Industrial robot provider ABB Robotics, a division of ABB Group, recently released the results of its second annual Automotive Manufacturing Outlook Survey. The new global survey was commissioned by ABB Robotics and conducted by Automotive Manufacturing Solutions (AMS).

The survey gathered opinions on a range of topics from nearly 400 industry experts, ranging from vehicle manufacturers and suppliers at all levels of management and engineering as well as other professionals throughout the automotive manufacturing world.

Energy-efficient robots for manufacturers of all sizes

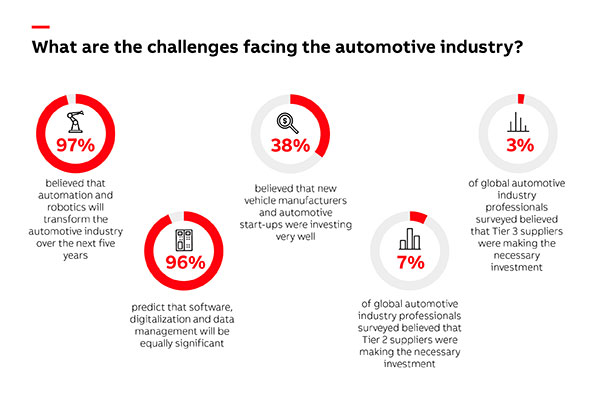

ABB said almost all respondents (97%) believed automation and robotics will transform the automotive industry over the next five years, with a similar number (96%) predicting software, digitalization, and data management will be equally significant.

“Automation has traditionally been seen as the preserve of only the very largest manufacturers,” said Joerg Reger, managing director of ABB Robotics automotive business line.

However, Reger said collaborative robots (cobots), large industrial robots, and AI-powered autonomous mobile robots (AMRs) can address challenges faced by smaller companies too. “Automation can make smaller companies more resilient, flexible and efficient.”

For example, ABB’s YuMi dual-armed cobots have recently helped Japan’s SUS Corporation - a supplier of die-cast aluminum components - reduce assembly time and increase productivity by 20%. ABB said introducing flexibility enables the company to respond to fluctuations in demand, with payback on the company’s investment expected within two years.

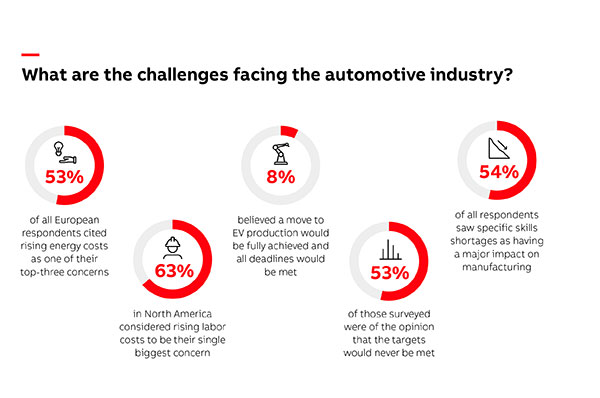

More than half (53%) of all European respondents cited rising energy costs as one of their top three concerns, compared to only 38% of those in Asia.

“Solutions to reduce energy consumption at the point of manufacture are already available,” said Reger. “New generations of intelligent automation and robot controllers, like ABB’s OmniCore, greatly reduce power usage by up to 20 percent through the use of leading software, lighter materials and regenerative systems.”

Investment in upstream supply chain automation

When asked about the pace of investment, most respondents believed new OEMs and startups are investing either “very well” (38%) or “quite well” (28%), followed by legacy OEMs who were thought to be embracing automation “very well” by 31%.

However, ABB reported only 7% of its respondents believed Tier 2 suppliers were making the necessary investment, with Tier 3 suppliers further behind at only 3%.

“While both new and established manufacturers are making key investments, the essential upstream supply chain supporting them is not moving as quickly,” said Daniel Harrison, automotive analyst from AMS. “This could prove problematic in terms of costs and also the speed at which new and increasingly complex components for EVs [electric vehicles] and connected cars are delivered to the factory.”

The survey also highlighted how supply chain disruption caused by global instability, which has resulted in component shortages and production delays, remains a key industry concern. ABB said more than a third (35%) of all respondents highlighted this issue, with a sharp increase amongst respondents in North America (51%) where it was cited as the region’s top manufacturing challenge.

Skilled labor shortages could impact EV manufacturing

ABB’s first Global Automotive Manufacturing Outlook Survey questioned industry experts as to whether legislative timetables to move to pure EV production were achievable. This year’s survey showed a drop in the number of respondents who strongly believed the transition could be realized, from 11% last year to 8% this year. More than half (53%) believed the targets will never be met, compared to 59% last year.

One reason for doubt over EV production deadlines may lie in concerns regarding key skills labor shortages. Over half (54%) of all respondents saw specific skills shortages as having a major impact on manufacturing. European (52%) and Asian (58%) participants singling out EV and battery expertise as their primary areas of concern. In North America, 63% said rising labor costs are their single biggest concern.

“As EV production accelerates, the need to upskill or redeploy large numbers of existing colleagues, as well as attract new talent into the automotive industry, becomes more critical,” said Harrison. “EV manufacturing in conjunction with the increased software, electrical, and advanced electronic content requires new and different skills, and the survey reflects a belief that more needs to be done.”

ABB Robotics said it has responded to skilled labor shortages by investing in robotics education outreach programs to teach students automation and software skills. The company’s IRB 1090 education robot is designed to empower students as they learn the fundamentals of robot programming.

Article topics

Email Sign Up