Leading industry analysts maintain that the “mega-deals” witnessed over the past two years in the third-party logistics provider (3PL) sector have abated, but that certainly doesn’t mean that mergers and acquisitions (M&A) will fall out of the picture.

According to Evan Armstrong, president of the consultancy Armstrong & Associates, the 3PL market is also still ripe for equity investment.

“The one outstanding example of this was when Aerospace, Transportation and Logistics [ATL Partners] bought a controlling share of Pilot Freight Services late last year,” he says.

“We also anticipate more M&A activity as 3PLs strive to expand geographic scale and provide integrated solution offerings.”

At the same time, says Armstrong, technological changes are having a dramatic impact on 3PL operations.

Companies such as project44, MacroPoint and others are driving improved transit status data and carrier capacity information from transportation providers to lead logistics companies.

“This year’s electric logging devices [ELD] mandate could also be a boon for shipment tracking and carrier capacity monitoring information,” says Armstrong.

“These types of advances allow for more process automation and increased operational efficiencies. They’re also increasing the quality of information available to customers of non-asset based transportation managers.”

Specifically, industries such as pharmaceuticals are increasing their digitalization needs, Armstrong’s research reveals, putting more emphasis on 3PLs to match these new technological demands.

To better ensure counterfeit products are not being sold within established sales channels, for example, the pharmaceuticals industry has a 2017 mandate to begin capturing product serial numbers across its supply chains.

“While this mandate has presented a challenge for many value-added warehousing 3PL operations, the ones we’ve met with are implementing the required operations changes and will meet the deadline,” says Armstrong.

Rank | Third-party Logistics Provider | Revenue |

|---|---|---|

| 01 | 13,144 | |

02 | 8,638 | |

03 | 6,793 | |

04 | 6,181 | |

05 | 6,098 | |

06 | 4,909 | |

07 | 4,200 | |

08 | 3,629 | |

09 | 3,573 | |

10 | 2,916 | |

11 | 2,659 | |

12 | 2,630 | |

13 | 2,360 | |

14 | 2,321 | |

15 | 2,310 | |

16 | 2,209 | |

17 | 2,200 | |

18 | 2,125 | |

19 | 1,798 | |

20 | 1,716 | |

21 | 1,710 | |

22 | 1,632 | |

23 | 1,620 | |

24 | 1,555 | |

25 | 1,500 | |

26 | 1,431 | |

27 | 1,250 | |

28 | 1,156 | |

29 | 1,150 | |

30 | 1,090 | |

31 | 1,055 | |

32 | 1,044 | |

33 | 1,006 | |

34 | 949 | |

35 | 900 | |

36 | 900 | |

37 | 900 | |

38 | 800 | |

39 | 800 | |

40 | 796 | |

41 | 790 | |

42 | 783 | |

43 | 773 | |

44 | 763 | |

45 | 750 | |

46 | 677 | |

47 | 650 | |

48 | 640 | |

49 | 626 | |

50 | 616 |

*Revenues are 2016 Gross Logistics Revenue (USD Millions) company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange rate in order to make non-currency related growth comparisons. Copyright © 2017 Armstrong & Associates, Inc.

“Adapt or Die”

Logistics managers should also expect more 3PL consolidation, says Armstrong, pointing out that the global market is finding it exceedingly hard “to grow and scale” their networks organically.

“Acquisitions are required to leapfrog into and move upward within the Top 50 Global 3PL rankings,” says Armstrong. “This will continue to drive acquisitions like we have seen with DSV/UTi; XPO/Norbert Dentressangle, and Con-way with Geodis/OHL.”

Finally, the “adapt or die” imperative is still with us - and will be for the foreseeable future. To keep pace with omni-channel fulfillment and disruptive technologies like drones, 3D printing, Internet of Things, driverless vehicles, advanced robotics and wearable technology, it’s become painfully clear that 3PLs must constantly evolve to anticipate shipper demands.

“Fortunately, 3PLs are amazingly good at embracing change,” says Armstrong. “For example, we’ve been in operations utilizing PINC Solution’s drones for improved trailer yard management and Google glasses for warehouse picking. In addition, many applications, such as HubTran, are adapting machine learning to automate mundane freight bill payment tasks.”

In the meantime, Armstrong adds that 3D printing remains mired in its growth stage, but will continue to impact spare and service parts logistics operations. “However, we will see some type of human-overseen driverless vehicles hit the streets in the near term, and that could be especially beneficial in long-haul trucking operations.”

For Armstrong, the “Uberization” of trucking, or what he prefers to call “digital freight matching,” is still trying to find its legs. “However, we see that there’s significant progress being made to build improved real-time lane pricing information with companies such as Cargo Chief, and improved carrier management applications from industry stalwarts such as C.H. Robinson and Coyote Logistics,” he says.

