The past few weeks have been difficult for the robotics industry, with several announcements of layoffs and shutdowns. At the same time, however, robot sales, funding, and demand continue to set records. What's really going on?

The setbacks included the following:

- Argo AI LLC—This Pittsburgh-based autonomous driving developer announced last week that it is was laying off 150 employees, about 5% of its global workforce of more than 2,000 people, according to TechCrunch. Ford Motor Co. and others have invested in Argo AI, which last year launched self-driving deliveries with Walmart Inc. in Miami; Austin, Texas; and Washington, D.C. The company this week said it will shut down its operations in Washington, D.C.

- Chowbotics Inc.—DoorDash Inc. acquired Hayward, Calif.-based Chowbotics in 2021 but last week said it is shutting down the salad-making robot startup. While DoorDash has launched its own robotics division and has filed a patent around autonomous delivery vehicles, reported Restaurant Dive, it's not yet clear what will happen to Chowbotics' staff or intellectual property.

- Get Fabric Inc.—New York-based Fabric raised $200 million in Series C funding in October 2021 and opened a micro-fulfillment center in Dallas in April. This week, the company laid off 40% of its 300-person staff and named a new CEO as part of a reorganization to being more of a platform provider than a service provider. “Most of our customers told us they prefer to operate our system on their premises and with their own teams,” CEO Avi Jacoby told TechCrunch.

- Nuro Inc.—The Mountain View, Calif.-based company, which we named a “delivery robot company worth watching” back in March, raised $600 million in Series D funding in November 2021. Yesterday, Nuro laid off 10 people in its offices in Phoenix, Houston, and Mountain View, Calif. It's closing its Phoenix office but will continue to operate out of Tempe, Ariz., as it shifts from on-road operations to teleoperated vehicles.

- Pudu Technology Inc.—Pudu Robotics, which makes mobile robots for indoor deliveries in restaurants, disinfection, and hospitality, raised close to $155 million last year. The Shenzhen, China-based company last week laid off workers, reported the South China Morning Post. While service robots have been popular in Asia, CEO Felix Zhang Tao cited the ongoing COVID-19 pandemic, falling private equity investments, and the long road to profitability.

- Starship Technologies—San Francisco-based Starship, which has developed and tested autonomous delivery robots, raised $100 million early this year. Last month, the company said it was “reducing headcount” by 11% to meet profitability goals, as its pilot with The Save Mart Cos. ended.

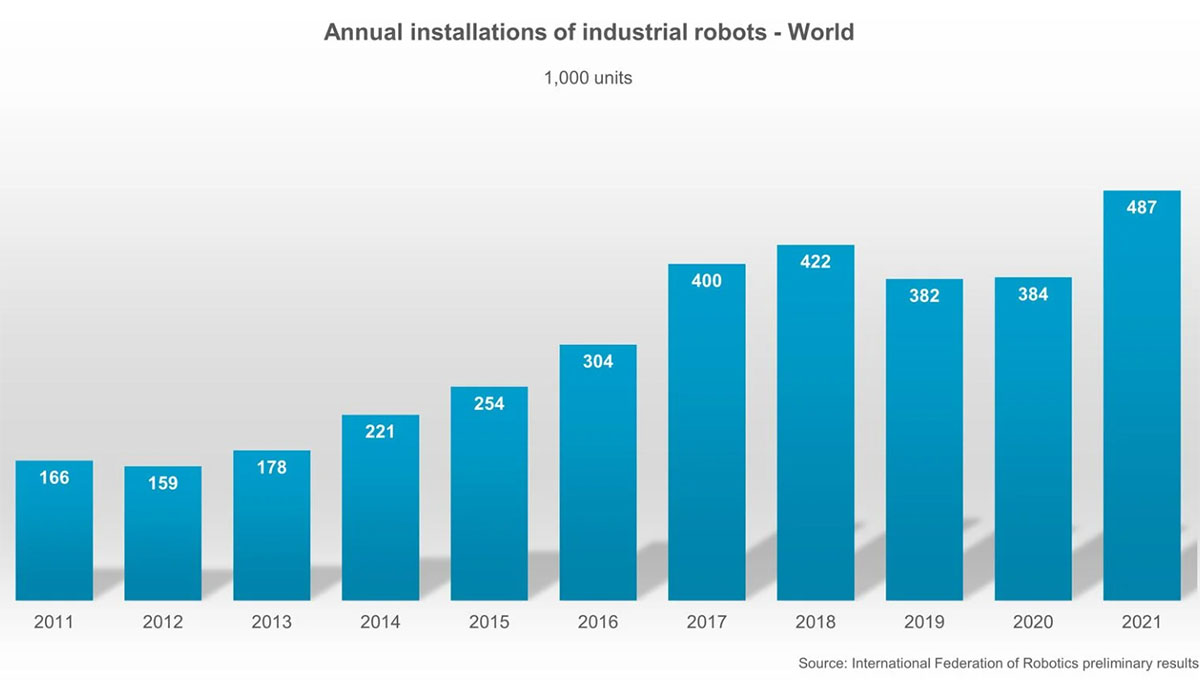

At the same time, the Association for Advancing Automation (A3) noted that North American robot sales increased by 43% in value year over year in the first quarter of 2022. Similarly, the International Federation of Robotics (IFR) reported a 28% increase in industrial automation orders between the first quarter of 2022 compared with the same quarter last year.

In addition, Robotics 24/7 has tracked up to $16 billion in robotics, 3D printing, drone, and autonomous vehicle transactions so far this year, including more than $920 million this month. In July alone, additive manufacturing provider VulcanForms raised $355 million, service robot developer XPENG Robotics obtained $100 million, autonomous mobility firm May Mobility closed on $111 million, and autonomous aircraft developer Merlin Labs raised $105 million.

