A new survey by Peerless Research Group reported that interest in automation is increasing among warehouse and distribution center operators. The “Annual Warehouse and Distribution Center Equipment Survey” found that usage and budgets for materials handling systems, including mobile robots, have increased.

Peerless Research, which is owned by Peerless Media LLC along with Robotics 24/7, asked readers about their spending plans for warehouse automation, materials handling equipment, and related software.

The findings suggested that operators are interested in more than a crude swap of human labor for robots. Respondents also said that they expect to spend more on labor and that they are more interested in training.

Despite ongoing supply chain problems and the COVID-19 pandemic, e-commerce growth has continued, forcing distribution centers (DCs) to scramble. This has led to both more spending on both workforce development and automation. This two-pronged approach is enabling retailers to keep up with fulfillment volumes.

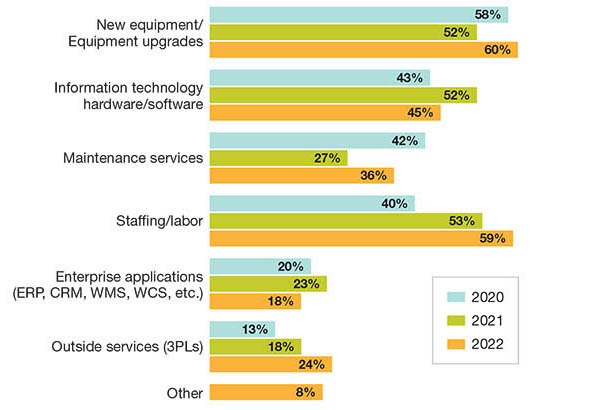

In which areas will you be investing over the next 12 months?

“It’s the new landscape,” said Norm Saenz, managing director and partner at St. Onge, a supply chain engineering and consulting company and Peerless' research partner for this project. “I think leaders in operations see the writing on the wall. They realize that there needs to be more automation in their facilities to support throughput requirements and offset the lack of enough workforce to carry out processes manually, so we’re seeing more automation.”

This year’s survey, conducted in December 2021 by Peerless Research Group, drew responses from managers and executives involved in materials handling system decisions in multiple verticals.

Compared with last year, the survey found less hesitancy about investments, reaching a level on par with the 2020 survey, which was conducted before the COVID-19 pandemic hit North America.

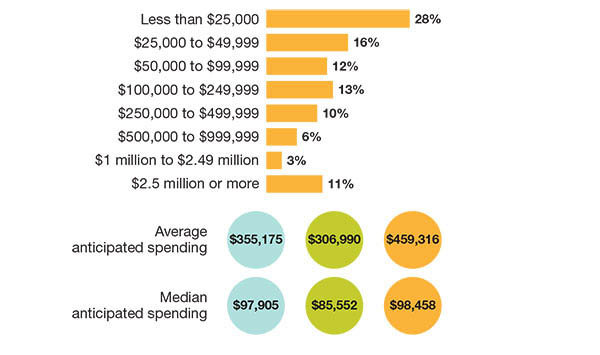

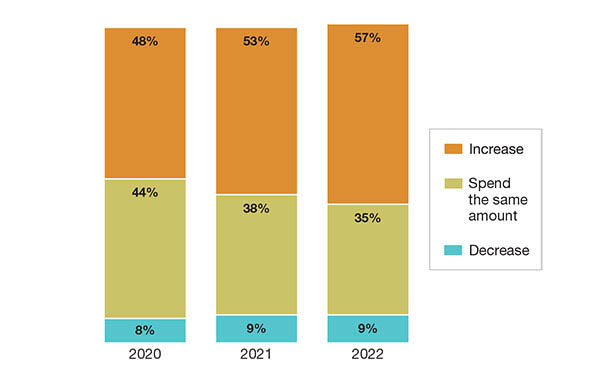

Not only did this year’s survey show less hesitancy, it also learned that budgets are rising fairly dramatically. The average anticipated spending on materials handling systems and related technology for 2022 came in at $459,316, well above last year’s average anticipated spend of $306,990.

