Leading industry analysts and consultants maintain that the landscape for global and domestic 3PLs may be shifting this year, but shippers can hedge their bets by vetting asset-based and non-asset players when planning future networks.

A healthy service provider portfolio, say our analysts, includes a bit of both.

In fact, this year’s list of Top 50 Global 3PLs, compiled by market consultancy Armstrong & Associates, validates the observation that shippers need a variety of options when it comes to moving freight this year.

“Shippers would prefer to work with a few providers, but the performance scale of operations often requires them to hire several 3PLs in order to optimize global procurement,” says Evan Armstrong, the consultancy’s president. “In the domestic arena, it’s more centralized.”

On the domestic front, both Coyote Logistics and XPO Logistics have broken the $2 billion revenue barrier through acquisition, creating two “mega” freight brokers to rival 3PL domestic transportation management (DTM) market segment leader C.H. Robinson Worldwide.

“With other major competitors such as Total Quality Logistics and Echo Global Logistics growing rapidly as well, this intense competition will continue to heat up,” says Armstrong. “In the end, it will mean increased operational performance levels for shippers and further consolidation within the small freight broker ranks.”

While the 3.5 percent year-over-year U.S. 3PL market growth in 2013 was sluggish, mirroring the overall economy, DTM led all 3PL market segments again in 2013, according to Armstrong’s research. Gross revenues were up, as was the cost of purchasing transportation capacity. However, the ongoing driver shortage continues to pressure DTM gross margins and net revenue growth.

“Amazon Effect”

Since 2011, Armstrong and his team have been monitoring the “Amazon Effect” on the third-party logistics market as part of its strategy consulting work.

Related: What is the Amazon Effect?

They’re finding that it’s becoming increasingly important for value-added warehousing and distribution-centric 3PLs with significant business in the retailing industry to anticipate continued growth by Amazon and position—or reposition—their companies within the market as more business shifts from brick-and-motor stores to internet order fulfillment operations.

“International transportation management (ITM) saw another slow-growth year. Expeditors International, Kuehne + Nagel, and Panalpina all had year-over-year revenue gains of 2.9 percent or less,” Armstrong observes. He also notes that more focus in Asia has been on building reliable regional value-added warehousing and distribution (VAWD) networks versus export activity.

Armstrong & Associates Top 50 Global 3PLs

Third-Party Logistics Provider

-

$31,432DHL Supply Chain & Global Forwarding

-

$22,587Kuehne + Nagel

-

$19,732DB Schenker Logistics

-

$17,317Nippon Express

-

$12,752C.H. Robinson Worldwide

-

$8,517CEVA Logistics

-

$8,140DSV

-

$7,738Sinotrans

-

$7,293Panalpina

-

$7,263SDV (Bolloré Group)

-

$6,627DACHSER

-

$6,266Toll Holdings

-

$6,080Expeditors International of Washington

-

$5,828Geodis

-

$5,492UPS Supply Chain Solutions

-

$5,300GEFCO

-

$5,224J.B. Hunt (JBI, DCS & ICS)

-

$4,441UTi Worldwide

-

$4,415Agility

-

$4,042Yusen Logistics

-

$3,923IMPERIAL Logistics

-

$3,433Hellmann Worldwide Logistics

-

$3,374Unyson Logistic

-

$3,212Damco

-

$3,119Burris Logistics

-

$2,850Schneider Logistics & Dedicated

-

$2,782Norbert Dentressangle

-

$2,718Kintetsu World Express

-

$2,575Kerry Logistics

-

$2,546Pantos Logistics

-

$2,293Sankyu

-

$2,280Ryder Supply Chain Solutions

-

$2,090FIEGE Group

-

$2,000Coyote Logistics**

-

$2,000XPO Logistics**

-

$1,900BDP International

-

$1,745NNR Global Logistics

-

$1,695Wincanton

-

$1,621Total Quality Logistics

-

$1,611Logwin

-

$1,555Nissin Corporation/Nissin Group

-

$1,586APL Logistics

-

$1,580Americold

-

$1,540Menlo Worldwide Logistics

-

$1,509GENCO

-

$1,470BLG Logistics Group

-

$1,400Transplace

-

$1,387FedEx Supply Chain/FedEx Trade Networks

-

$1,301Landstar

-

$1,290OHL

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to USD using the average exchange rate in order to make non-currency related growth comparisons. **34 & 35 Tied.

