One of the hottest technologies right now for companies that operate warehouses and distribution centers is the software layer that sits between real-time, automated materials handling systems on the floor and complex transactional systems that manage orders, customers and inventory.

View: SC24/7 ‘Quicklook’ Companies

This software layer - traditionally known as a warehouse control system (WCS) - is evolving into what many suppliers are calling warehouse execution system (WES) solutions as users try to find better ways to coordinate resources around the pressures of omni-channel fulfillment.

This evolution can be seen in WES or advanced WCS suites that are taking on higher-level functions such as waveless processing and real-time operations intelligence.

The best testimony to the growing importance of WES may be the continued acquisition of WES providers, such as Dearborn Mid-West Company’s recent acquisition of W&H Systems, Dematic’s acquisition of Reddwerks, Swisslog’s acquisition of FORTE Industries last April, Bastian Solutions’ purchase of Forte Engineering last March, as well as Intelligrated’s acquisition of Knighted in 2012.

The need for better software to deal with the complexities of omni-channel fulfillment may explain much of the focus on WES.

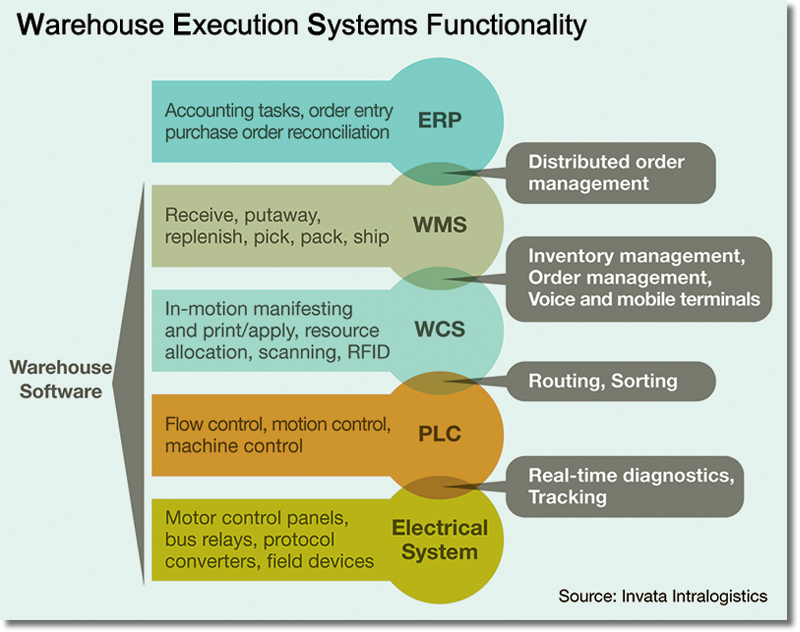

Today’s warehouse execution software offerings span higher-level functions such as order processing and wave management, down to more traditional WCS-level functions such as routing and controlling automated equipment.

The omni-channel environment places enormous pressure on DCs to keep up with higher order volumes including rapid processing of small e-commerce orders. These throughput pressures are fueling interest in WES and advanced WCS solutions, says Clint Reiser, a senior analyst with ARC Advisory Group.

“DC operators are looking for ways to improve economies of scale and ensure high throughput,” says Reiser. “These concerns are driving interest in WCS and warehouse automation solutions.”

The market for WES solutions is growing rapidly, adds Reiser, at roughly 10% a year. There are multiple vendors involved, including some smaller companies with WCS or WES solutions, and some major vendors of materials handling automation that have acquired or built WES capabilities.

So what can users expect from a WES solution, and how do they differ from older WCS projects? For one thing, WES solutions are seen as being more standard or “productized” than WCS deployments of the past; and second, much of the functionality revolves around higher-level order fulfillment and operations intelligence functions.

“As WES matures, it absolutely is becoming more productized, as does any category of software,” says Ed Romaine, vice president of sales and marketing with SI Systems, which offers a WES.

“The benefits of WES are a natural progression in optimizing warehouse performance. These solutions are able to constantly monitor the different islands of automation and balance them out around changing order fulfillment requirements and automation, inventory and labor resources. For vendors, it’s a matter of improving the capabilities of WES modules to make the software a better investment.”

