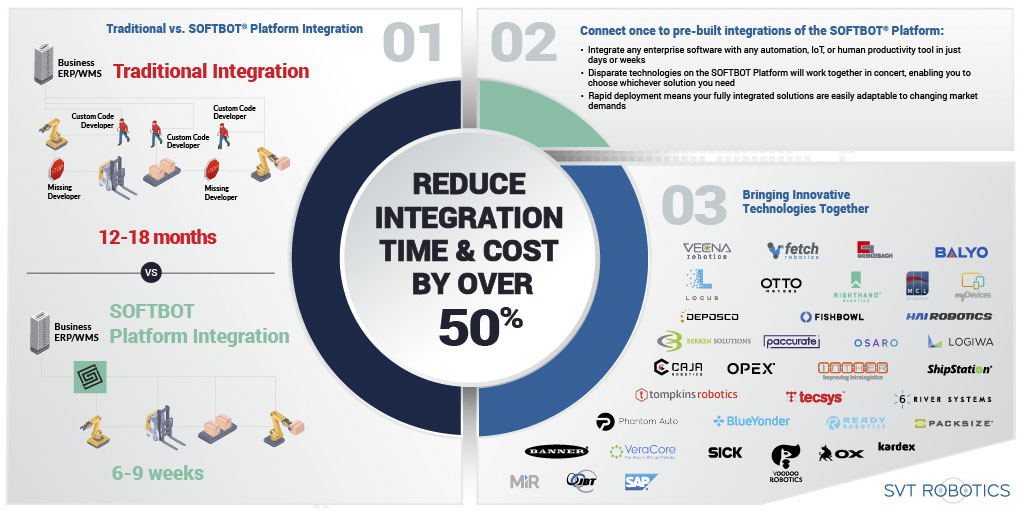

While many distribution center and warehouse operators are interested in robots, deploying them can be intimidating. SVT Robotics Inc. has developed the SOFTBOT platform to accelerate the adoption of automation.

The Norfolk, Va.-based company claimed that its software enables customers to quickly and easily integrate robots, Internet of Things (IoT) devices, and human productivity tools with enterprise systems.

A.K. Schultz, founder and CEO of SVT Robotics, spoke with Robotics 24/7 about the startup's recent accomplishments and its outlook for warehouse and logistics automation in 2023.

SVT Robotics looks back

How long has it taken to get warehouse automation and SVT Robotics to this point?

Schultz: It took four years and millions of dollars to get to this point. To see it unfold in front of customers, it's been worth every day of the past four years.

“SVT” stands for “simplicity, velocity, and transparency.” Data is everywhere, sitting on servers, and used once. It gets dropped, and there's digital pollution. Every piece of data can be recycled into something productive.

Like a turbocharger makes a car more powerful—where exhaust spins a compressor, and waste energy contributes to increased power—this is the transparency element of SVT.

As for simplicity, I heard an IBM vice president once say that competitive advantage is when companies take complexity, encapsulate it, and offer it to their customers in a simple way. Our job is to injest and absorb complexity on your behalf.

Industry warms to robotics

What SVT Robotics achievements of the past year or so are you proudest of?

Schultz: SVT had raised Series A funding back in November 2021, and we launched the big release of our platform at MODEX.

This past year has been a whirlwind, and SOFTBOT resonated deeply with our customers.

How have attitudes toward automation changed?

Schultz: I’ve been doing this since the early 2000s. Back then, only the biggest, most forward-thinking companies were automating in factories and warehouses, which had controlled processes.

By nature, warehouses are adaptive, taking the chaos between manufacturers and retailers. Only big companies like Walmart, Target, Amazon, GXO, DHL, or Kroger could automate.

While we were talking about a labor crisis coming, it was hard work to sell robotics. The companies that leaned in early on are now scaling automation—they've made those investments.

Now, everyone realizes it's happening, and there's no debate over whether to automate. It's now, “How do we do it? How can we make it happen with no skills within the organization?”

SVT partners up to offer easier adoption

How can SOFTBOT help?

Schultz: Our platform is about “de-frictioning” every single element of adoption process. Every week, we’re launching new features to make it easier.

It's not that different than plugging in a printer or putting a Roomba in a room. We're doing everything in our power to make that happen.

SVT Robotics has partnered with Locus Robotics, Osaro, Tecsys, and others. How do you identify complementary offerings?

Schultz: The partner network that we've built has become a big reinforcement loop. We're trying to bring as much value as our partners.

We have robots from multiple companies in our lab in Norfolk. In two months, we've had 12 companies come to see the lab.

In that same timeframe, we demonstrated one company's products twice as much as it has itself. We're showing how everything can hang together, and customers can see how an array of technologies can work in our lab.

We're in discussions to more than triple the size of our lab property to allow the entire public to see how all these things can work together in one place. It's for real, not in a 10x10 [ft.] booth on a show floor. Visitors are picking products.

Demonstrating the value of automation

Can you give an example of an SVT Robotics demonstration?

Schultz: We recently went live with 6 River Systems [6RS] in our lab. We built a micro-warehouse with inventory, installed a WMS [warehouse management system], and created our SVT/Shopify robotics store. [Editor's note: Shopify acquired 6RS in 2019.]

We bought boxes of ramen and put them on the shelves. Now, when someone gets a 6RS demo, they can place an order, and next thing you know, the robots are moving. They can help pick it, and the visitor can get an e-mail that the order is complete.

A customer can see all the workflows, ending with the picked order and confirmation. We're showing this experience from the consumer point of view all the way through.

