Don’t let the numbers fool you: 2014 was a good year for the lift truck industry.

The combined value of Modern Material Handling’s list of the Top 20 lift truck suppliers is down 3.5% this year, but nearly all reporting companies noted unfavorable currency conversions that in many cases turned gains into losses.

In actuality, those companies often saw double-digit growth in unit sales.

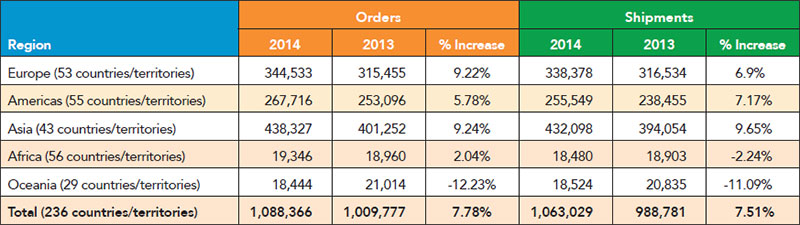

According to the 2014 World Industrial Truck Statistics (WITS) figures, global orders and shipments increased by almost 8%, a rate that has steadily grown in recent years from the low single digits.

Read last year’s Top 20 Lift Truck Suppliers ranking.

Brett Wood, chairman of the Industrial Truck Association (ITA) and president and CEO of Toyota Material Handling North America, says the global market continues to be relatively robust, with 1 million unit sales in 2014.

“This is in part a reflection of the strength of certain economies, especially here in the United States, lift truck sales will always coincide with general economic trends, and it is encouraging to see the steady recovery since the recession period in 2009.”

Wood also predicts increased consolidation, whether through acquisitions, mergers or partnerships.

News Update: On the heels of this statement, Modern Materials Handling learned that Mitsubishi Heavy Industries and Mitsubishi Nichiyu Forklift have jointly acquired UniCarriers, which will result in the companies holding respective stakes in UniCarriers of 65% and 35%.

Top 20 industrial lift truck suppliers

-

2014 Revenue (USD Millions)*Company

-

$7,712Toyota Industries Corporation

-

$5,314KION Group

-

$3,033Jungheinrich AG

-

$2,767Hyster-Yale Materials Handling, Inc.

-

$2,500Crown Equipment Corp.

-

$2,159Mitsubishi Nichiyu Forklift Co., Ltd.

-

$1,533UniCarriers Americas Corporation

-

$1,123Anhui Forklift Truck Group Corp.

-

$971Hangcha Group Co., Ltd.

-

$900Komatsu Ltd.*

-

$741Clark Material Handling International, Inc.

-

$683Doosan Industrial Vehicle

-

$477Hyundai Heavy Industries*

-

$190Lonking Forklift Co., Ltd.

-

$190Combilift Ltd.

-

$181Tailift*

-

$108Hubtex*

-

$82Hytsu*

-

$76Godrej & Boyce Manufacturing*

-

$69Paletrans Equipment*

* 2014 revenues not available by press time. Figure based on foreign exchanges rates as of 12/31/14.

View The Top 20 Industrial Lift Truck Suppliers Full Version PDF

Following a series of big mergers in recent years (TCM/Nissan became UniCarriers, Mitsubishi Heavy Industries and Nippon Yusoki became Mitsubishi Nichiyu), this year’s rankings remain relatively unchanged.

However, lift truck manufacturers continue to broaden product offerings, and a series of acquisitions illustrate a desire to further expand capabilities. Examples include KION’s acquisition of the handling automation division of Egemin Group and Hyster-Yale Materials Handling Inc.‘s acquisition of Nuvera, a fuel cell specialist.

Related: Don’t Be Fooled By Hyster-Yale Materials Handling Inc.‘s Low Valuation; It’s Well-Deserved (Keuka Capital)

There is more evidence suggesting a surge of innovation the lift truck space.

In the ITA’s 2014 Business Trends Survey, more than two thirds of members noted that fleet size in general is getting smaller - despite strong sales. The survey indicated the top drivers of fleet reduction include improved truck productivity, better usage of fleet data and warehouse automation.

