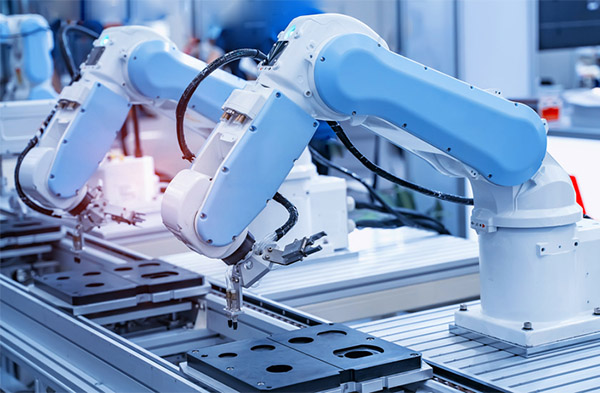

Emerson Electric Co. last week announced a definitive agreement to acquire Afag Holding AG. The company said the transaction will combine Afag's electric linear motion systems with its own pneumatic motion technology to create a leading product portfolio for factory automation.

“Afag brings exciting technology that will enable Emerson to accelerate growth in our existing $900 million factory automation business,” said Ram Krishnan, operating officer of Emerson. “As discrete and hybrid customers continue to accelerate electrification across their manufacturing processes, Afag's technology is ideally suited to provide improved energy efficiency and performance gains.”

“We look forward to combining Afag's motion capabilities with our existing pneumatic leadership, creating a unique and differentiated solution for our customers,” he added in a release. “Afag and its employees will play an important role in enhancing Emerson's strength and innovation in factory automation.”

Afag brings electric motion to portfolio

Zell, Switzerland-based Afag said it is a leading innovator in electric linear motion, feeding, and handling automation.

“We are excited to join Emerson and build on its existing factory automation leadership, while further expanding our global reach,” stated Adrian Fuchser, CEO of Afag. “Our customers rely on Afag for essential, customized systems, and we are energized by this opportunity to create a more comprehensive and holistic solution for their motion needs.”

“We share Emerson's vision of providing complete solutions in essential industries, and we look forward to driving continued success as part of Emerson,” he said.

Emerson noted that Afag serves customers in growing end segments including battery manufacturing, automotive, packaging, medical, life sciences, and electronics. It said the electric linear motion segment will expand its served market by more than $9 billion and is expected to grow mid-single digits annually, supporting Emerson's long-term, profitable organic growth.

Emerson enables manufacturers

St. Louis, Mo.-based Emerson said it provides hardware and software “for the world's essential industries.” Through its leading automation portfolio, including its majority stake in AspenTech, the company said it helps hybrid, process, and discrete manufacturers optimize operations, protect personnel, reduce emissions, and achieve their sustainability goals.

Emerson claimed that factory automation is one of its four “priority adjacencies.”

The company said it expects the transaction to close by the end of Emerson's fiscal 2023, subject to customary closing conditions, including receipt of regulatory approvals. Emerson and Afag did not disclose the terms of the transaction.

For the transaction, Bryan Cave Leighton Paisner LLP is serving as legal advisor to Emerson. Afag will be reported in Emerson's Discrete Automation segment.

Article topics

Email Sign Up