Intel and Mobileye announced on March 13 that they have entered into a definitive agreement pursuant to which Intel will acquire Mobileye.

Under the terms of the agreement, a subsidiary of Intel will commence a tender offer to acquire all of the issued and outstanding ordinary shares of Mobileye for $63.54 per share in cash, representing a fully-diluted equity value of approximately $15.3 billion and an enterprise value of $14.7 billion.

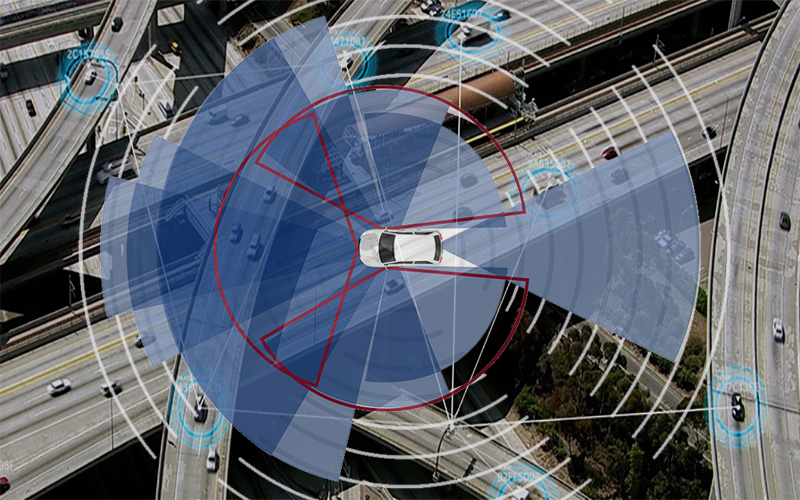

The acquisition will couple the best-in-class technologies from both companies, including Intel’s high-performance computing and connectivity expertise and Mobileye’s leading computer vision expertise to create automated driving solutions from the cloud through the network to the vehicle.

The combination is expected to accelerate innovation for the automotive industry and position Intel as a leading technology provider in the fast-growing market for highly and fully autonomous vehicles.

The transaction extends Intel’s strategy to invest in data-intensive market opportunities that build on the company’s strengths in computing and connectivity from the cloud, through the network, to the device.

As reported by Bloomberg, Intel is trying to accelerate a push into what many chip companies view as the next big opportunity: self-driving cars and the data they generate.

With Mobileye, Intel gains the ability to offer automakers a larger package of components they will need as vehicles become more autonomous.

The Santa Clara, California-based company estimates the market for vehicle systems, data and services will be worth as much as $70 billion by 2030.

“They’re paying a huge premium in order to catch up, to get into the front of the line, rather than attempt to build from scratch,” said Mike Ramsey, an analyst with technology researcher Gartner.

About Mobileye

Mobileye was founded in 1999 by Amnon Shashua and Ziv Aviram and made its name with systems that alert drivers to pedestrians, unintended lane departures and speed limit violations. The technology, which can also trigger braking to prevent an accident, counts General Motors Co. among its customers.

Recently, Mobileye has been pushing to sign up more carmakers for its advanced products, such as technology that collects data from vehicle fleets to build a real-time, crowd-sourced mapping service. Goldman Sachs Group Inc. invested $100 million in 2007 for a minority stake in Mobileye.

Intel will combine its existing autonomous vehicle technology unit with Mobileye and the new group will be run in Israel by Shashua, the companies said in a statement.

“Shashua is the personification of car safety and autonomous driving,” said Shmuel Harlap, chairman of car importer Colmobil Ltd. and Mobileye’s biggest shareholder. “Just look at his quarrel with Elon Musk and you understand the personality.”

Last year, Musk’s electric carmaker Tesla Inc. stopped using Mobileye’s systems and the two companies argued publicly about the breakup. The Israeli company expressed concerns about the safety of Tesla’s Autopilot hands-free highway driving feature, while Tesla accused the supplier of trying to block its in-house efforts to develop computer vision capabilities for cars.

$2 Trillion

Alphabet Inc.’s Google has clocked more than 2 million self-driving test miles on public roads, Tesla has gathered data from 1.3 billion miles of data from Autopilot-equipped vehicles, and Mercedes-Benz parent Daimler AG has partnered with Uber Technologies Inc.

Google, which separated its self-driving car project into a new unit called Waymo last year, plans to start a ride-sharing service using semi-autonomous minivans made by Fiat Chrysler Automobiles NV as soon as the end of 2017. Volkswagen AG is rolling out Moia, a new division that will focus on ride-sharing and other mobility services. Mercedes already offers cars that can pilot themselves at highway speeds.

Digital mobility services for automobiles will reach $2.03 trillion (1.9 trillion euros) in 2025, up from 860 billion euros in 2016, according to Sarwant Singh, a senior partner at the global market research company Frost & Sullivan. In an interview earlier this year he attributed much of Mobileye’s success to the fact that it was first in its field.

Intel Chief Financial Officer Robert Swan said the company expects to see $175 million a year in cost and tax savings from the transaction and that this will help cover the premium Intel is paying for Mobileye.

Read the Article: Truckers Prepare For Era of Driverless Trucks

Article topics

Email Sign Up