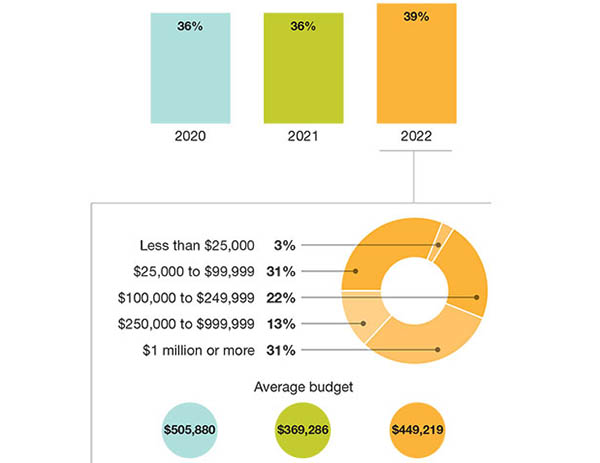

Over the next 12 months, approximately how much do you expect to spend in total on materials handling equipment and information systems?

2022 respondent demographics

Peerless Research Group’s e-mail survey questionnaire was sent to readers of Logistics Management and Modern Materials Handling in December 2021, yielding 114 qualified respondents. The respondents were from sites whose primary activity is corporate headquarters (32%), warehouse/distribution (26%), manufacturing (25%), and warehousing supporting manufacturing (13%).

The median annual revenue of responding companies was $52 million, while the average was $184.8 million, compared with an average of $188.9 million last year and a median of $50 million. Qualified respondents—managers and personnel involved in the purchase decision process for materials handling systems—held influence over an average of 108,330 sq. ft. (10,064 sq. m) of DC or facility space.

Hesitancy dissipates

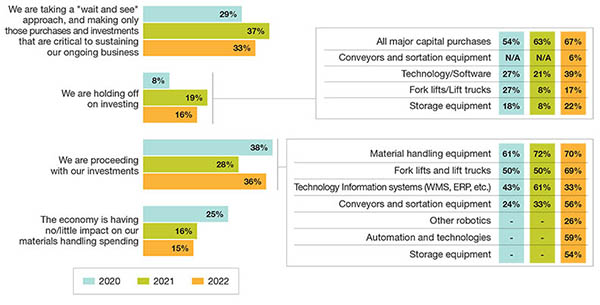

Each year, the survey asks how the present state of the economy is affecting spending on material handling systems and related technologies. Compared to last year’s findings, there is less hesitancy. In particular, those saying that they’re “holding off” on purchasing decisions dropped from 19% last year to 16% this year.

“The trend is toward more optimism and use of automation,” said Donald Derewecki, a senior consultant at St. Onge, who along with Saenz reviewed the survey findings. “The survey shows that a cross-section of companies of different sizes realize that they have to keep up with automation and information technology to stay competitive. Maybe the smaller companies don’t want to be bleeding-edge, but more of them realize they need to keep up with the mainstream.”

Conversely, this year 36% said they are proceeding with investments, up from 28% last year. Those taking a “wait and see” approach also declined, from 37% last year, to 33% this year.

When asked which broad categories they’re proceeding to invest in, the categories of growing interest versus last year were lift trucks (named by 69% this year, up from 50%) and conveyors and sortation (named by 56%, up from 33%).

For this year’s survey, we also added “robotics” and “automation and technology” as other areas companies are proceeding to invest in. We found that 26% want to proceed with robotics, 59% with automation, and 54% with storage solutions.

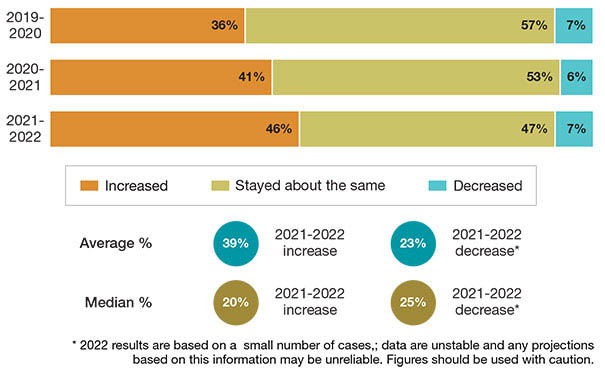

How is the present state of the economy affecting your spending on materials handling equipment, technologies, and services?

