The North American robotics market has continued its strong growth in response to increasing demand in industries beyond automotive, as well as labor shortages exacerbated by the COVID-19 pandemic, reported the Association for Advancing Automation (A3) today.

Third-quarter 2021 sales brought the total number of orders so far this year to nearly 29,000 units valued at $1.48 billion, the best numbers ever recorded for the North American robotics market, said Ann Arbor, Mich.-based A3.

The number of units sold increased by 37%, up from 21,072, and 35% in value, up from $1.09 billion, over the same period in 2020. It surpassed the previous highest records from 2017 by 5.8% and 0.5%, respectively.

In Q3 alone, North American companies ordered 9,928 robots valued at $513 million, up 32% and 35% respectively, over the third quarter of 2020. This marks the third-highest quarter ever in units ordered and fifth highest in value, said the organization.

“With labor shortages throughout manufacturing, logistics, and virtually every industry, companies of all sizes are increasingly turning to robotics and automation to stay productive and competitive,” stated Jeff Burnstein, president of A3. “As our latest statistics indicate, sales are on track to make 2021 the biggest year ever for robotics orders in North America.”

New industries add automation

While automotive manufacturing remains the biggest user of robotics, other industries and small and midsize enteprises (SMEs) are adopting or adding automation, said A3.

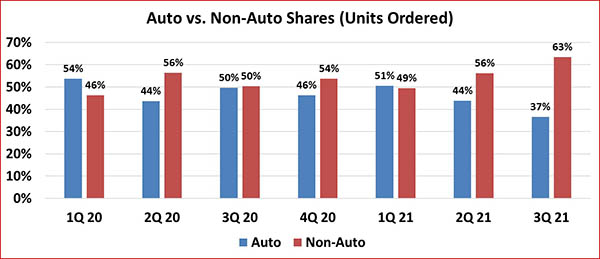

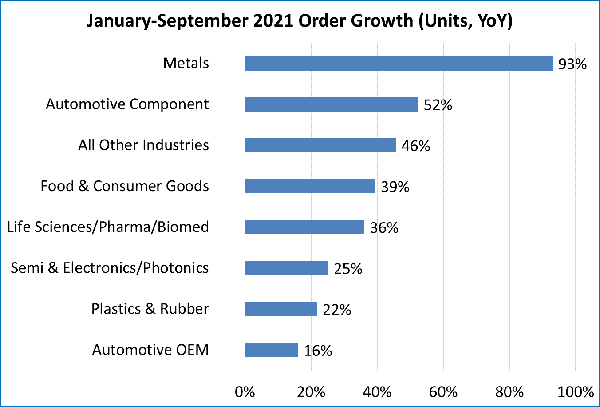

In the first nine months of 2021, automotive-related orders increased 20% year over year to 12,544 units ordered. Non-automotive orders outpaced this growth, expanding 53% to 16,355 units ordered. This is only the second time non-automotive orders have surpassed automotive-related orders in the first nine months of a year. The first was in 2020, according to A3.

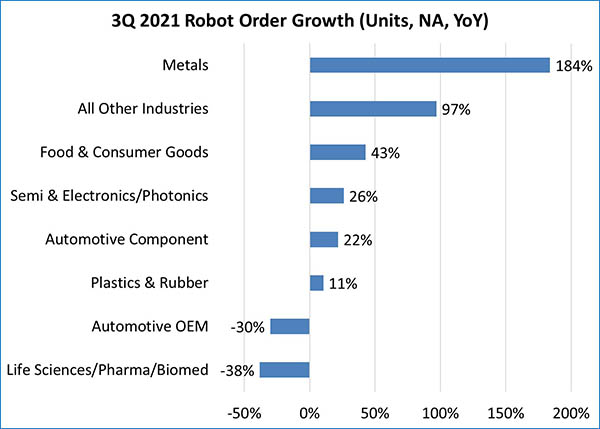

In Q3 2021 specifically, nearly two-thirds of sales, or 6,302 orders, came from non-automotive industries. This was further demonstration of the trend of robotics growing in areas outside of automotive OEM and tier suppliers, A3 said. Unit sales from non-automotive industries in Q3 saw the following increases over the same quarter in 2020:

“More industries that were low-level users have started substantially increasing the numbers they're buying,” Burnstein told Robotics 24/7. “While automotive is still buying lots of robots, the smaller segments are collectively a larger percentage of robot orders, which is a very positive long-term story.”