Aside from the strength of the dollar, a lot could change in the next year. And although the numbers might suggest otherwise, the lift truck industry is flourishing even as it rapidly changes shape.

The Top 10

Toyota Industries Corp. (TICO) is once again No. 1 on our list, reporting virtually identical revenues that belie a 14% increase in the company’s materials handling segment and a reported 11.6% increase in unit sales.

In September of 2014, TICO, parent company of Toyota Material Handling USA, announced it had acquired the forklift business of 15th-place Tailift. Operating mainly in Taiwan and China, Tailift manufactures electric and internal combustion forklifts as well as industrial machine tools. Established in 1973, the company employs 1,000 workers, and Tailift’s forklift department has a production capacity of 28,000 forklifts per year.

Second-place finisher KION Group reported revenues 13% below those of last year, creating a more than $2 billion gap between the list’s leaders. In 2011, Toyota’s annual revenues were 5% ahead of KION.

Citing growth in western Europe and China, KION reported early 2015 results, which showed Q1 revenues 7% above the same period in 2014 and order intake 13.4% higher than in Q4 2014.

“Our strong position in western Europe and China, combined with our successful multi-brand strategy, enabled us to maintain the momentum of our record 2014 results as we entered the first quarter of 2015,” said Gordon Riske, CEO of KION Group. “The marked rise in revenue and order intake reflects the strength of our position in the new truck and service businesses, in emerging and developed markets.”

KION also highlighted its recent acquisition of the handling automation division of automation specialist Egemin Group. The division, to be named Egemin Automation, offers automated warehouse systems, automatic guided vehicles and in-floor chain conveyor solutions.

The rest of the top 10 held their rankings from last year, with No. 3 Jungheinrich reporting 9.1% year-on-year revenue growth in euro, which corresponds to a 4% decrease year-on-year in U.S. dollars. The company reported 15% growth in the number of units produced in 2014 and 9% growth in order intake.

A statement from 4th-place Hyster-Yale Materials Handling pointed to significant increases in “an unexpectedly strong North America market, partially offset by a decrease in European shipments, primarily in Eastern Europe.” Hyster-Yale’s operating company, NACCO Materials Handling Group (NMHG), also acquired Nuvera Fuel Cells in late 2014. Massachusetts-based Nuvera is focused on fuel cell stacks, related systems, on-site hydrogen production and dispensing systems.

According to a release, NMHG intends to commercialize Nuvera’s research and technology through the rapid integration of fuel cell technology across large parts of the company’s lift truck product range. It expects to be able to offer integrated, factory-fitted fuel-cell solutions, associated hydrogen generation and delivery capability, and aftermarket solutions designed to fit most electric-powered lift truck brands.

In sixth place, Mitsubishi Nichiyu grew 10%, which a statement from the company explained was a result of accounting changes. Some subsidiaries adjusted their fiscal calendar to match the parent company, which added three months of revenue for the first year of the calendar change adoption.

In its third year on our list, No. 7 UniCarriers (the result of a 2012 merger between Nissan Forklift and TCM) reported revenues of $1.53 billion, a 9% decrease from 2013.

Following unit-digit increases in revenues last year, No. 8 Anhui Forklift, the Chinese makers of Heli forklifts, reported revenues of $1.123 billion, a 3% increase. Ninth-place Hangcha Group also saw revenues hold steady at $971 million, a year after it grew by $150 million.

Rounding out the Top 10 for the second consecutive year is Komatsu. Although it was unable to confirm figures by press time, a company representative said 2014 revenues would be comparable to the $900 million it reported in 2013.

Notable Performances Since 2012

Factors such as currency conversion rates and restructurings can influence a comparison of revenues over the past few years. That said, in its six consecutive years at the top of our list, Toyota’s revenues have grown by 68%, and 12% since 2012. Holding firm to second place over the same period, KION’s 2014 revenues are 15% lower than in 2012, following strong performances in 2012 and 2013.