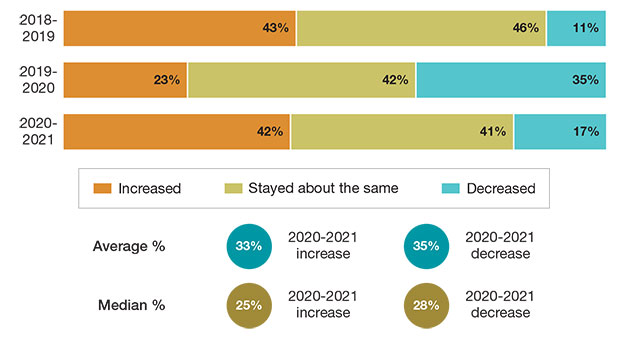

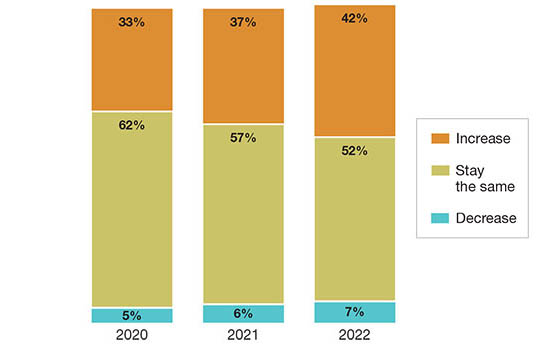

When asked how 2021 spending compared to 2020, 42% said it increased, up from 23% on the same question last year. The “stayed about the same” response dropped by just 1%, but only 17% said that their spend level decreased, down sharply from 35% last year.

How did your company’s spending on materials handling systems in 2021 compare with 2020? And by what percentage?

Looking at expected spend for 2022 compared to 2021, 46% said their spend level will be up this year, which is 4% higher than the 41% who last year said their spend level would be up versus the previous year.

How do you expect your company’s spending on materials handling solutions in 2022 to compare with 2021? And, by what percentage?

The annual survey also asked if spending will increase over the next “two to three” years, and, once again, the findings trended upward. This year, 57% predict increased spending on materials handling systems over the next two to three years, compared to 53% last year.

Overall, how do you expect your spending on materials handling equipment and related information systems to change in the next two to three years?

As mentioned, the average anticipated spend for 2022 (the survey asked for anticipated spend for the next 12 months) reached $459,316, up from $306,990 last year. The median 2022 anticipated spend was also up—from $85,552 last year to $98,458 this year.

In terms of dollar ranges for anticipated 2022 spending on materials handling, a combined 14% of respondents plan to spend $1 million or more, though with many smaller companies among respondents, 28% plan to spend less than $25,000.

When asked in which areas they will be investing over the next 12 months, 60% will spend on new equipment or equipment upgrades, up from 52% last year. In addition, 59% said they plan to invest in labor, up from 53% last year, while 24% said they will invest in outside services, up from 18% the year before.

This year, 36% said they will invest in maintenance services, up from 27% last year. Forty-five percent planned spend on information technology (IT) hardware or software, down from 52% in our 2021 survey. However, other findings in the survey reflect a need for software.

Labor spending includes incentives

The higher spending on labor doesn’t necessarily mean respondents are looking to add significantly more people, explained Saenz. Some are likely paying higher wages or incentives to attract and retain the same level of staff, or at least an adequate level of staffing to support their operational volume. They're doing this as they turn to automation to reduce the overall labor requirement, he said.

“Companies are definitely paying higher wages to try and attract and retain enough people, while also looking at more automation,” Saenz said. “Both are part of the strategies we see: spending more on automation to be more efficient and also spending more on labor to ensure they have enough people to staff these more highly automated facilities.”

While labor availability concerns have been around a long time, added Derewecki, the problem is only escalating, making it harder for companies to meet significant peaks in demand if they rely on mostly manual processes.

