Keeping Pace with the Times

Challenged by rising freight rates, driver shortages, tight truck capacity, and changing customer demands, shippers are using more technology to work through these and other transportation-centric problems.

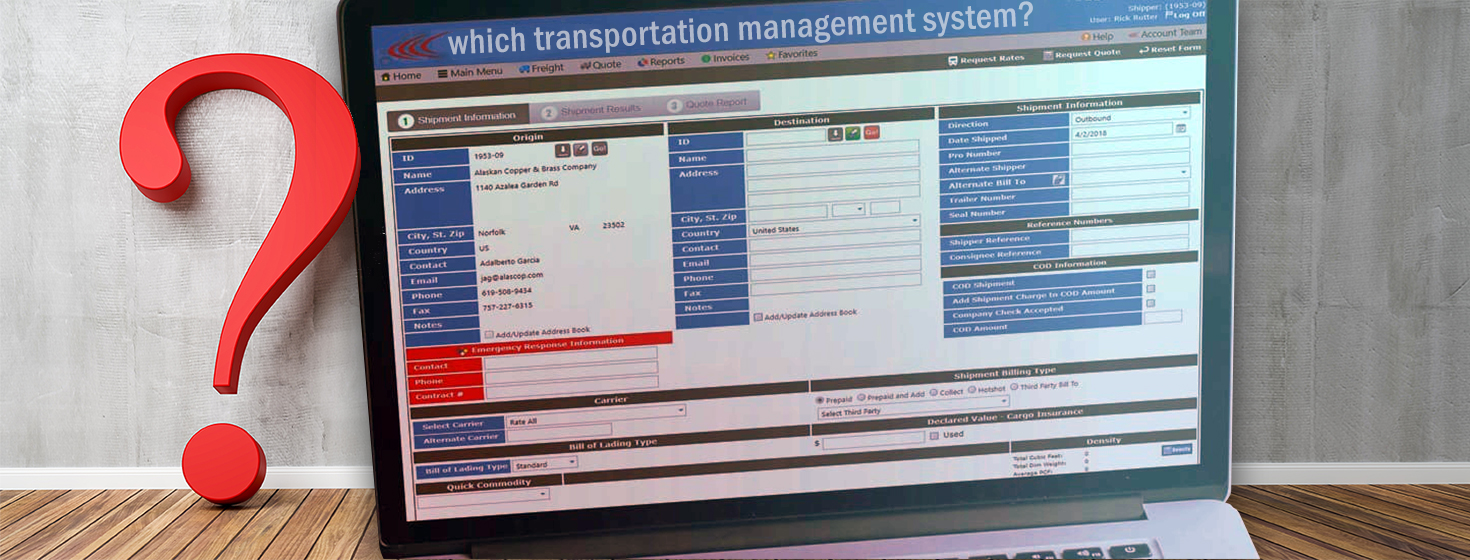

As the true workhorses of the supply chain management software cluster, transportation management systems (TMS) have become the “must have” for companies that - working under the pressures of e-commerce and omnichannel - need to move beyond clipboards, spreadsheets, and phone calls to manage their increasingly sophisticated transportation networks.

“Last year was a great year for TMS,” says Bart De Muynck, Gartner’s research director, transportation technology.

“In fact, in 2018 we saw investments go up across the entire supply chain technology spectrum.”

And that rising tide buoyed all ships, so to speak, with TMS being one of several supply chain sectors to see more sales and higher adoption rates, says De Muynck, who credits a continued investment in TMS on the part of larger shippers plus first-time buyers investing in their first platforms as two of the key market drivers.

“We still see some larger shippers that don’t have a TMS beginning to make their first investment in the technology,” says De Muynck. Another driver is the companies that invested in TMS 10 years ago to 20 years ago and now want Cloud-based systems that come with modern-day bells and whistles like data analytics and transportation optimization capabilities.

“A lot of these companies are switching over to newer, and typically multi-tenant Cloud solutions,” he adds.

Read: Logistics Company Transforms Customer Service & Reduces Costs by 50 Percent with Move to the Cloud

Over the next few pages, we’ll look at the growth of TMS over the last year, show how it’s being used to help shippers keep up with their customers’ delivery demands, hear from a shipper that’s reaping the rewards of its new TMS, and take a peek at what’s around the next corner for this critical supply chain software segment.