Tied for No. 14, Combilift has posted double-digit percentage increases for each of the last three years, growing 32% in that time. The company has effectively doubled revenues since 2009. The next highest growth rate over the past three years goes to No. 14 Lonking, which is up 21% since 2012. Lonking representatives report that the slightly lower 2014 revenues contradict a 19% year-over-year growth in revenues and a 22% increase in the number of units shipped, for a total of 22,110.

Hyster-Yale, Crown, Anhui and Hangcha also achieved double-digit growth since 2012.

Electric vs. Internal Combustion

According to Wood, the worldwide market for Class 1 electric counterbalanced trucks and Class 3 electric hand trucks continue to enjoy double-digit growth. The industry continues to see growth in the overall electric lift truck category, he says, due to regulations related to emissions, sustainability initiatives and technological advancements in electric lift truck components including batteries.

Globally, the more mature markets have embraced electric vehicles faster than the emerging markets, Wood suggests. For example, the Asian market is made up of only 35% electric lift trucks, while the North American market is 60% electric and European market is 80% electric. The overall worldwide market is 45% electric.

“So, even with the trend toward more electric, 55% of the global customers still prefer engine-powered lift trucks, especially in emerging markets that have more outdoor applications,” Wood says. “The industry remains committed to sustainability - not only through innovative products but also throughout manufacturers’ operations with initiatives like zero landfill waste programs. Sustainability is the new normal in all aspects of lift truck manufacturing.”

Growth by Region

WITS tracks quarterly and monthly statistics on lift truck sales, and is compiled by six trade groups based in North America, Brazil, Japan, Korea, Europe and China.

Worldwide Lift Truck Market

Source: The World Industrial Truck Statistics (WITS) organization.

According to the 2014 WITS figures, global orders increased by almost 8%, up slightly from last year and representing more than 1 million units. In 2012, shipments were flat and in 2013 they increased 5%. In 2014, more than 1 million units were shipped, a 7.5% increase.

Additional highlights of the WITS figures include:

- Following a nearly flat year, orders and shipments to Europe spiked in 2014, up 9% and 7% respectively.

- The Americas, which last year kept pace with double-digit growth in Asia, shipped a quarter of a million units, a 7% increase.

- According to figures from the ITA, 184,979 units of Class 1 through 5 lift trucks were U.S. factory shipments, as compared to 172,073 units in 2013, an increase of 7.5%.

- Asia hovers around 10% growth for the second year in a row after volume decreases of a few percentage points in 2012. The region still accounts for 40% of global shipments.

- In Oceania (Australia and nearby islands), shipments and orders continued falling from 2012 highs, reporting more than 20% decreases in orders and shipments over the span of two years.

How the Suppliers Are Ranked

To be eligible for Modern Materials Handling’s annual Top 20 lift truck suppliers ranking, companies must manufacture and sell lift trucks in at least one of the Industrial Truck Association’s seven truck classes: electric motor rider; electric motor hand trucks; internal combustion engine; pneumatic tire; electric and internal combustion engine tow tractors; and rough terrain lift trucks.

Rankings are based on worldwide revenue from powered industrial trucks during each company’s most recent fiscal year. Revenue figures submitted in foreign currency are calculated using the Dec. 31, 2014 exchange rate.

Top White Paper Resources

The Truth about Electric Lift Trucks and Their Impact on Your Operations

Amid all the information toay from so many sources, what’s the truth about electric lift trucks? Electric lift trucks offer considerable cost advantages over the life of the unit and can perform as well as ICE lift trucks in many cases. Yale (NACCO Materials Handling Group)

The Impact of Customization on Materials Handling Success

This white paper outlines significant challenges facing businesses today and discusses how they can be addressed through more effective materials handling processes and equipment. Hyster (Hyster-Yale Materials Handling)

Determining The Right Lift Truck Navigation System

While factors such as warehouse layout, aisle size and order picking methods impact overall productivity and order picking accuracy, the use of lift truck equipment and related navigation systems also plays a major factor. Jungheinrich

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up