“It’s just very difficult for DCs that experience significant spikes in demand, to go out and find 40 or 50 extra people for just a couple of months,” Derewecki said. “That is where much of the demand for automation is coming from.”

This year’s survey also found an increase in pre-approved, annual capital expenditure (CapEx) budgets for materials handling solutions, with 39% reporting they had one, up from 36% the previous year.

The average pre-approved budget climbed from $369,286 last year to $449,219 this year. When we asked about ranges, 31% reported a pre-approved budget of $1 million or more.

Do you have a pre-approved annual capital expenditures budget for materials handling solutions?

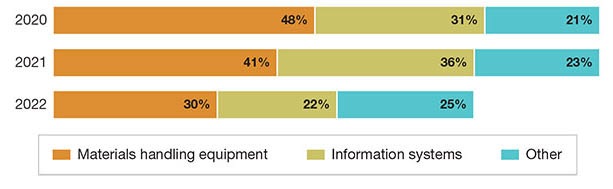

Spending breakdown

When asked what percentage of overall spending will be on either materials handling equipment, information systems (IS), or “other,” over the next 12 months, this year 30% is for equipment, 22% is on IS, and 25% on “other.”

Last year, this breakdown was 41% on equipment, 36% on IS, and 23% on “other.”

And, what percentage of your overall spending during the next 12 months will be on…

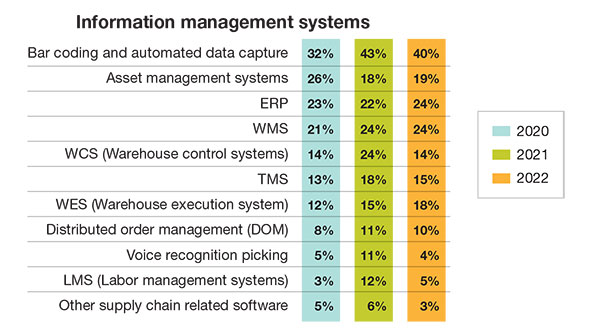

When asked to break down which IS niches they will be spending on during the next 12 months, categories on the upswing this year include warehouse execution systems (WES), up 3%, and enterprise resource planning (ERP), up by 2%. The warehouse management system (WMS) category held steady at 24%.

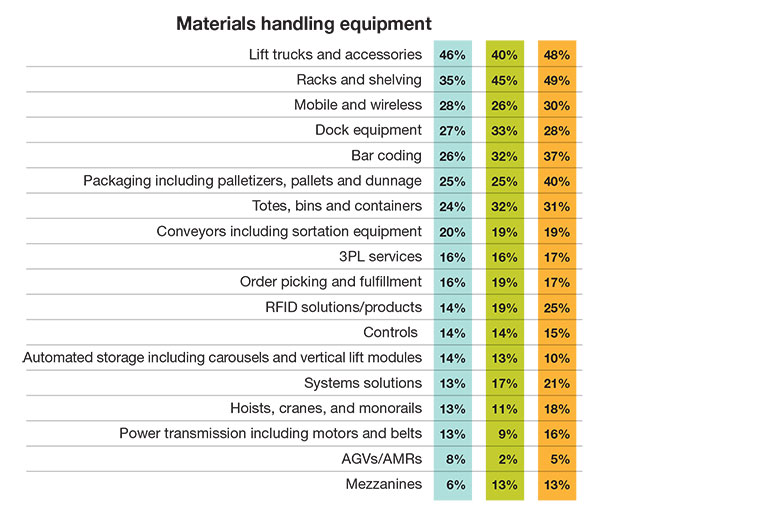

In terms of interest in various types of equipment over the next 12 months, the growth categories included lift trucks (8% gain versus last year), radio frequency identification (RFID) systems (up by 6%), and power transmission including motors and belts (up 7%).

Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) were up 3%, and more dramatically, packaging investments including palletizers and pallets, were up from 25% last year to 40% this year.