“This has benefited Kerry Logistics and Toll Holdings who have significant operating networks in China and Southeast Asia,” says Armstrong. “As a sign of this shift, Kerry Logistics, the leading VAWD 3PL in Greater China, was spun off from its parent Kerry Properties Limited via an initial public offering in December 2013.”

Armstrong & Associates Top 50 U.S. Domestic 3PLs

Third-Party Logistics Provider

-

$12,752C.H. Robinson Worldwide

-

$6,080Expeditors International of Washington

-

$5,492UPS Supply Chain Solutions

-

$5,224J.B. Hunt (JBI, DCS & ICS)

-

$5,046Kuehne + Nagel (The Americas)

-

$4,600Exel (DHL Supply Chain - Americas)

-

$4,441UTi Worldwide

-

$3,374Unyson Logistic

-

$3,119Burris Logistics

-

$2,850Schneider Logistics & Dedicated

-

$2,838DB Schenker Logistics

-

$2,641CEVA Logistics (The Americas)

-

$2,280Ryder Supply Chain Solutions

-

$2,188Panalpina (The Americas)

-

$2,000Coyote Logistics**

-

$2,000XPO Logistics**

-

$1,900BDP International

-

$1,621Total Quality Logistics

-

$1,580Americold

-

$1,540Menlo Worldwide Logistics

-

$1,509GENCO

-

$1,400Transplace

-

$1,387FedEx Trade Networks/FedEx Supply Chain Services

-

$1,301Landstar

-

$1,290OHL

-

$1,200Cardinal Logistics Management

-

$1,189Swift Transportation

-

$1,138Werner Enterprises Dedicated & Logistics

-

$1,091NFI

-

$1,007Damco (The Americas)

-

$1,000syncreon

-

$993APL Logistics (The Americas)

-

$968Penske Logistics

-

$884Echo Global Logistics

-

$821Yusen Logistics (Americas)

-

$807Ruan

-

$803Transportation Insight

-

$800Jacobson Companies**

-

$800Neovia Logistics Services**

-

$798England Logistics

-

$795Agility (The Americas)

-

$755ModusLink Global Solutions

-

$734Ingram Micro Logistics

-

$721Hellmann Worldwide Logistics (The Americas)

-

$648New Breed Logistics

-

$615U.S. Xpress Enterprises

-

$580Kenco Logistic Services

-

$574Crane Worldwide Logistics**

-

$574Freightquote**

-

$570DSV (The Americas)

*Revenues are company reported or Armstrong & Associates, Inc. estimates and have been converted to USD using the average exchange rate in order to make non-currency related growth comparisons. **15 & 16, 38 & 39, 48 & 49 Tied.

Armstrong says that while the internet services and retailing 3PL market sub-segment is only a small portion of the Fortune 1000 domestic spend with 3PLs, it has grown 140 percent from 2007 to 2013.

“Amazon is the 800-pound gorilla in the e-retail market, and as it deploys its own local delivery fleets and continues to expand its value-added warehousing and distribution network, it will drive strategic change,” says Armstrong. “Those 3PLs that could be most affected include DHL Supply Chain & Global Forwarding, FedEx SupplyChain, GENCO, OHL, UPS Supply Chain Solutions, and the smaller e-commerce fulfillment niche players like eBay Enterprise (formerly GSI Commerce) and Innotrac.”

While Amazon outsources very few functions to 3PLs, Menlo Worldwide Logistics has been a key beneficiary from Amazon’s growth, having significant portions of business awarded to it in 2013, he adds. “It’s this kind of resiliency that will be a key differentiator in the 3PL marketplace moving forward.”

