If you wanted to create the perfect mix of conditions to trigger the growth of a type of automated equipment for distribution center operations, you couldn’t do much better than the factors lining up in favor of robotics. E-commerce and omni-channel fulfillment are driving labor-intensive piece picking, and warehouse labor is increasingly difficult to find and retain.

DC operators know they need to automate to reduce these challenges, but few operations are able to plunk down millions for traditional automation projects that carry long payback times and might be difficult to reconfigure. Enter a new generation of robots, based on technology that uses on-board sensors and a more “natural” approach to navigation.

Research shows high interest in robotics. According to MHI’s “2018 Annual Industry Study”, 65% of professionals surveyed now see robotics and automation as a major source of disruption and/or opportunity, up from 61% last year.

Analyst firm Interact Analysis forecasts the market for autonomous mobile robots (AMR) and smart automatic guided vehicles (AGV) for logistics will grow from $300 million in 2017 to $3 billion by 2022, or roughly a 10-fold increase. “We are seeing true exponential growth now,” says Ash Sharma, a research director for Interact Analysis. “While numerous companies have been doing pilot projects for the last two years in warehousing or manufacturing facilities, now they are looking to expand their use of robotics. They are automating more processes, rolling out robots to more sites, or more countries. We are past the piloting stage.”

While e-commerce has increased piece-picking requirements, robotics also has evolved rapidly, with less reliance on guidance infrastructure like tape, and more use of smart, on-board navigation. The AMR term has emerged to describe this self-driving nature.

3PL RK Logistics is using Fetch Robotics’ AMRs for materials transport. The robots eliminate labor hours consumed pushing goods on a cart.

The flexibility of today’s AMRs makes them suited to DCs, notes Sharma. “Logistics facilities are rapidly changing environments, especially warehouses run by third-party logistics (3PL) providers, who might be on three or four-year contracts,” he says. “They don’t want their automation to be fixed in a way that makes it difficult to expand or change.”

For potential users of robotics, characteristics like flexibility and autonomy are a good thing, but there is some complexity in assessing all the choices, including:

- What different types of robotics exist for DCs, and what sort of workflows do they support?

- How do these robots coexist with human labor and more traditional forms of automation?

- Besides the “bot” itself, what other factors are involved in selecting robotics?

While today’s robotics in some cases promise fairly rapid return on investment (ROI), the difficulties in finding enough labor may make at least some use of robotics a forgone conclusion for many operations. “We’re trying to understand which robotic approaches are the best fit,” says Trever Ehrlich, creative solutions manager for Kenco Innovation Labs, an organization of 3PL Kenco Logistics that examines leading edge solutions. “Robotics is where we have to go to remain competitive.”

Multiple “bot” approaches

Using automated vehicles for materials handling isn’t new, as automatic guided vehicles have been used successfully in factories and warehouses for decades. But the traditional AGV was reliant on tape or other guidance markers, says Melonee Wise, CEO of Fetch Robotics, which offers AMRs. With AMRs, she says, “autonomous” is the key word, whereas with most AGVs, “guided” is the operative word.

“AMRs are robots that have on board intelligence and use sensors for obstacle avoidance, not just safety related behaviors,” Wise says. “They are able to make intelligent decisions about the environment, and they can work in environments that are constantly changing.”

The main role for Fetch’s AMRs is material transport, moving goods long distances so that a human doesn’t have to do so by pushing a cart or by driving a vehicle. In other cases, AMRs can function like conveyor. Wise says most customers can get ROI in nine to 12 months with Fetch’s AMRs, while their flexibility makes them appealing to 3PLs. Fetch’s customers include 3PLs such as RK Logistics.

Software from 6 River Systems sends a robotic “Chuck” to an aisle where a human picker badges into the robot and follows it to pick goods from an aisle using the Chuck’s lights, display and scanner to guide and confirm the work tasks.

“The 3PL space is our main customer base,” Wise says. “This is because of the flexibility and because we can get them up and running very quickly.”

Mobile robots differ in the workflows they do. Some focus on material transport. Others function as “goods-to-person” systems in which mobile robots transport shelves that hold goods to a light-directed, ergonomic picking station where a human does the picking. Yet another category is robotic-assisted cart picking in which the AMR has integrated features such as visual display, put lights, or a bar code scanner.

One vendor offering these smart, collaborative carts for human picking is 6 River Systems, which was founded by former Kiva Systems executives (Kiva was a pioneer in goods-to-person robotics that was acquired by Amazon). “We are a drop-in replacement for cart picking that is a full-system solution,” explains Jerome Dubois, co-founder of 6 River Systems. “We not only do the transport, we are the pick station, we are the put-to-light, we are the scanner, and the aisle manager functions. Everything is contained within our robot.”