The survey also asked about which new purchases or substantial changes to existing systems fell into one of three broad areas of investment: IT; use of third-party logistics providers (3PLs); and various “system equipment” investments such as automated storage and retrieval systems (ASRS), lift trucks, and conveyors. The big gainer here was systems equipment, up from 24% last year, to 44% this year.

Which systems and equipment are you likely to evaluate or consider during the next 12 months?

While IT was down 10% versus last year, Derewecki and Saenz observed that “systems solutions” like ASRS typically involve software to run and manage, so some IS spending is wrapped up in these investments.

Another part of the survey that bodes well for software vendors is that many respondents want to automate how they gauge productivity for key factors like cycle times or throughput going forward. This ultimately takes software both to generate the data and to visualize metrics. This question asked if respondents use a manual process for certain metrics, an automated one, or are currently not monitoring the area, as well as if the plan to automate measures in two years.

For example, this year, we found that while just 30% automate measurement of daily throughput, 69% anticipate automating this metric in two years. Similarly, while 27% have an automated means for tracking order cycle times, 54% plan to automate this within two years.

Another is dock-to-stock cycle time, measured in an automated way by 25% today, but 55% anticipate a more automated means of tracking this within two years.

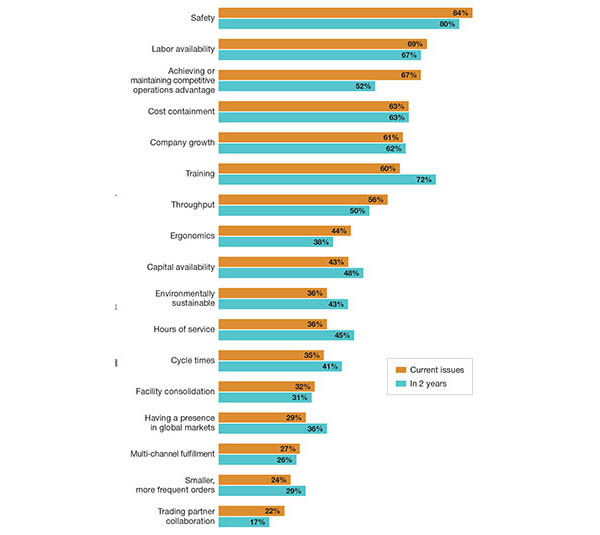

In terms of industry issues rated as “very important” today, compared with what will be very important two years from now, some issues like cost containment and safety drew high percentages today, and remained fairly stable in importance rating two years out.

Others showed a sharper rise in importance, including training, rated as very important today by 60%, but very important for 72% in two years. Capital availability, cycle times, hours of service, having a global presence, and dealing with smaller, more frequent orders also increased in this two-year look ahead on “very important” practices.

How important are each of these issues today? Two years from now, how important do you expect these issues to be?

Generally, observed Derewecki, automation solutions involve training, even if once installed they reduce the overall labor requirement versus manual processes. “Training people on how to use software, and how to maintain and work with any automation they’re putting in, is going to be critical to getting the most from these systems,” he said.

The rise in having pre-approved budgets, as well as projected higher importance on CapEx funding as an issue, may reflect that more organizations are trying to justify materials handling automation expenditures in a more structured, long-term way.

As Saenz explained, “the lead time for getting some of these systems approved and installed can be quite long, so you have to think ahead.”

Saenz added that there’s lot of DC network projects going on, consolidating conventional buildings down into fewer, more highly automated buildings.

“These factors are putting pressure on organizations to come up with longer-term capital outlay plans, so that they can get projects approved and actually have new systems in place when and where they need them,” he said.

Robots on the rise

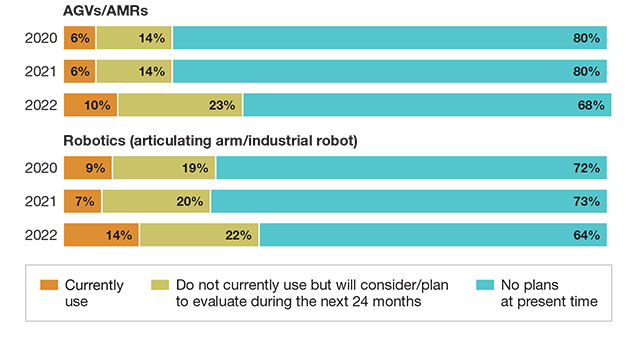

Perhaps of little surprise, interest and use of robotics was up. Not only did 26% of respondents named robotics as a category that they’ll invest in, but they also expressed growing interest in mobile robots.