Rank | Third-party Logistics Provider | Revenue | |

|---|---|---|---|

| 01 | 26,105 | ||

02 | 20,294 | ||

03 | Nippon Express | 16,976 | |

04 | DB Schenker | 16,746 | |

05 | C.H. Robinson | 13,144 | |

06 | DSV | 10,073 | |

07 | XPO Logistics | 8,638 | |

08 | 7,046 | ||

09 | GEODIS | 6,830 | |

10 | 6,793 | ||

11 | 6,646 | ||

12 | DACHSER | 6,320 | |

13 | 6,273 | ||

14 | 6,181 | ||

15 | 6,098 | ||

16 | 5,822 | ||

17 | 5,276 | ||

18 | 4,800 | ||

19 | Bolloré Logistics | 4,670 | |

20 | 4,415 | ||

21 | Yusen Logistics | 4,169 | |

22 | CJ Logistics | 3,662 | |

23 | 3,629 | ||

24 | 3,576 | ||

25 | 3,573 | ||

26 | 3,443 | ||

27 | 3,352 | ||

28 | 3,097 | ||

29 | 2,916 | ||

30 | 2,659 | ||

31 | 2,500 | ||

32 | 2,360 | ||

33 | 2,321 | ||

34 | 2,275 | ||

35 | 2,125 | ||

36 | 1,720 | ||

37 | 1,716 | ||

38 | 1,710 | ||

39 | 1,700 | ||

40 | 1,676 | ||

41 | 1,640 | ||

42 | Landstar | 1,632 | |

43 | 1,620 | ||

44 | 1,615 | ||

45 | 1,555 | ||

46 | 1,550 | ||

47 | 1,500 | ||

48 | 1,431 | ||

49 | Groupe CAT | 1,328 | |

50 | 1,250 |

*Revenues are 2016 Gross Logistics Revenue (USD Millions) company reported or Armstrong & Associates, Inc. estimates and have been converted to US$ using the average annual exchange rate in order to make non-currency related growth comparisons. Copyright © 2017 Armstrong & Associates, Inc.

Building a Portfolio

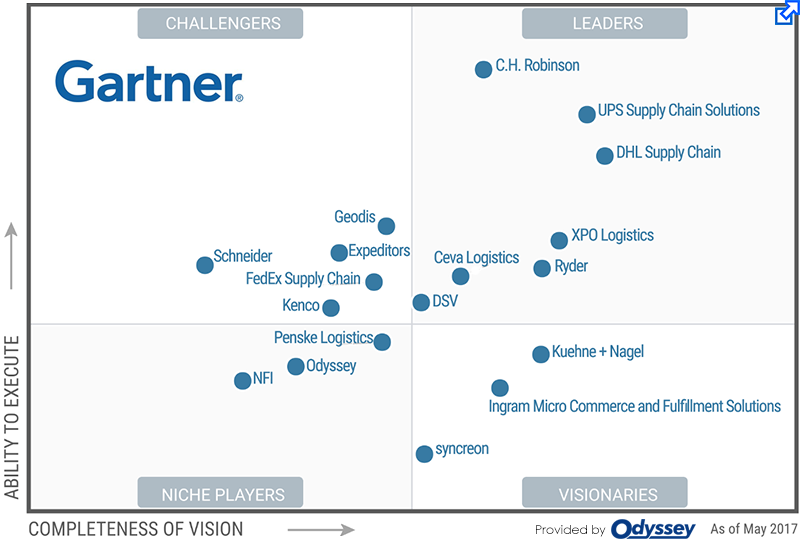

Many of the same observations are shared in Gartner’s annual “Magic Quadrant” report that was released last month at its supply chain conference in Phoenix.

The aim of the report is to provide a qualitative analysis of the market, its direction, maturity and its participants.

Greg Aimi, Gartner’s director of supply chain research and co-author of the “Magic Quadrant,” says that logistics managers are still pressing for consolidation in their 3PL portfolios, but not until providers can demonstrate that they have a truly global network.

“For this to happen,” says Aimi, “there must be a significant air and forwarding capability. Furthermore, 3PLs in the Asia Pacific region have yet to get started with western acquisitions - but I assume they will.” He adds that the report revealed that logistics managers are seeking out a high-degree of industry vertical expertise and specialized solutions, thereby driving a number of “tuck-in” M&As.

Read Gartner: Reviews for Third-Party Logistics, North America

“At the same time, the technology area for 3PLs is just getting started,” adds Aimi. “Let’s just forget that they were laggards when it came to unifying software systems to a single global platform in the past. Today, global operational transparency requirements and digital business drivers from their shipper customers are just going to increase the need for 3PLs to be top dogs when it comes to tech and innovation.”

New Journey

According to Aimi, this is the second iteration of the “Magic Quadrant” for North American 3PLs. Since the first report, Gartner made significant changes in the criteria definitions to better identify what makes a 3PL valuable to shippers seeking a North American regional provider.

Researchers note that the 3PL industry is “progressing along a maturity spectrum,” and trying hard to accommodate increasing shipper requirements through a combination of acquisition and organic growth strategies. However, not all are at the same place in their journey.

Gartner Magic Quadrant for Third-Party Logistics, North America

According to Gartner, there’s a transformation underway across today’s logistics industry, and perceptions of logistics service providers are changing. Relationships historically have been transactional, pragmatic and “physical activity oriented.”

