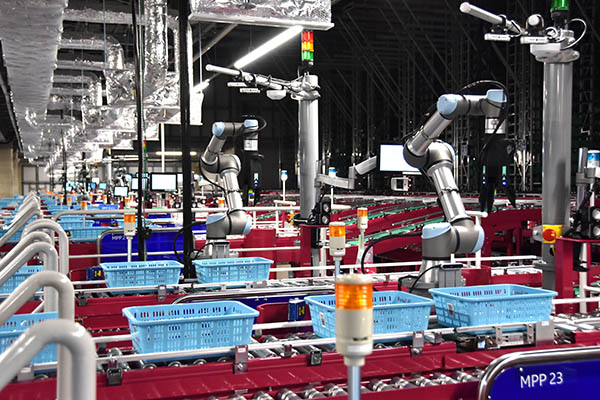

The warehousing industry has ramped up its automation efforts in response to the increased order volumes and labor shortages during the COVID-19 pandemic, according to ABI Research. Technologies such as augmented reality-powered smart glasses and handheld devices with enhanced capabilities are addressing productivity. In addition, autonomous, collaborative, and mobile robots are the most popular and fastest-growing systems in the warehouse workspace.

“Mobile robots are at the heart of the warehouse robotics market and account for most shipments and revenue,” stated Adhish Luitel, an analyst for supply chain management and logistics at ABI Research. “These robots, made up of autonomous guided vehicles (AGVs) and autonomous mobile robots (AMRs), are being used to move goods within the warehouse and being integrated within wider automated or manual workflows.”

Worldwide commercial robot revenue in warehouses will have a compound annual growth rate (CAGR) of over 23% from 2021 to 2030 and will exceed $51 billion (U.S.) by 2030, said the research firm last week.

Warehouse robots mature

In the past few years, warehouse operators have moved from the early exploration phase to deployments as the commercial robotics market matures, said ABI Research. Early adopters are benefitting from live implementations of fully capable technical solutions, it said.

As a sign of the growing maturity of the market, numerous vendors such as Advantech, Brochesia, Kontakt.io, and RightHand Robotics now offer compelling products and solutions, said ABI Research.

The surrounding ecosystem of software vendors and systems integrators is also maturing, as software and integration capabilities become increasingly important to differentiation.

The analyst firm said it has assessed fulfillment and warehousing processes of operators such as Penske, A. Duie Pyle, Amazon, and JD.com to evaluate the efficacy of different systems and the friction points that might arise.

These companies have been reaping the benefits of enhanced key performance metrics such as shorter dock-to-stock cycles and improved inventory accuracy, said ABI. This is thanks to successful deployment of various automation and vision-based systems in their day-to-day operations, it found.

Combining systems for results

“In addition to robots, warehouse operators should be seeking to combine the value of multiple solutions across the fulfillment workflow to achieve desired results,” explained Luitel. “There is also a need for operators to look beyond productivity and assess how technologies affect worker satisfaction and safety, worker comfort, energy consumption, distance traveled, and error rates.”

For example, “pick-by-vision” solutions from augmented reality (AR) vendors such as Picavi require only 15 minutes to learn to use. They can improve efficiency by 30% and safe up to 60% in training time, ABI Research said.

In addition, automated storage and retrieval systems (ASRS) from Alert Innovation can help grocery retailers enhance their return on investment (ROI) by over 50% in comparison with traditional automated picking systems, according to ABI.

“We can also expect intelligent automation solutions to influence processes across the supply chain,” Luitel said. “In the future, operators will be venturing further into solutions like robotic process automation (RPA) and mobile warehousing.”

These findings are from ABI Research's “Modern Fulfillment Trends: Warehouse Robotics, Handheld Devices and Wearables” technology analysis report. This report is part of the company's Supply Chain Management & Logistics research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, “Application Analysis” reports present in-depth analysis on key market trends and factors for a specific technology.

Article topics

Email Sign Up