This year, 10% said that they currently use AMRs or AGVs, and 23% are evaluating them for use within the next 24 months. Last year, that breakdown was 6% who currently use, and 14% evaluating them.

Does your company currently use or are you considering mobile or industrial robots for materials handling applications?

Similarly, interest in industrial robotic solutions with articulating arms for piece picking, palletizing, and other processes is growing. Fourteen percent said that they use industrial robotics of some type, and 22% are evaluating them for use during the next 24 months. Last year, that breakdown was 7% who currently use, and 20% evaluating them.

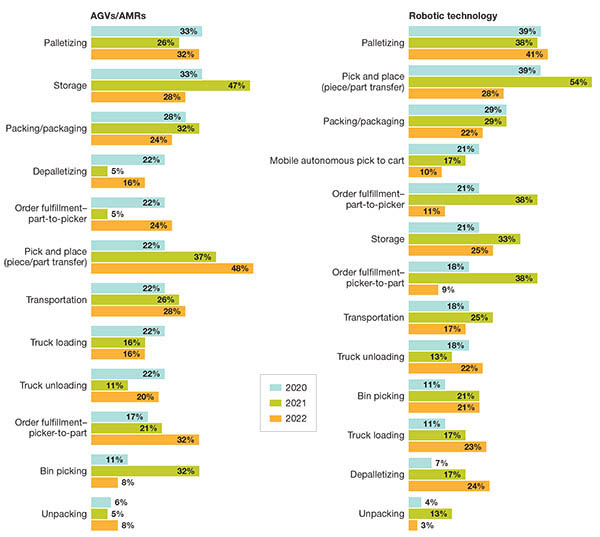

We further asked which applications mobile and industrial robots will be used for. Growth applications for AMRs and AGVs this year include order fulfillment (both “part to picker” and “picker to part” workflows), transport, as well as transport involved with palletizing and depalletizing.

For other robotic technology, growth applications included truck unloading, truck loading, bin picking, as well as palletizing and depalletizing.

This year’s findings around maintenance of materials handling systems found that internal staffers remain the most common source for carrying out maintenance, well ahead of outsourced maintenance or a combined approach of internal and external resources. For 2022, 67% said that they rely on in-house maintenance, up from 53% in 2021.

However, there was also a 6% rise in respondents who outsource the maintenance function, while 23% use a combined approach, down from 35% in 2021.

When asked what role automation vendors or third parties play in maintaining automation, upgrades and upkeep visits were the most commonly cited purpose, at 43%, down 3% from the previous year. Most reasons stayed fairly stable, though use of vendors and third parties for maintenance “consulting” was down 10%, though for “data analysis” it was up from 14% last year to 19% this year.

For which applications are you using different robots?

E-commerce prompts capacity increases

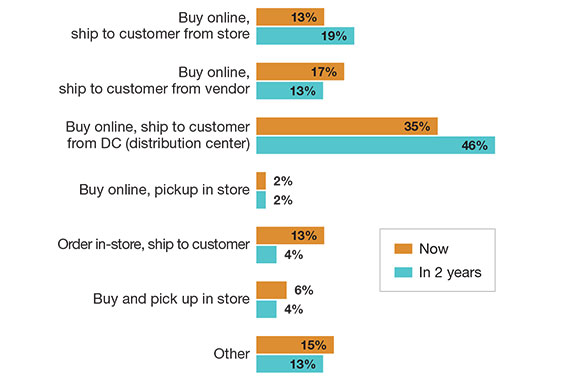

The annual survey asked about the most common method of fulfilling online orders today, and which method respondents believe will be most common in two years.

The most common practice today is to “buy-online, ship to customer from a DC,” used by 35% today, and expected to be the most commonly used method by 46% in two years. Similarly, 13% of respondents this year said that “buy online, ship to customer from store,” is today the most common method—but this grows to 19% in two years.