6 River’s software can integrate with a warehouse management system to get order information, and with that data, it figures out the most efficient work assignments for each robot or “Chuck” as they are called. The software then sends a Chuck to an aisle where a human picker badges into the robot and follows it to pick goods from an aisle using the Chuck’s lights, display and scanner to guide and confirm the work tasks. “We actually lead the associates through their work, making it a directed workflow and paced environment,” says Dubois.

A key advantage to robotic-assisted cart picking is that it’s easy for new workers to learn, says Dubois. “Each Chuck is physically leading you and telling you what to do, so from a training perspective, and from the user’s perspective, it’s an easy environment to work in, he says.

Another type of robot seeing use in DCs combines an AMR with a smart, robotic arm for picking or materials transfer. IAM Robotics is an example of this approach, which Joel Reed, a vice president with IAM Robotics, calls a “mobile manipulation robot” approach. “We have a mobile platform that travels autonomously into the warehouse storage, finds the inventory locations, individually identifies objects, and picks the objects.”

IAM’s units have been deployed at companies including Rochester Drug Cooperative. A recent twist on IAM Robotics’ technology is the Swift Picking Module, which functions like a flexible automated storage and retrieval system (AS/RS), but rather than being an enclosed storage infrastructure with an enclosed crane or other movement mechanism, it uses IAM’s mobile manipulation robots and an open shelf environment.

The major advantage of a mobile manipulation robot, says Reed, is that it automates both movement and picking/transfer of goods. “We see that the industry is looking for a more complete solution [for the labor challenge] and that’s what we are answering,” he says.

Goods-to-robot, anyone?

Robotics picking arms are using artificial intelligence (AI) and new gripper designs to make them better suited to piece picking. While various means can be used to present work to a robotic piece-picking station, a fairly new twist is using robotic arms in combination with goods-to-person automated systems such as shuttles, in what might be termed a “goods-to-robot” setup.

Swisslog Logistics Automation offers multiple types of automation and robotics solutions, including goods-to-person automation, goods-to-person mobile robots, and robotic picking arms. “Today, goods-to-person solutions are quite mature,” says Fredrik Henriksson, senior director of e-commerce consulting for Swisslog. “That was the first step in increasing the output … now the robotic picker is the second step.”

Swisslog’s parent company KUKA Robotics offers smart, collaborative picking robots with sensors that allow them to be operated safely near humans without being fenced off. These picking arms could work in concert with one of Swisslog’s mini-load solutions in which the system would present goods to the picking robot. “The key advantages are that the automated cell can run 24/7, and the accuracy is higher [than with a human picker],” says Henriksson.

Robotics vendors have also partnered up to more fully automate processes. For example, Vecna Robotics, a vendor of AMRs and zero-infrastructure AGVs, recently partnered with RightHand Robotics, a provider of robotic picking solutions, to combine Vecna’s autonomous mobility with RightHand’s autonomous piece picking.

At the 2018 Modex show, Righthand’s “RightPick” work cells successfully picked and placed more than 131,000 items during the show. Machine learning software within RightPick is the key to being able to pick a variety of items, along with the gripper design, sensors and vision technology on the bot.

Leif Jentoft, co-founder of RightHand, says in the Modex demo, the mix of items spanned bottles, boxes, blister packs, bags and even people’s shoes and wallets. With machine learning, RightPick is constantly gathering data on what works best for grasping different types of items without having to train the system on specific items.

“We’re working on a project now where the warehouse has more than 100,000 SKUs that they will be feeding to our system,” Jentoft says. “Our system is model free. It can handle things it has never seen before.”

Software-driven

There are some limits to what a robotic picking arm can handle. A small robotic arm and gripper designed for piece picking into a tote, for instance, isn’t going to be able to pick a large heavy box that contains a product like a lawnmower.

Robotic piece picking is an interplay between the software smarts that perceives how to grasp items, the gripper’s charactistics and capabilities, and issues like weights and dimensions of items you need to move, explains Herbert ten Have, CEO of Fizyr, a vendor that offers deep learning software to enable robotic picking. Fizyr’s software and technology focuses on the perception part of this challenge—knowing how to best grasp any object the robot sees.

Fizyr works with automation providers who apply its deep learning software within their solutions. Combining shuttles with robotic piece picking is a high-growth opportunity for Fizyr, says ten Have, in part because the variety of items to be handled offers a more “controlled environment” than the nearly limitless variety of items that might move through a postal DC, where Fizyr’s technology also has been used.

Coexist or lights out?

John Hayes, vice president of sales and marketing with Vecna, believes that advances in small, low-cost AMRs and smart piece-picking robots are happening so fast that fully automating key DC workflows will happen quicker than expected just a few years back. “We’re going to get to the lights-out DC far quicker than many might think,” Hayes says. “Even today with the lost cost of mobile robotics, you can automate a lot of movement in your facilities for far less than it used to take.”