“For instance, welding is becoming a pretty hot area,” said Burnstein. “This includes small metalworking shops for all kinds of products, but we don't classify it in great detail.”

“While we're still not seeing huge numbers in agriculture and construction, we know there are opportunities,” he said. “But we are seeing life science, pharmaceutical, medical devices, food processing, and consumer goods segments going up.”

“If anything, we're under-reporting the growth in sales of all types of robots,” he acknowledged. “We don't have numbers on AMRs [autonomous mobile robots] or collaborative robots yet, and these segments may be growing even faster than traditional industrial robots.”

Macroeconomic factors

While there was a brief decline in demand for automation last year because of trade tensions and pandemic-aggravated slowdowns, it has steadily increased since then, said A3. A combination of supply chain concerns, labor shortages, and accelerated e-commerce demand have led to more robotics use.

“According to the Reshoring Institute, reshoring of production is at record highs due to supply chain issues,” Burnstein said. “While we don't yet know the impact of inflation on robotics orders, I keep hearing—it doesn't matter the industry: warehousing or manufacturing—labor shortages are the primary driver of automation right now. Everyone needs robots to keep up production to meet demand.”

Most industrial robots are made in Asia or Europe, but they are sold through U.S.-based subsidiaries, noted Burnstein. “However, much of the integration services, software, AI, and vision systems come from U.S. suppliers,” he said. “All those technologies work together, and a lot of mobile robots come from U.S. companies.”

Manufacturer and A3 member 3M has experienced the trends firsthand.

“3M is seeing an upswing in providing automated solutions and processes for our customers, but as a manufacturer ourselves, we are also increasingly investing in automation,” said Carl Doeksen, global robotics/automation director at 3M’s Abrasive Systems Division. “The pandemic put a spotlight on the benefits that automated processes bring—from the ability to ramp up and scale up production quickly and efficiently, to helping improve the lives of our employees, our customers, and their families.”

Looking ahead

Unlike other market analyses, A3's reports are based on data from robot manufacturers and its members, said Burnstein. “They're providing us actual numbers on a quarterly basis,” he explained. “Getting accurate data that's not shared with other companies is critical to the validity of that data. We don't have a vested interest and have been getting actual sales and shipment figures by segment since 1984.”

“It's hard to predict growth quarter by quarter, but the long-term story is that we're adding more and more robots,” Burnstein said. “If you look at the future of robotics and automation, it's still early days.”

In addition, growing demand for hardware, software, and services is providing new career opportunities. “Not only is there so much opportnity on the technology side, but there's also sales, maintenance, and business development,” said Burnstein. “I just had a discussion with Georgia Tech, and a student there told me it convinced him to go into robotics.”

This week's reopening of U.S. borders to more countries as the pandemic subsides is good news for robotics suppliers and users, said Burnstein. After a successful AMR and Logistics Conference in Memphis, A3 is looking forward to hosting its Automate event in Detroit in June 2022.

“Automate 2022 is still the largest individual event for robotics customers, OEMs, and component suppliers,” noted Burnstein. “We've had people from more than 60 countries attend. Next year's show in Detroit will be larger than any show we've ever held. As one of the manuacturing centers of the country, automation is transforming Detroit's role. We're hosting preview webinars now on topics such as collaborative automation and motion control.”

“It's hard to read those quarterly numbers and not be excited about automation's potential for U.S. manufacturers of all sizes,” he said.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up