Balancing Act

Resiliency and balance are not mutually exclusive qualities, maintains John Langley Jr., Ph.D., at the Pennsylvania State University. Indeed he argues that the Armstrong rankings reflect more global diversity of gross revenue, thereby challenging the “80-20 Rule.” Also known as “The Pareto principle,” it states that roughly 80 percent of the effects come from 20 percent of the causes.

“This translates into the way the economy is functioning now, with non-asset based 3PLs having much greater leverage for buying asset-based services,” says Langley.

He also observes that domestic trucking supply and demand drives a lot of pricing pressure these days, which encourages logistics managers to spread their business around. “Asset-based providers are having a resurgence,” says Langely. “At the end of the day, someone has to own the assets, and we see them now dealing more directly with retail and Fortune 500 shippers.”

Related: 2013 Third-Party Logistics Study (or 2014 Third-Party Logistics Study)

Adrian Gonzalez, the founder and president of Adelante SCM, a peer-to-peer networking community for logistics professionals, agrees that a balanced transport portfolio is ideal. “Logistics managers are trying to mitigate risk by using asset-based carriers for dedicated fleet control operations,” he says. “This is not only true in the truckload segment, but also in intermodal. Shippers have to weigh the benefits of flexibility against the advantages of having predictable routes.”

Non-asset based players resemble “technology providers,” more than ever, Gonzalez adds, noting that increased focus on customer relationship management is redefining the 3PL arena.

“Not just regionally, or domestically, but all around the world, he says. “While someone has to own the physical assets, many 3PLs are becoming much more reliant on cloud computing to provide seamless transparency for the shipper. Asset-based giants are also realizing the advantages of adapting to new IT technologies.”

Gonzalez maintains that through the years, service providers and software vendors have “busted out of their boxes” via mergers and acquisitions, new business models, and new product development to pursue new growth opportunities, and to provide manufacturers and retailers with more complete “end-to-end” supply chain solutions.

“In the past, you had a box for freight forwarder, a box for broker, a box for warehouse operator, and so on,” Gonzalez says. “At the same time, logistics managers had a box for parcel shipping solution, a box for fleet management application, and a box for outbound transportation solution.” Today, he says, the boxes and labels of yesterday are giving way to a single amorphous category: providers of supply chain software and services.

“A logistics service provider can offer its own transportation management system while still being a 3PL and software vendor,” says Gonzalez. “It can also be a B2B connectivity service that facilitates the exchange of data, documents, and other information with carriers and other trading partners.”

Those distinctions, he argues, are becoming less important. For Gonzalez, the only question that still matters is the first one manufacturers and retailers must ask themselves when defining their supply chain strategies and initiatives: What are our desired outcomes?

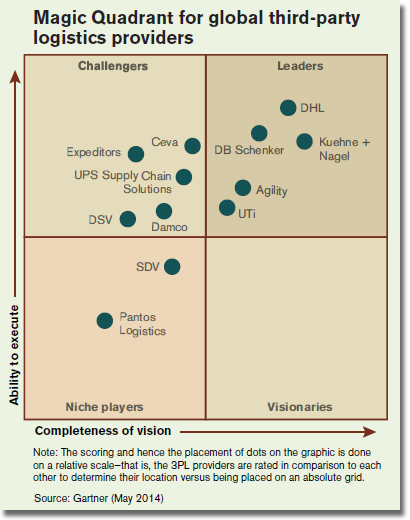

Magic Quadrant

Analysts for The Gartner Group are more concrete when it comes to defining the role of the 3PL. For them, the logistics service provider (LSP) predominantly operates a business that moves, stores, or manages products or materials on behalf of a shipper without ever taking ownership of such products or materials.

In its annual Magic Quadrant for Global Third-Party Logistics report, Gartner considers 3PLs and LSPs to be synonymous. “Increasingly, 3PLs have extended their services beyond the basics, providing opportunities to increase their value and resolve additional customer supply chain challenges,” says Greg Aimi, Gartner’s director of supply chain research and Magic Quadrant co-author.

