Earlier this month, research firm Interact Analysis released a new report outlining mobile robot sales for 2021. The firm found that global sales of mobile robots jumped more than 70% in 2021, topping 100,000 units for the year.

The report focused on “material handling applications in manufacturing and logistics environments,” it said.

“Despite the market for mobile robot technology being well established, it is not yet close to reaching saturation, with new applications and opportunities continuing to emerge,” said Interact Analysis. “The manufacturing industry is expected to continue to drive growth, as the market rebounds from the effects of Covid and a slow start to 2020.”

Strong outlook for mobile robot sales

Interact Analysis said the market outlook for automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) continues to be strong, but slightly lower than previously expected. Ash Sharma, managing director at Interact Analysis, said the firm lowered its outlook because it found that average revenues per unit numbers were lower than expected.

“In 2021, this dropped by 22% as a result of a change in regional mix and the influence of price erosion,” he said. “Tugger/AGC ARPUs reduced by just over 25% in 2021, followed by forklifts (20%) and tow tractors (>15%). In terms of unit pricing, we expect to see that every time mobile robot (AGV and AMR) shipments double, prices will fall by around 10% to 15%.”

Even with those concerns, Interact Analysks said it expect the installed base of mobile robots to reach more than 4 million units by 2027.

“Both AMRs and AGVs will experience strong demand in the next five years, but growth of AMR adoption will dwarf that of AGVs due to the greater range of possible applications,” it said.

“Logistics will continue to be the primary market for mobile robots, but significant growth is also anticipated in the manufacturing industry as new applications present themselves as the market develops,” noted Interact Analysis.

China strong on S2P, Americas invest in order fulfillment

The firm found that China and other Asia-Pacific countries (APAC) are investing heavily in self-to-person robots, while the West is investing more in order fulfillment bots.

“However, revenue growth in APAC regions will be slower out to 2027 because of the lower average selling price (ASP) of the technology in this region,” it said.

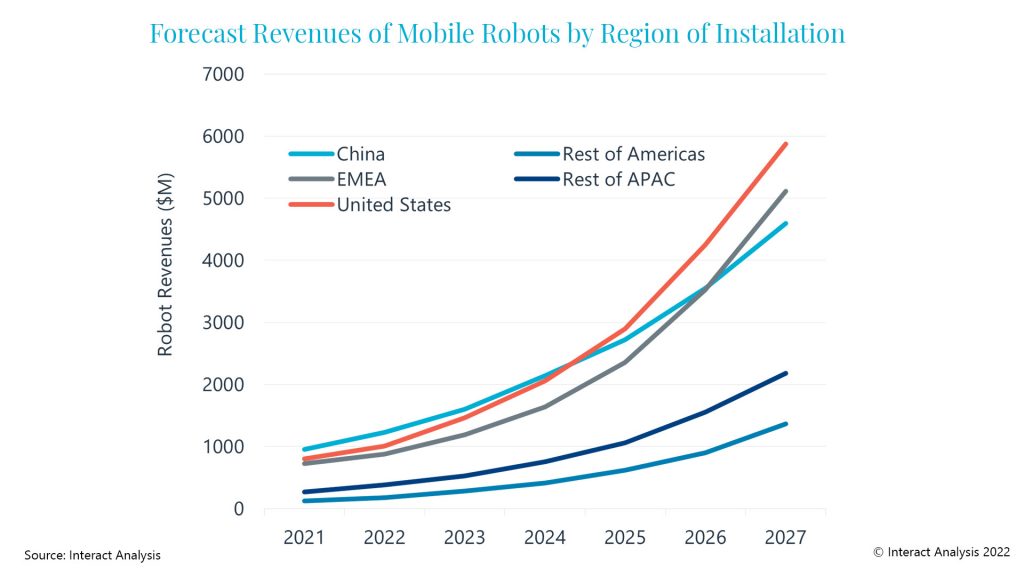

“The Americas and EMEA regions look set to enjoy substantial revenue growth in the next five years, with the market reaching almost $6B in 2027 for the US, while the figure sits at just over $2B for the rest of APAC and $5B for EMEA,” added Interact Analysis. “Despite this, China alone will account of around 40% of mobile robot shipments in the next five years due to an increasing trend towards lower cost robots.”

China highest on revenue growth

Interact Analysis said China led the way in revenue growth, and attributed AMR maker Geek+ for driving sales and helping the country become the leading robotics vendor. It also HikRobot and KION were also major contributors.

“China experienced such remarkable demand for flexible automation solutions in 2021 in the wake of the COVID-19 pandemic that there was very little in terms of labor shortage compared with other regions,” the firm said. “Looking out to 2027, the material transport sector will dominate mobile robot shipments, while sales volume will be driven by conveying solutions.”

Article topics

Email Sign Up