Sales of professional service robots rose 37% in 2021, according to the International Federation of Robotics, or IFR. By region, the strongest growth came from Europe with a market share of 38% followed by North America with 32% and Asia with 30%.

Sales of new consumer service robots grew by 9%, according to IFR’s “World Robotics 2022—Service Robots.”

“Service robots for professional use are extremely diverse,” said IFR President Marina Bill. “They are usually designed to perform a specific task and can be found in warehouses, in hospitals and airports or even helping on dairy farms automatically milking cows.”

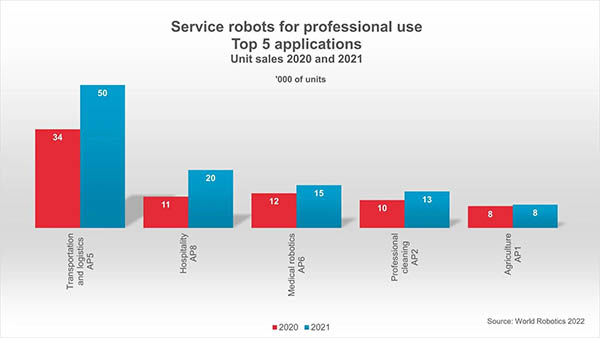

Top 5 applications for professional service robots

About 121,000 professional service robots were sold in 2021 - more than one out of every three built were targeted for the transportation of goods or cargo. The majority are used in indoor environments e.g factories. A total of 286 companies are producing service robots in this category, according to IFR.

Hospitality robots enjoy growing popularity but compared to market potential, sales figures are still low: More than 20,000 units were sold in 2021, an increase of 85%, the IFR has found. Robots in this category are either used for food and drink preparation or for mobile guidance, information, and telepresence.

Sales of medical robots were up 23% to 14,823 units. The majority are surgical robots, followed by robots for rehabilitation and non-invasive therapy, while the share of robots for diagnostics is still comparably low.

Demand for professional cleaning robots grew by 31%. Sales of more than 12,600 units were reported. The main application in this group is floor cleaning. Disinfection robots that spray disinfectant fluids or use ultraviolet light to destroy viruses have also seen a strongly growing demand since the start of the Covid-19 pandemic, the IFR reported. Other professional cleaning helpers are, for instance, professional window, pool- and solar panel cleaning robots.

Robotics plays an important part in the digitalization of agriculture with more than 8,000 units sold in 2021, an increase of 6% from 2020. Robots are well established in cow milking, assisted by robotic barn cleaners and feeding robots, it said. Robots for the cultivation of crops are still in their early days.

Service robots for consumer use

“Service robots for consumers are mainly used in domestic environments: They help with vacuuming, floor-cleaning, or gardening, and are also used for social interaction and education,” Bill said. “These service robots are produced for a mass market with completely different pricing and marketing compared to service robots for professional use.”

Robots for domestic tasks constituted the largest group of consumer robots. Almost 19 million units were sold in 2021, an increase of 12 percent from 2020. Vacuuming robots and other types of cleaning robots used for domestic floor cleaning are the most popular. Those kind of service robots are available in almost every convenience store, making it easily accessible to consumers, it said.

The IFR considers lawn-mowing robots as gardening robots. This market is expected to grow by low double-digit growth rates on average each year over the next few years.

Robots used to help older residents age in place are a growing niche market, according to IFR.

Service robotics industry structure

Although the service robotics industry is a young and growing industry, 87% of service robot producers worldwide are considered incumbents that were established before 2017. The share of start-ups has decreased in recent years because the industry’s focus has shifted towards software and application development, according to IFR.

Many service robot suppliers use third-party hardware to create a solution and are therefore not counted as a service robot producer in IFR industry structure statistics.

The IFR’s market observation suggests two reasons for the decreasing share of start-ups: Some market segments have already achieved a level of maturity that sees companies growing, for instance, AMRs for warehouse logistics.

Further, founding activities shifted away from the development of hardware towards software development and application development. Many service applications are based on collaborative industrial robots, purchased from an industrial producer. The service robot supplier is therefore not considered a robot producer - the robot is purchased from a third party. These companies act like system integrators, combining different components and developing software to create a solution.

Earlier this month, the IFR outlined the findings of its industrial robotics report.

Article topics

Email Sign Up