WES solutions combine WCS and warehouse management system (WMS) functions to manage warehouse operations in a more real-time fashion than you can with a typical WMS. Because WES has connectivity to automated materials handling systems such as conveyors, sortation, automated storage and retrieval systems (AS/RS) and pick-to-light (PTL) systems, it has a tight grasp of bottleneck issues.

On top of that, WES also adds certain WMS-level functions such as wave management, order picking or packing. This allows WES to take in order requirements from a WMS or an enterprise resource planning (ERP) system and do much of the warehouse execution on its own, or work in concert with a WMS that might handle functions like receiving and putaway.

As a result, WES vendors typically offer modules like wave creation, picking, packing, PTL management, routing, analytics and other functions needed to manage work on a DC floor. This expands upon the WCS of the past, which took more of a toolset approach to communicating with or controlling islands of automation and establishing material flow.

Vendors agree that WES goes beyond the traditional WCS role of linking one island of automation to the next. In explaining Dematic’s recent acquisition of Reddwerks, Ulf Henriksson, Dematic Group president and CEO, says the acquisition provides functionality that excels at synchronizing all elements of a DC’s processes.

“Software in our market is no longer about the control of individual pieces of machinery - it’s about efficient management of the entire fulfillment process,” he says.

Configurable Modules

Especially for the more basic functions such as routing, WES/WCS has become a more standard, configurable solution set, says Helgi Thor Leja, a senior industry leader with Fortna, which offers a WES/WCS solution. “I think it has to become productized,” Leja says.

“Years ago, WCS solutions were predominantly customized for each client. And, you can imagine how expensive it is to develop custom solutions.”

Standardization is accomplished with Fortna’s WCS with integration templates and standard drivers to automated equipment. With WCS solutions like routing, it’s possible to be more standard than you can with higher-level functions such as waveless management, which can be highly dependent on the automation assets that need to be coordinated, as well as the capabilities of the host order management system, Leja explains.

“I believe some of the complex business layer functions that WCS can address still involve some customization, or can be built up from a base set of functionality with some tweaks, but some of the more basic functions have become quite productized,” he says.

Mike Howes, vice president of software and controls engineering for FORTE Industries, says that with its WES, the suite contains simple “best practice” methods for functions like picking or packing, and users can configure these using a workflow engine. “That gives them the configurability they need to manage the process without having to customize the product,” says Howes. “So, we look to prebuild some simple, best practice functions, and then offer a configurable approach to the way they are deployed.”

Howes acknowledges that in some cases, a client may have such complex needs around functions like lot or serial tracking that the best fit is a “very good WMS.” But in most cases, WES configurations will fit client needs.

Howes also points out that FORTE’s deployments are accompanied by an assessment of material flow and analysis of order profiles to see how the WES should be configured. “We need to go through and make sure that we understand how the client wants to interact with the system,” he says.

WES may be getting more configurable, but it may never be as standard as some other types of software such as office productivity suites. Jay Moris, president of Invata Intralogistics, which offers WES or what it simply calls “warehouse software,” says WES solutions can make use of pre-established logic or “algorithms” for key functions, as well as standard interfaces to WMS or ERP, and a common data platform to make them easier to deploy.

“For us, WCS/WES are purpose-deployed solutions, and they are deployed around a function or set of functions,” says Moris. “We have standard toolsets, algorithms and stored procedures that we have deployed over and over again, but they always get deployed a bit differently.”

WES deployments, agrees Moris, involve careful analysis of a DC’s desired processes and must reflect equipment details, such as how many drop points a unit sorter has. “You really can’t take someone’s ‘WCS in a box,’ deploy it in a slightly different configuration and expect it work,” he says.

One key to making WES easier to implement, says Romaine, is that customizations made for a client can be incorporated into the base system. “By using a true versioned platform, what winds up happening is that you have a wide breadth of different ways of handling every step within the warehouse, and these become part of the platform,” he says.

ARC’s Reiser generally agrees that WCS is becoming more productized, but warns that in some instances, there might be “substantial modification” during installations. “With certain vendors, there are pockets of functionality that have moved into that ‘productized’ software direction, but this trend is not applicable to all vendors or all WCS functions,” he says. “With some WCS implementations, it’s not just configuration - there is substantial modification work being done.”