Robotics experts weigh in

Robotics 24/7 spoke with several leading industry observers to determine whether robotics users, suppliers, or developers should worry about recent setbacks or talk of inflation and recession.

A 'reality check' for robotics

“I’m starting to wonder if the #Robotics Industry is going to make Rightsizing the Word of the Year,” wrote Aaron Prather, senior technical adviser at FedEx Express, in a LinkedIn post. “Not to say that it is a bad thing, but it is very clear that there are some use cases that are not ideal for robotics and that some companies are 'overpromising and underdelivering' because the tech is simply not there yet. Another term for this is 'Reality Check.'”

Prather, who will deliver the keynote at our upcoming Robot Applications Conference, added that these are the growing pains of a maturing industry and that some venture capital firms (VCs) should be more patient and do their due diligence.

“I do think VCs are starting to push for quicker turns on their investments, and that is something many of these firms can’t do, he told Robotics 24/7. “However, I blame the VCs for not doing their homework before putting their money into them. There needs to be more due diligence, especially now more than ever as financial markets lean more towards less risk taking.”

Applications matter, according to A3

Not only must robotics startups manage investor expectations, but they should also focus on solvable problems, said Jeff Burnstein, president of A3.

“I think this is a difference between certain types of applications,” he said. “Autonomous mobile robots are growing rapidly in warehousing and distribution applications, but that doesn’t necessarily mean that the type of service applications companies like Starship and Pudu Robotics are focused on are seeing the same type of growth.

“Companies like Chowbotics continue to face challenges, as we are still in the very early stages of global adoption of service robotics,” Burnstein said. “Autonomous driving has taken longer to develop than many people expected, so it’s not surprising to see that impacting companies focused on that space.”

“Even in technology areas that are growing rapidly, we’ll always see winners and losers,” he said, adding that “I’m not suggesting any of the companies laying off people are 'losers,' just making a general statement. I know nothing about the specifics of any of these companies, so it’s always possible there are other factors in play.”

Challenges for China

While global growth appears to be a given, the world's largest user of robotics has been hard-hit by the pandemic, noted Georg Stieler, managing director for China at Stieler Technology & Marketing in Shanghai.

“The IFR reports their global numbers usually with a six-month delay,” he said. “This means that the effects of the lockdowns in China and in Shanghai in particular have not been reflected in these numbers yet.”

“We will know our China numbers for Q2 2022 by early August,” Stieler explained. “At this point, we expect that robot sales there dropped by around 30% during this period. Reasons for that were ongoing travel restrictions within the country, worsened supply chain issues due to ports operating at limited capacity, the fact that not only the top four robot companies have their main operations in and around Shanghai, as well as a generally poor investor sentiment in this climate of uncertainty.”

While volatility and COVID-19 restrictions could continue, demand in certain markets will continue to grow, he added.

“I am not surprised by the current turmoil at some Chinese robotics startups,” said Stieler. “Since I have started working in China, new trends have always emerged at higher speeds and larger volumes, but also shown greater volatilty. Venture capital and robotics are no exception.”

“There are certainly segments that do better than others,” he said. “In mobile robots, for instance, the low-hanging fruits in warehouses have been picked, and companies are now looking more into factory applications, which are technically more demanding. ... We still see positive developments along the NEV [new energy vehicle] supply chain and in healthcare and semiconductors.”

Still bullish on the potential of robotics

Oliver Mitchell, managing director at ff Venture Capital (ffVC) in New York, told Robotics 24/7 that he's still optimistic about robotics companies at different stages of development.

“At ffVC, we invest in early-stage companies and continue to see expansion,” he said. “Our portfolio companies continue to exceed expectations. For example, Civ Robotics automates surveying and construction workflows. Only 14% of surveyors pre-pandemic were under 34.”

“There is a real trend of robots filling the need for manual labor. There was already a shortage of migrant workers for picking grapes before the pandemic, which increased sales for our portfolio company Burro,” said Mitchell. “Plus One Robotics provides vision guidance for logistics, another area of great activity.”

Why, then, have some robotics companies struggled?

“There has been a lot of hyperbolic activity in the robotics space, with lots of front-page eye candy for consumers,” Mitchell replied. “Now that public markets have constricted SPAC [special-purpose acquisition company] activity, that has created anxiety among startups that relied on that interest. The autonomous vehicle space is in [Gartner's] 'trough of disillusionment' right now.”

Mitchell said that some startups have mismanaged expectations, similar to Burnstein's point about applications.

“Is making salad or pizza the most economical use case?” he asked. “Many of these high-profile redirections reached 'unicorn' status [with $1 billion valuations], but they couldn't meet revenue targets.”

“We saw companies getting ahead of themselves and expanding their teams too fast,” he added. “Once certain companies get to be large, they act like sports teams—'I don't just want three midlevel engineers; I want one of the best.'”

“We can't control the market, but we can de-risk it. At ffVC, we focus on founder-friendly and accurate valuation,” Mitchell added. “Robotics is a tough industry, with a different capital structure than enterprise software. Its scale is different, and the pool of investors is smaller. We see 3,000 deals a year, but we only invest in 10. We kiss a lot of frogs.”

“At the end of the day, automation has to be tied to real business needs,” said Mitchell. “The best year to invest in mechatronics startups was 2008, during a downturn and the year ffVC was founded. Adversity breeds creativity. I'm bullish on automation that makes sense in promising areas such as infrastructure, logistics, and healthcare.”

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up