The Best Modes at the Lowest Price

Positioned between a shipper’s enterprise resource planning system (ERP) or other legacy solutions and its warehouse management system (WMS), TMS automates the inbound and outbound shipping processes.

Charged with obtaining the best possible mode at the lowest possible price, this software also handles the execution process (i.e., rate acceptance, carrier dispatch, etc.) and provides visibility into the shipping process (shipping from point A, arrival at Point B, Customs clearance, and so on).

A more modern TMS is delivered via the Cloud (versus an on-premise solution) and comes with data analytics, transportation optimization capabilities as well as the ability to track key performance indicators (KPIs).

Some of the newer entrants into the TMS market include Kuebix and 3Gtms, both of which made Gartner’s “Magic Quadrant” for transportation management systems listing for the first time in 2018. These and other Cloud-based providers have opened the doors for smaller shippers that want to automate and gain visibility over their transportation activity.

“Kuebix has onboarded more than 14,000 companies since releasing its free TMS,” says De Muynck. “That wouldn’t have happened 10 years ago when we were still thinking that only large shippers could get value out of using TMS technology.”

Read Kuebix Free Shipper: What a Difference a Year Makes

Over the next few years, De Muynck expects these “niche players” in the TMS market to become challengers - meaning, they’ll be giving more traditional providers a real run for their money. When that happens, he says that there will still be enough business to go around.

“Although TMS is a mature market, where the top six vendors claim more than 50% of the market,” says De Muynck, “we still see an opportunity for newer, smaller vendors to grow in the market.”

Been There, Done That

As companies push to position their fulfillment and warehousing operations as close to their customers as possible, TMS is helping them achieve that goal.

“The last-mile is definitely an area of interest for a lot of shippers due to its dynamic nature,” says Amit Sethi, senior manager for logistics and supply chain at Capgemini.

“A lot of shippers have already ‘been there, done that’ in terms of getting the cost savings out of the long-haul aspect of transportation, or those shipments moving more than 300 miles.”

Also piquing shippers’ interest right now are the metrics, analytics, and KPIs that a modern TMS can provide. That data can be used to make better decisions. In essence, a TMS paints a KPI/metric-based picture of the entire end-to-end supply chain, Sethi says, all while sitting outside of the four walls of the enterprise and warehouse. It also interacts with trading partners in the value chain - vendors, customers, freight providers, and carriers - thus creating a complete loop that logistics professionals can turn to as a reliable source of data and intelligence.

“We’re definitely seeing more shippers harness this TMS capability,” says Sethi, “and then use it as a good data source for how the entire supply chain is performing.” This trend is helping to drive TMS functionality as a whole right now, he adds and is prompting vendors to weave such capabilities into their solutions.

For example, while TMS has historically centered on batching and tracking shipments at certain times throughout the day, running a successful last-mile operation demands 24/7 optimization, with feedback coming from drivers on an almost real-time basis. Then, based on that feedback, the TMS is being asked to optimize not in batch mode, but on an in-line, constant, 24/7 basis. “Quintiq plays particularly well in this space,” Sethi notes, “with its continuous freight optimizer.”

Going forward, Sethi expects to see more innovation on the vendor side and higher TMS adoption rates on the shipper side. The convergence of these two trends could help drive even more market growth during the coming year. “TMS usage is expanding across new industries, including mineral, mining and other raw material-oriented companies,” says Sethi, “due to the need to more effectively manage fees, rates, assets, people and transportation as a whole.”

Sensata: Putting a Modern TMS to Work

A supplier of sensing, electrical protection, and control, and power management solutions, Sensata Technologies of Attleboro, Mass., operates in 12 countries, including China, Japan, Korea and Malaysia. Up until recently, Sensata managed its transportation in a silo. If a shipment was moving from Mexico to Europe, for example, the former would handle the process with little (if any) intervention from other locations. That meant very little transportation network visibility and even less collaboration among the company’s various locations.

“We were working in silos,” says Janelle Ballerstedt, Sensata’s global logistics and TMS project lead. “If we were shipping direct to a customer, we didn’t know what our options were with onsite carriers, who could provide next-day delivery, or what the costs looked like. We just didn’t have the visibility that we needed.”