For example, these services include returns and repair processing, assembly and kitting, packaging, postponement, shipment consolidation, and cross-docking. In some cases, 3PLs also offer fourth-party logistics provider (4PL) or lead logistics provider (LLP) services. Customers use 4PL/LLP as a single management team to oversee and coordinate other 3PLs and carriers on their behalf.

“Large multinational and global manufacturers, distributors, and retailers are requiring their 3PLs to offer a broader set of consistent and reliable services across more and more countries, and to integrate those services across end-to-end business processes so that they might be able to use them as a global preferred provider,” explains Aimi.

As a consequence, adds Aimi, the 3PL industry is progressing along a “maturity spectrum” in accordance with these new customer requirements, through a combination of acquisition and organic growth strategies.

“This Magic Quadrant is intended to chart the evolution of the largest 3PLs as they improve their ability to become a global preferred provider for their customers,” says Aimi. “Logistics and supply chain executives can use this research to better understand 3PLs and their capabilities when evaluating and selecting the right set of providers to meet their global logistics needs.”

Above the Radar

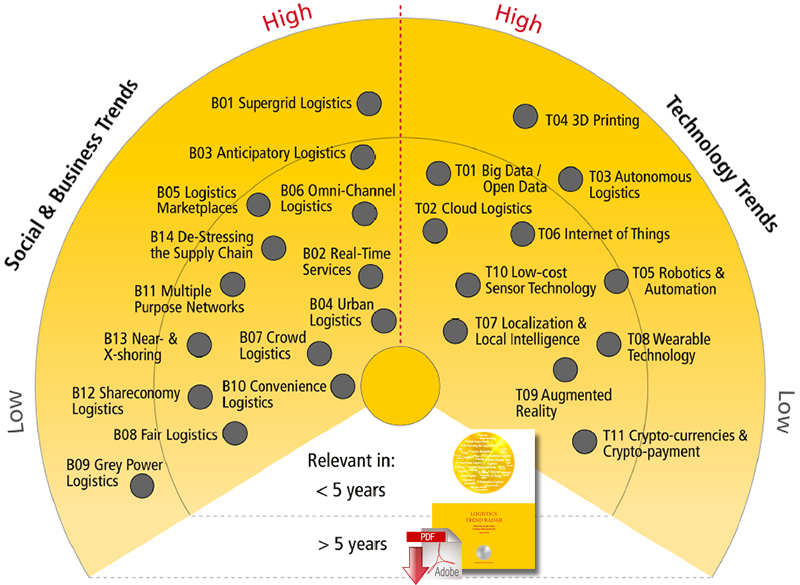

Aimi’s words of advice should resonate with the world’s largest logistics provider, DHL, which has just published the second edition of its Logistics Trend Radar.

The current report builds on the recent developments already identified in 2013, introduces new trends, and then sketches a future landscape for logistics professionals and the challenges they will face, but also outlines solutions that are underway—especially multi-channel retailing and predictive purchasing.

Some of the new trends the report highlights include omni-channel logistics, or the integration of different offline and online shopping channels; anticipatory logistics, or the application of big data analysis of customer product searches in order to send a shipment before the customer places an order; and crypto payment, the universal payment systems that allow global cross-currency payments to clear in seconds.

According to researchers, the Trend Radar report serves as a panoramic 360 degree view across the whole breadth of the logistics landscape. Based on this overview, the DHL research team will further explore selected trends in a “deep dive” format, based on research in cooperation with customers, research institutes, and industry experts.

“We combine our expertise with input from academia and other partners,” says Markus Kückelhaus, DHL’s director of trend research, adding that the Trend Radar paper is a good starting point for logistics professionals wanting to prepare their logistics network for future challenges.

Other Top Third-Party Logistics Provider articles:

Related Update: 2014/15 Top 50 Global & Domestic U.S. Third-Party Logistics Providers

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up