Some e-commerce companies tell us they wanted to automate. “One week ago, I mapped the warehouse, and now we're picking up and hooked up to your WMS and Shopify, and we're done.” It doesn't have to be a hard experience.

How do you count for edge cases and exception handling?

Schultz: We had a group of IT, operations, and engineering people from a company. They had questions about exceptions: “What if there's not enough inventory, or the robot drops a pallet in wrong place?”

These will happen, as will exceptions that no one thought of. There's no way to unpack it all with a 400-page specifications document that's obsolete. We've believe in embracing the reality of this chaos and coexisting with it.

We pulled up an app with all the blocks and decision trees and said, “Give me a case.” ;Nick [Leonard], our vice president of product, went in and mapped out a case of a lack of inventory.

He drew a logic tree with real blocks and real code, and he built an exception handler right there. People looked at one another astounded that this is possible. It would normally be a one-month specification process, but this is how it should be.

Supply-side challenges

Speaking of shortages, how are supply chain problems affecting the robotics vendors?

Schultz: Material availability is affecting some suppliers—they can't get forklift chassis—and there are lead-time issues with the chip shortage. But these delays are no reason to slow down with robotics.

One of the biggest points of scarcity in this industry is access to customers' IT teams. They’ve become a precious commodity.

They're already maintaining security, enterprise software and, upgrade paths for all systems, and then you've got WMS layers and robots going in. These are $500,000 to $1 million systems, and they’re trying to maintain a $100 million IT infrastructure.

What ends up happening is that the ROI [return on investment] from robotics projects gets lumped in with other projects. Some have existential priority, like security.

The business ask is impossible for an IT group to write point-to-point communication and maintain it. Robot companies have updates three to four times a year.

Our infrastructure pipeline is built with tasking engines—it doesn't matter what device or human—we abstract and insulate them. Our goal is to solve boring software problems so others can do cool stuff with robots.

Do you see consolidation happening in this market?

Schultz: There are rumors of it happening, not just in robotics, but in the general integration space. Accenture picked up MacGregor Partners for its WMS.

A few robotics companies are in deals mode right now. Like Amazon, some end customers have been acquiring players, and we'll see consolidation among robotics companies. The customers struggle with the amount of players.

Talent is a big problem in our industry. Sometimes, it's cheaper to buy a company than to find engineers, and some have lots of capital and see a market opportunity.

THL [Thomas H. Lee Partners] has been successful at this, acquiring Brooks Automation's Semiconductor Solutions Group. SoftBank's $2.8 billion acquisition of 40% of AutoStore is the stuff of legends.

Another axis of consolidation to consider is companies that possessed technology that couldn’t stand on its own but is cool. There are some really interesting components, like perception AI to predict traffic flows from camera data. That's abstract enough that very few end customers that know what to do with it.

SVT is partnering with Ox on augmented reality picking. Integrating AMRs [autonomous mobile robots] with voice picking—there's so much upside from these types of human augmentation.

We pride ourselves that we’re the “Switzerland of robotics.” We're machine-agnostic. There are companies that we think do a great job, but we're not working on selling their robots, but to connect with great technology that's available.

How do you assess new robots?

Schultz: It's important for us to know who's mature and who's more nascent. SVT is constantly scoping the market and seeing what technologies we should introduce to our customer base. It's part of our commitment to educating ourselves.

Humans in the loop and RaaS

What do you think about “lights-out” facilities versus “human-in-the-loop” automation?

Schultz: The human in the loop is important. That's not to say that a lights-out warehouse is impossible, but only a few companies can embrace this.

In order to have supply chains that are partly automated, how robots interact with humans matters. The best companies are those that recognize how they will interact.

For example, Gideon has a robot for truck unloading, and it's getting into case picking. Plus One Robotics has exploded on the market, and 6RS and Locus are pure human-in-the-loop robotics.

The companies getting adoption have a strong trajectory—you can drop their robots into a brownfield environment, and they can augment peak activities.

What about the robotics-as-a-service (RaaS) model? Is it helping robot fleets spread?

Schultz: You want to de-risk companies' ability to adopt automation. Maintenance technicians are one of the most underestimated roles. These facilities have people used to maintaining forklifts and other equipment, but not robots.

Locus has made the RaaS model really simple. We've worked with them at a customer site that normally runs 25 robots and at peak asked for 25 more. It then shipped them back at the end of that time.

There's the ability to scale and work with existing operations or having to buy 50, nine of which aren't working, or buying 25 and figuring out a workaround.

Some companies are offering RaaS models that are a bit kludgy, more like a capital lease.

Looking ahead to 2023

What are some of the challenges operators face this year?

Schultz: We've got investors who monitor the markets, and we've seen that even if there's a recession, some companies will have a war chest, while others won't automate for fear of their businesses. The companies that are strong will double down on robots to absorb capacity.

The problem right now with the supply chain industry is capacity. That's partly why there are so many robot companies. There's so much demand that they can have a tiny market share and still have a viable business.

Some operators have been inactive over a few years, and the bill will come due, and it will be that much harder [to automate].

What do you expect for logistics in 2023?

Schultz: I believe that 2023 will be the year that the bulk of 3PLs [third-party logistics providers] will really lean into automation. More will get into automation space, not with micropilots – DHL, Geodis, and GXO have been at it for a while.

Over a third of the top 20 3PLs have been cutting their teeth with one or two systems to get internal confidence and competence. Add in macroeconomic conditions where they were not just able to throw bodies at the problem, and lean supply chains are out.

2023 will be the tipping point for the 3PL market to really embrace automation.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up