Higher-Level Focus

One function that has drawn attention to WES is so-called waveless processing. Under waveless, a WES solution is constantly taking in order requirements from a host system and releasing the related work to the optimal machine and labor resources, rather than batching work together into a wave at the start of a shift. Waveless functionality is seen as being able to “level out” the fulfillment work at a steady, highly productive pace while being able to drop in e-commerce orders.

“With waveless, [a WES solution] is constantly monitoring the different islands of automation and balancing them,” says Romaine. “So, if one zone is going faster than the other zones, for instance, it reaches in and rebalances the workload. In my view, waveless is where you put the flag up on WES.”

WCS has always played a “traffic cop” role in material flow, but today’s WES is able to look at more than machine status, say vendors. As Moris points out, with WES, “as resources are or become available, more orders are committed against those resources. Those resources can be inventory, they can be people, or they can be the automated machinery involved.”

Another high-level area of WES functionality is analytics and business intelligence. Vendors see this as an area of high interest for users who are concerned about throughput and want mobile access to dashboards. While older WCS deployments often involve some reporting, these reports have more of a rear-view mirror nature to them, and tended to focus on point utilization, says Paul Hendrikse, senior account manager with DMW&H.

Today, solutions such as DMW&H’s Shiraz are able to correlate machine anomalies with other factors such as labor resources and inventory levels to do things like predict completion times or see where labor might be reassigned.

“We can now look at and understand the whole environment around the materials handling systems, whereas 15 years ago, we were just looking within the materials handling systems,” says Hendrikse. “These solutions are now more predictive and capable of more functions than they used to be.”

Read: What Can Warehouse Execution Systems Do For Your Distribution Center Operations?

Business Intelligence and Mobility

Much like a manufacturing execution system (MES) in a plant plays an operational intelligence role, so too do WES solutions provide dashboards to gauge order fulfillment progress or uptime issues. What’s more, some WES providers have made their dashboards mobile friendly, making operations intelligence something that managers can tap into anytime, anywhere.

For example, Fortna offers mobile apps, including mobile dashboards and an app that lets users point a tablet’s camera at a trouble spot to relay a live feed to a remote support expert. “Many of our clients want to be able to run their business from an iPad,” says Leja. “They want to be able to look into the system from wherever they are and see how operations are performing, and along with that, to have a dashboard suited to their role.”

Maintenance technicians and managers can also use analytics and alerts from WCS to see if machines might need preventative maintenance or are operating outside of the desired threshold. Leja believes these mobile functions are resonating with Fortna’s users because so many of them are now operating high-volume omni-channel fulfillment centers where even a small amount of downtime can throw off hundreds of orders.

“You would be surprised how many of our clients concentrate most heavily on uptime because they know that if their systems in the DC go down, their business goes down,” says Leja. “Discussion of waveless operations or goods-to-person technology are fine, but when a system goes down, that is when the stress level really grows.”

MSC Industrial, an industrial supplier leader with an online marketplace, uses Fortna’s WCS solution to coordinate automation systems and monitor performance and uptime at all of their customer fulfillment centers. Fortna served as the consultant for a redesign of the centers aimed at improving the throughput MSC needed to support its growing online business, which promises customers that orders placed by 8 p.m. eastern will get out that day.

Under the project, which began with MSC’s Harrisburg, Pa., DC, the facility’s previous pick-and-pass operation was replaced with a paperless RF picking process that sends each order electronically to merchandise selectors in waves. Associates pick the items in their areas and place them in totes that are then consolidated (multi-line) or are sent straight to packing.

The project also included improvements to conveyor systems, consolidation points, pick-to-light and put-to-light systems, and a packaging automation system that significantly reduced packing time and created consistent, more eco-friendly packaging, says Leja.

In MSC’s case, the WCS is the means for coordinating material flow and automation around waves while providing MSC with a system with which to monitor throughput and uptime. “You can imagine how important uptime is to a company like MSC Industrial,” says Leja.

“Like many of our clients today, they have to compete with the Amazons of the world when it comes to fulfillment expectations, which is why uptime and analytics are so important.”

Related: Increasing DC Throughput with Warehouse Execution Software & Warehouse Control Systems

Article topics

Email Sign Up