As businesses get back to work after pandemic-induced pauses, more and more are turning to automation for help. In the second quarter, robot orders increased by 67% over the same period last year, said the Association for Advancing Automation yesterday.

North American companies ordered 9,853 robots worth a total of $501 million in Q2 2021, up from 5,196 sold during the early peak of the COVID-19 pandemic in Q2 2020, according to the Association for Advancing Automation (A3). Last quarter's increase marks the third-highest quarter on record for robot units sold overall, added the Ann Arbor, Mich.-based organization.

“With the big increases in automation sales, and favorable economic conditions in U.S. manufacturing sector throughout much of 2021, it’s clear users have accelerated their orders for robotics and other forms of advanced technologies,” stated Jeff Burnstein, president of A3. “By automating—either for the first time or expanding on how they use automation—companies will be better prepared to handle any upcoming issues that impact their business.”

“The pandemic acted as an accelerant,” he told Robotics 24/7. “From the difficulty in bringing people in to work to the difficulty of finding people to work, it jumped out. The labor shortage is real, and it is forcing companies to automate.”

Non-automotive growth continues

In addition, more than half of Q2 2021 orders (5,530) came from non-automotive customers in industries such as metals, electronics, food, and healthcare. A3 said this reflects the increasing recognition of the potential benefits of automation across sectors.

“This was on par with our expectations,” said Burnstein. “With demand accelerating in every industry, we're not surprised at the strength in numbers. While this may not continue going up at that rate forever, exposure to general non-automotive industry—which is as large or larger than the automotive space—is encouraging for the long term.”

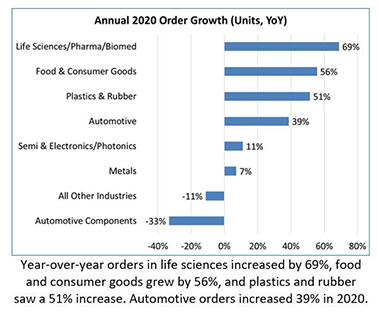

According to A3, the most substantial increases in robot orders in Q2 came from companies in the following segments:

- Metals, up 99% over Q2 2020

- Automotive components, up 85%

- Semiconductor and electronics/photonics, up 62%

- Plastics and rubber, up 51%

- Food and consumer goods, up 51%

- Automotive OEMs, up 49%

- Life sciences/pharmaceutical/biomed, up 21%

Component technology markets have record growth

In addition to the large increase in robotic orders, machine vision, motion control, and motor markets had record increases over Q2 2020, reported A3. The North American machine vision market expanded 26% to $764 million, a new record.

For January through June of 2021, the North American machine vision market grew 18% to $1.5 billion, which is the best start to a year on record, A3 said.

The motion control and motors sector recorded $1.065 billion in shipments, 13% greater than Q2 2020 sales and setting another record. Motors, actuators, and mechanical systems and electronic drives saw the largest increases.

“This is all part of the same trend, as technology improves and new spaces emerge,” Burnstein said. “Five years ago, the logistics space wasn't as big as it is now, and mobile robots are not yet part of our numbers.”

What about collaborative robots? “Cobots may not be getting as much attention as they should be because of the recent focus on AMRs [autonomous mobile robots],” Burnstein said. “But they contuinue to grow as traditional robot makers like ABB, FANUC, KUKA, and Yaskawa become active in that space.”

Consolidation and integration

Both increasing demand and improving technologies have led to numerous partnerships and company fundings.

“Consolidation will likely continue,” said Burnstein. “There's so much money invested in robotics now, which is a sea change from five to 10 years ago, when nobody was investing in robotics hardware.”

“At last week's AMR and Logistics Conference, we saw Cascadia Capital, Cambridge Consultants, and others looking for opportunities,” he said. “There will be lots more startups and mergers and acquisitions to come.”

A3 also counts integrators among its members. How important is their role as robotics usage grows?

“As you look at more industries starting to automate, they'll need assistance,” Burnstein replied. “Most companies don't have the resources to put in all of these technologies together, so integrators will continue to play a key role.”

“The revitalization of automation we’re seeing across myriad industries is extremely encouraging,” Burnstein added. “Not only will the increase in automation use be a win for our member companies, but it will also help the U.S. economy grow even more as customers increase productivity and fill the millions of manufacturing jobs that remain unfulfilled.”

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up