Some other methods are projected as taking a slight dip in two years, such as “buy-online, ship to customer from vendor,” seen as most common by 17% today, but only by 13% in two years.

The survey also asked if e-commerce “will or is already prompting change in where distribution and manufacturing activities take place.” This year, 57% said e-commerce is prompting more distribution functions in manufacturing, up a full 10% from last year. In addition, 32% said e-commerce was prompting more manufacturing functions in distribution, down from 47% last year.

When asked “where does packaging and fulfillment occur”—with choices including warehouses, factories, fulfillment centers, DCs, retail stores, and outsourced—the most common site remained a warehouse, cited by 55% this year, up from 47% last year.

Also, 27% this year indicated that packaging and fulfillment occurs at a fulfillment center, up from 19% last year, while 8% cited stores this year, up from 2% last year, and finally, 53% said packaging occurs in manufacturing, up from 40% last year.

In your operation, which is now most common? Which do you believe will be most common in 2 years?

Warehouse space crunch continues

To some extent, the warehouse space crunch can be seen in this year’s survey results. For example, when asked about current activity/capacity level for standalone DCs, a combined 31% have a capacity level that exceeds 80%. This showed a significant chunk of respondents likely need more space.

However, for those respondents reporting a capacity level of 50% or more, the average capacity level is 78% this year, down slightly from 80% the year before.

Similarly, for warehouses that support manufacturing, the survey found that a combined 23% currently exceed a capacity level of 80%. Among those reporting 50% or more capacity, the average level reached 80%, down slightly from last year, but still indicating tight space capacity for these respondents.

Saenz noted that capacity levels can vary widely between different companies, even though it’s true that warehouse space has grown tighter this year. International supply chain snarls can affect companies differently, he adds.

“Some companies can’t source the inventory they need, so they have warehouses with a surprising amount of empty space, while other organizations have decided to over buy intentionally to ensure availability for customers, so they are short on space,” said Saenz. “It’s sort of a mess with inventory, because of the larger supply chain issues.”

What is your current activity level for standalone warehouses/distribution centers?

Survey results paint a bigger picture

Even though this survey focuses on DC/plant-level systems, some findings reflect the bigger picture. For example, this year, the concerns around labor availability are seen in the growing importance of workload planning as a key practice for managing DC operations.

This year, 46% rated workload planning as important, coming in as the fourth leading practice today; but two years from now, 53% see it as being very important.

Likewise, labor productivity was already rated as important by 54%, but 60% said it will be important two years out. The top practice is “continuous improvement,” but this practice is seen as declining in importance two years out.

A similar question on important practices for manufacturers found that just-in-time (JIT) production, rated as a key practice by 25% today, dips slightly to 22% in two years. Outsourcing among manufacturers, rated as important by 25% today, also declined in importance in two years, to 20%.

Such findings are likely related to today’s international supply chain snarls and may reflect some respondents rethinking their sourcing and production strategies.

On the other hand, respondents said they expect lean manufacturing to grow in importance in the next two years, so there appears to be lasting confidence in pull-based methods, even if it was a tough year for the JIT approach.

“For some companies, it has turned from 'just in time,' to 'just in case we can’t get it, we’re going to buy more,'” observed Derewecki.

In the next two years, how do you expect your activity level to change for standalone warehouses/DCs?

Our questions also found heightened global supply chain concerns. Specifically, logistics increased as a risk factor being analyzed by respondents, from 52% last year, to 65% this year.

In addition, “outsourcing tasks” was being analyzed for risk by 39%, up from 24% last year. A higher percentage said it is also looking at natural disasters as a risk factor this year (up by 5%).

What’s more, this year, 55% said that they have a program for identifying and analyzing risks, up sharply from 39% the year before, and also a bit higher than in 2020, when 52% said they had a plan for identifying risks.

Macro-level supply chain issues aside, one thing that’s clear in multiple findings in the 2022 survey: Respondents are ready to embrace more automation and robotics, and they are budgeting more to make it happen.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up