While AMRs will reduce human labor requirements, and in some cases might take the place of conveyor, it’s not as though robots will totally replace people and traditional equipment. In some cases, notes Fetch’s Wise, its AMRs are used to transport goods coming out of vertical lift modules (VLMs), while allowing associates to focus on other tasks besides transporting goods.

“Companies simply can’t find enough labor,” Wise says. “If you look at what Fetch does, it’s taking the people you can get and making them a heck of lot more efficient because it removes the transport workload.”

For the most part, vendors see robotics taking over the more repetitive tasks, freeing up workers to deal with other issues like solving stock outs, packing, doing quality checks, or in some cases, monitoring a fleet of robots. IAM Robotics’ Reed, for example, says that in deployment of its system, one person might be responsible for managing five to 10 robots. “People find that an interesting role to take on,” he says. “They vie for that position.”

Final factors

Automating a warehouse with AMRs, mobile manipulation robots or picking arms involves multiple factors besides the look and movement of the bot itself. These include the software the vendor uses for task management, fleet management and integration, as well as industry experience. Potential users also may be able arrange leasing or a “robotics-as-a-service” payment model.

“Historically, we could not find leasing companies that would service a lease, but the last two years, the market has exploded for leasing,” says Hayes.

Kenco Innovation Labs’ Ehrlich says Kenco has not yet deployed AMRs, but certainly sees the potential and is studying the various types available, the workflows they can support, and additional factors such as vendor experience, integration mechanisms to host systems, and software functions in areas like order processing and batching, or fleet monitoring.

“There is not one best robot out there for every need,” says Ehrlich. “You have to do your research. And, you should ask about vendor experience, and reference customers you can talk to or go visit to see how the system actually works. It’s stunning how good the technology has gotten, but it’s also good to find a vendor with deep experience in warehouse processes.”

Companies mentioned in this article:

- 6 River Systems

- Fetch Robotics

- Fizyr

- IAM Robotics

- Interact Analysis

- Kenco Innovation Labs

- Righthand Robotics

- Swisslog Logistics Automation

- Vecna

View Robotics Related Products and Accessories

CartConnect Autonomous Cart-Based Workflows

CartConnect Autonomous Cart-Based Workflows

CartConnect solutions increase cart workflow efficiency and output in warehouse and manufacturing environments, they provide flexible cart handoffs between warehouse associates and CartConnect robots.

Click&Pick high-speed order fulfillment system

Click&Pick high-speed order fulfillment system

High-speed order fulfillment combines storage with pick stations

RightPick.AI

RightPick.AI

Software enables lights-out robotic item picking.

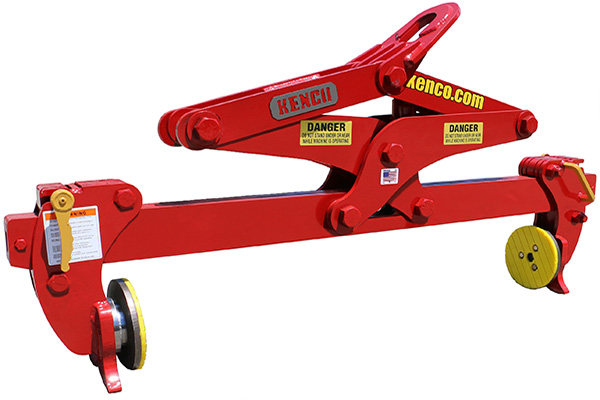

Multilift V1 lifting attachment

Multilift V1 lifting attachment

Grab and move concrete walls, blocks or slabs with any lifting equipment.

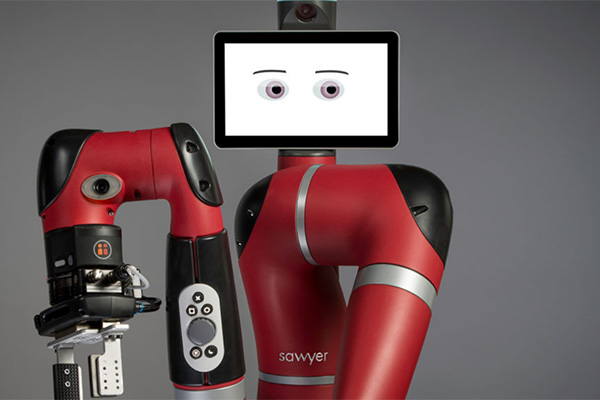

Sawyer single-arm, high-performance robot

Sawyer single-arm, high-performance robot

Collaborative robot tends machines, other precise applications.

RoboDrive Motors for Robotics Applications

RoboDrive Motors for Robotics Applications

Motors for robotic applications.

About the Author

Follow Robotics 24/7 on Linkedin

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up