Researchers note that 3PLs contributed by competing head-to-head in low-margin pricing wars and assumed the role of an interchangeable commodity. Consequently, the idea of leveraging specialized services seemed out-of-reach - until recently.

“As acceptance has grown for an increased amount of logistics outsourcing, companies are realizing that their performance is more dependent on not only their 3PL providers’ capabilities and execution, but also the manner in which they are managed.”

“This mandates a transition in the roles and responsibilities of tomorrow’s logistics professional from being a master of logistics execution to a master of provider orchestration; and it puts an importance on the relationship between customer and 3PL,” says Aimi.

Shareholder Pressure

Interestingly, while the importance of resource integration is widely acknowledged, it’s not uncommon for logistics companies to continue to operate their systems separately, notes John Manners-Bell, chief executive of the London-based consultancy Transport Intelligence (Ti).

For example, Manners-Bell notes that companies like DHL, UPS, Deutsche Bahn and SNCF continue to operate despite the fact that there is little integration between many of their operations or functions. He maintains, however, that this is a less than optimal situation and has often led to a significant lag in the realization of costs savings or to the absence of expected cooperation.

“What’s more,” says Manners-Bell, “this lack of cooperation makes disposals likely if and when management comes under pressure from shareholders. While contract logistics companies typically integrate well, due to their asset-light nature, they still need to work on the daunting challenge of integrating the IT systems of the acquired company.”

Ti researchers say that the logistics industry maintains the consolidation trend, suggesting that acquisition remains the most favored route towards building global portfolios of integrated services. Their analysts agree with Armstrong and Gartner that the level of consolidation in 2017 is estimated to drop compared to 2016, both in terms of total deal value and volume.

“However, looking ahead, the outlook for consolidation activity in the industry remains positive,” says Manners-Bell.

“In addition to being driven by the search for growth through global presence and expertise in high-margin sectors, the continued growth of e-commerce will also drive M&A activity in the logistics industry.”

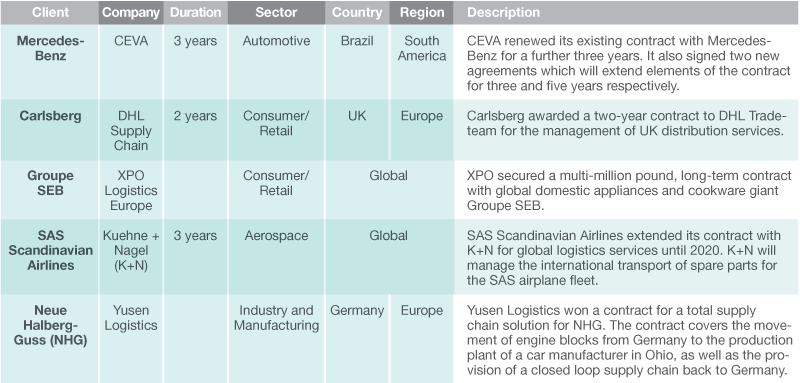

Examples of major contracts in early 2017

Source: Ti database of major contracts

John Langley, Jr., Ph.D., clinical professor of supply chain management at Penn State University, agrees with many of the points raised by Armstrong, Gartner, and Ti, but concludes that logistics managers must be aware of other imperatives as well.

“Three factors will contribute to a greater reliance on technology as 3D or additive manufacturing comes into play,” says Langley.

“We have the same forecast for issues related to block chain, visibility, and optimization.”

At the same time, Langley cautions managers to consider disruption and risk when choosing a global 3PL, particularly if they’re operating in a politically unstable environment.

“Also of significance is that the ‘Amazon concept’ is resulting in a great need for providers of all types to reassess their existing capabilities and essentially transform their strategies and operations to better fit into the future needs of shippers,” says Langley.

“Logistics managers should be ever mindful that 3PLs are partners who are re-examining their supply chains and looking for useful ways to innovate and transform.”

View All Previous Top 50 U.S. & Global Third-Party Logistics Providers

Related 3PL White Papers

21st Annual, 2017 Third-Party Logistics Study

The results and findings of the 2017 21st Annual Third-Party Logistics Study provide current perspectives on the nature of shipper and 3PL relationships, why they are generally successful and some of the ways in which they could be improved. Download Now!

Selecting and Managing a Third Party Logistics Provider

If done correctly, the partnership with your Third Party Logistics, 3PL provider can truly be a source of competitive advantage for your company, in this white paper, we set out to provide a summary of the best practices for selecting and managing a 3PL. Download Now!

How Non-Traditional Services are Revolutionizing the Supply Chain

This white paper will look at the impetus behind this change, as well as examples of non-traditional supply chain services, from there, the paper discusses how these value-added services impact the partnership between 3PLs and their customers. Download Now!

Five “New Rules” of 3PL e-Commerce Fulfillment

The purpose of this white paper is to spell out “The Five New Rules of 3PL e-Commerce Fulfillment.” rules and explain how they will benefit your 3PL warehouse, it also provides the guidance you need to help your 3PL e-Commerce fulfillment business prepare for future growth. Download Now!

More SC24/7: Third-Party Logistics White Papers

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up