Turning to Kuebix for help, Sensata decided to automate and streamline its outbound freight process. Currently, in use with eight of the firm’s 12 international locations, Kuebix’ Cloud-based TMS manages multiple transportation modes, including heavyweight air freight, parcel, hand-carry carriers, and less-than-truckload (LTL). It will soon add ocean to that lineup. “We’re using our TMS all around on the outbound side,” says Ballerstedt.

The TMS also helps Sensata divvy up the transportation duties across its logistics team and its customer service team, both of which are involved in the process. When shipping inter-company or to a customer, for example, both teams need to know when the materials are delivered.

“We needed a tool that would enable better communication among our logistics, warehouse and customer service teams,” says Ballerstedt. “Kuebix offered that, while other TMS providers didn’t have the communication component that we needed.”

One of the most used features in Sensata’s new TMS aligns directly with the shipper’s process for expediting shipments. If a customer needs materials the next day, and if those materials are going to cost $10,000 to ship, the TMS provides options that help Sensata minimize those fees while keeping its customers happy. For example, an 8:30 a.m. delivery might cost the full $10,000, but a 12:00 p.m. delivery might be half of that amount. And by the end of the day, that amount could be reduced by 60% to 70%.

So instead of just opting for the first next-day delivery option, Sensata’s customer service team can work with the receiver to find the right timing at the right price. “They’re able to have more informed conversations with our customers and understand what their true needs are,” says Ballerstedt, “all while gaining a better understanding of how transportation works.”

Those individual “wins” and the high levels of visibility that Sensata now has across its supply chain added up to a cost avoidance of $2.2 million during the first year that its new TMS was in place. Other benefits include happier carriers who, instead of getting 25 e-mails per day from Sensata, now get a single feed from the TMS. “It has been very beneficial for improving communications with carriers,” says Ballerstedt, “as well as internally on our own team.”

More Capabilities and More Consolidation Ahead

As more shippers like Sensata explore their TMS options, and as existing users upgrade to newer systems, Sethi expects the market to continue down a healthy growth path. And with more shippers wanting to optimize their freight procurement activities, he says the value of TMS will only continue to expand over the coming years.

The rise in freight marketplaces will also continue, Sethi adds, as will the influx of transportation procurement tools like Coupa. “We’re now starting to see procurement platforms that give companies better insights into freight procurement, and focus on automating that process,” he says, “then benchmark data against the industry as a whole in order to make better procurement decisions.”

Looking ahead, De Muynck expects more private equity investment bankers to take an interest in TMS, similar to what happened when Summit Partners acquired MercuryGate and E2Open (which is backed by Inside Venture Partners) bought Cloud Logistics.

“The acquisition phase is definitely not over,” adds De Muynck. “We’re going to continue seeing a lot more moves like this. There’s not that much left to buy right now, but with all of these new TMS vendors hitting the market, in the next two years they’ll start to become interesting for companies to acquire.”

Related Article: Asking the Right Questions When Evaluating Today’s TMS Transportation Management Systems

Related White Papers & eBooks

Shipper’s Guide to Evaluating, Selecting, & Building the Business Case for TMS

This white paper explores the important factors shippers should review when vetting software and transportation management system vendors, this is a must-read for shippers looking to implement a TMS to better manage freight. Download Now!

The Complete Buyer’s Guide to Transportation Management Systems

There is almost no limit to how a Transportation Management System can benefit your unique supply chain, but the key to success is finding the right one for your goals, so, before selecting a TMS, use the 12 questions in this buyer’s guide to find the best solution for your company. Download Now!

The Shippers Guide to Transportation Management System ROI

Taking a deeper look at the technology needs of transportation departments, Ohio State University Logistics Professor Jim Hendrickson conducted research into the value that supply chain execution systems provide. Download Now!

E-Commerce Transportation Execution

In this white paper, we’ll further explore the key challenges that shippers are facing in the e-commerce/omnichannel environment and show how transportation execution and optimization is already helping companies jump these hurdles, improve customer service levels, and cut costs. Download Now!

5 Reasons to Buy a True SaaS Transportation Management System

This white paper describes how a true SaaS infrastructure can give users real-time benchmarking of transportation rates, and connect your company to a Global Trade Network. Download Now!

Achieving End-to-End Visibility in Your Supply Chain

To run today’s supply chains requires a new paradigm, one that extends what ERP has done for the company within its four walls to the new reality of the multi-enterprise supply chain. Download Now!

More White Papers on Transportation Management Systems

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up