners are headquartered here, and we already have a market.”

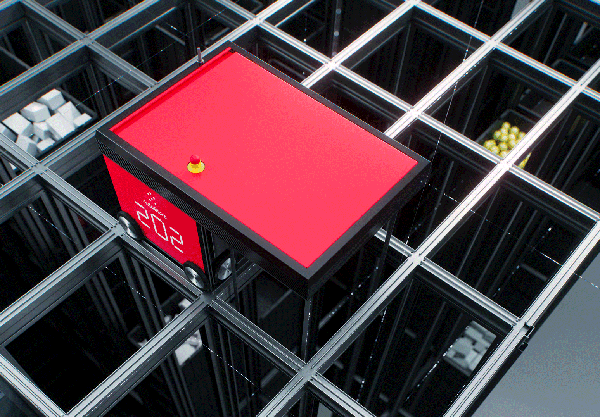

Founded in 1996, AutoStore said it is a pioneer in dense cube storage automation. The Nedre Vats, Norway-based company said it has installed more than 850 automated storage and retrieval systems (ASRS) in 45 countries. It works with systems integration partners for sales and service.

Singapore a hub for international business

Why Singapore? The Southeast Asian island city-state has the world's second-highest robot density, with 605 robots per 10,000 employees in 2021, according to the International Federation of Robotics (IFR). It also has the advantage of being “neutral turf” between Japan, China, and other large countries.

“With our new location, the office is not just to sell into the Singapore market, but also to serve as a hub for the larger APAC region,” Schitter told Robotics 24/7. “We have opened a subsidiary in Japan and another in South Korea.”

While Singapore can be expensive, it offers several other advantages, he noted. “We see a lot of corporate headquarters here,” noted Schitter. “Space is very precious here, so everything is expensive.”

“Cost pressures are a good driver for automation,” he added. “From here, we can serve the larger Southeast Asian market, as well as Australia.”

“Also, many people speak English here, which makes life easier for international clients to enter,” Schitter explained. “A lot of decisions for supply chain optimization happen here, and it's easy to travel to clients and conferences.”

AutoStore plans for market expansion

At a recent “investor day” in London, AutoStore claimed that it experienced a 40% to 50% compound annual growth rate (CAGR) globally in the past year. “We've had even larger growth in APAC, but it's still a smaller base to grow out of,” said Schitter.

“AutoStore comes in quite handy when addressing trends like the shift in consumer behavior to e-commerce, which is slowing a bit as the pandemic eases,” he said. “Seventy percent of our clients are largely in e-commerce, with many in retail, apparel, and grocery.”

“Our new R5+ robots provide a larger bin, and by expanding that volume, we see a wider area of applications,” Schitter said. “We're also entering different ambient conditions—systems for chilled or frozen goods are on our roadmap.”

With rising labor shortages and costs, customers are also evaluating ASRS for production of everything from metal parts to electronics, he said. AutoStore is working with its partners to focus on retail, healthcare, and other markets, according to Schitter.

“We've announced a total of about 30 business-development managers, and we'll invest heavily in staff for both our offices and production faciliites,” he said. “Through our partner network, we can reach clients with 2,000 sales representatives. We're doing a lot to educate the market on the potential of our cube storage in terms of space efficiency, shrinking warehouse by a factor of four or multiplying it by four.”

“Our largest competitor is still the manual warehouse; we don't typically lose projects ot other technologies,” Schitter said. “There's still so much potential for all the automation out there.”

ASRS provider builds supply chain resilience

The company plans to open another production facility to reduce transportation costs and delivery lead times, he said. Like other technology providers, AutoStore has dealt with supply chain disruptions.

“We distinguish between modules—everything that moves, including robots and parts,” Schitter said. “We produce these modules out of Poland for the global market, and we want to get our people and products as close to the customer as possible.”

“For larger volumes of, say, aluminum extrusion parts, in 2019, we had only two suppliers,” he noted. “Now, we have 11, and by the end of the year, we'll have 14 out of nine different countries. Bins can also be hard to transport, but we now have certified suppliers in Japan, China, and Australia to reduce costs and time.”

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up