Forget General Motors, forget Ford.

Tesla is now the largest car manufacturer in the United States.

While that is untrue for obvious reasons, the Californian electric car maker is in fact the country’s most valuable automobile company in terms of market capitalization.

Having surpassed Ford as recently as last week, Tesla’s share price continued to climb on Monday, causing the company’s market cap to edge past General Motors by the end of trading on Monday.

Considering the fact that Chrysler, the third of Detroit’s famous “Big Three” is no longer American-owned (it is a subsidiary of the Italian car company Fiat Chrysler), people are already starting to label Tesla, GM and Ford as the “New Big Three”.

For decades, the U.S. has taken pride in the Big Three as the country’s largest automobile manufacturers.

All headquartered in Detroit, the epicenter of the U.S. car industry, the Big Three (and the supplier industry behind them) provide hundreds of thousands of manufacturing jobs in the country and drive a significant portion of the U.S. economy.

Is Tesla really ready to join that club?

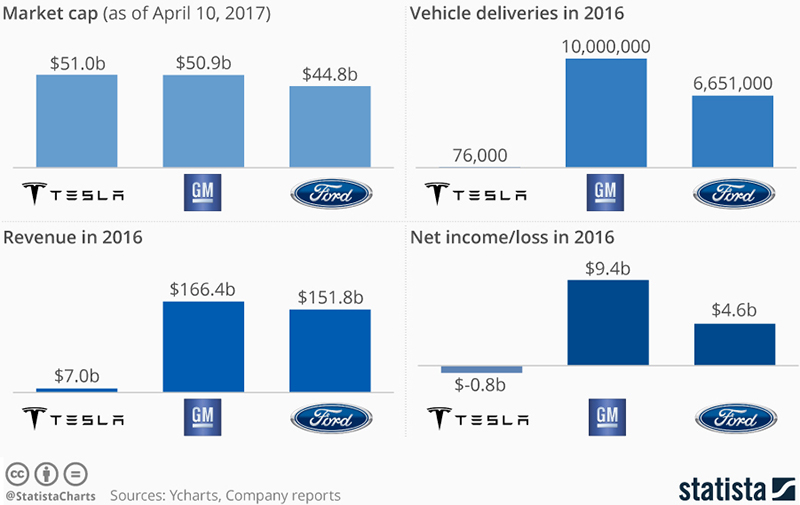

As our chart illustrates, Tesla’s numbers don’t really match its valuation yet.

The Numbers Behind the 'New Big Three'

The company produces a fraction of the number of vehicles that GM and Ford produce; it trails in revenue and has yet to become profitable.

Tesla’s current valuation is driven by the belief that the future of mobility is electric and that the company has enough of a headstart to eventually dominate that future.

Read Mobility of the Future: Examining Future Changes in the Transportation Sector

Related Article: What Intel’s $15.3 billion Acquisition of Mobileye Means in the Age of Driverless Vehicles

Related White Papers

Build-to-Demand: Leveraging Real-Time Data Across an Automotive Manufacturers Value Chain

In this white paper we survey the automotive industry landscape and propose the value proposition delivering a build-to-order solution, we discuss the challenges to transitioning to a build-to-demand strategy, and we examine the key enablers for build-to-demand. Download Now!

Automotive Inbound Supply Best Practices

This white paper looks at executing strategies required by manufacturer’s to fully leverage the potential of today’s innovative network-based supply chain systems and processes, and how to fully engage the knowledge and capabilities of an extended enterprise across the supply chain in real time. Download Now!

Article topics

Email Sign Up