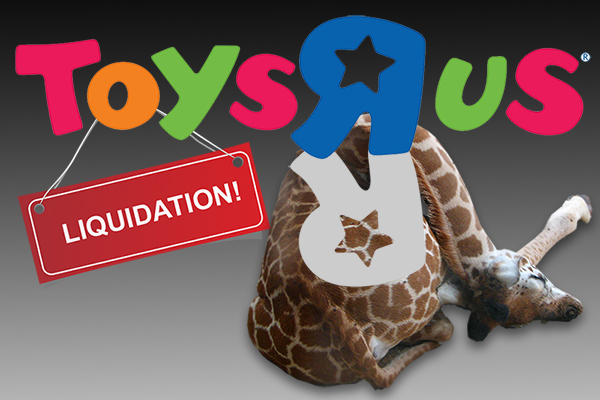

Toys R Us, the toy superstore chain that became a dream factory for kids nationwide, said in a U.S Bankruptcy Court filing early Thursday that it must liquidate, a move that will likely lead to the closure of all its stores and sale of remaining merchandise.

As reported by Reuters, the closure is a blow to generations of consumers and hundreds of toy makers that sold their products at the chain’s U.S. stores, including Barbie-maker Mattel Inc, board game company Hasbro Inc and other vendors like Lego.

“This is a profoundly sad day for us as well as the millions of kids and families who we have served for the past 70 years,” Chief Executive Officer Dave Brandon said.

With shoppers flocking to Amazon.com Inc and children choosing electronic gadgets over toys, Toys ‘R’ Us has struggled to boost sales and service debt following a $6.6 billion leveraged buyout by private equity firms in 2005.

Toys ‘R’ Us said on Thursday it is seeking approval to liquidate inventory in its 735 U.S. stores, which debtors anticipate will close by the end of this year.

It is in talks to sell 200 of those stores as part of a deal to sell its 80-odd stores in Canada.

For its operations in Asia and Central Europe, including Germany, Austria, and Switzerland, the company will pursue a reorganization and sale process. The already announced administration of its UK business will continue, the company said.

The wind-down follows a bruising holiday season when the company failed to stay competitive and sales came in well below projections. The quarter accounts for 40 percent of its annual net sales.

Toys ‘R’ Us’ creditors said in a court filing that Target Corp, Walmart Inc and Amazon pricing toys at low-margins and a greater-than-expected decline in toy and gift card sales following its bankruptcy filing in September led to the weak performance in the quarter.

“Even during recent store closeouts, Toys R Us failed to create any sense of excitement,” said Neil Saunders, managing director of retail research firm GlobalData Retail. “Its so-called heavy discounts remained well above the standard prices of many rivals.”

Toys R Us Store Closures

Wayne, New Jersey-based Toys ‘R’ Us was already in the process of closing one-fifth of its stores as part of an attempt to emerge from one of the largest ever bankruptcies by a specialty retailer.

In September, when the company operated more than 1,600 stores globally, with roughly 800 stores outside the United States, it got court permission to borrow more than $2 billion to start paying suppliers.

But efforts to keep the business going collapsed after lenders decided that in the absence of a clear reorganization plan, they could recover more in a liquidation by closing stores and raising money from merchandise sales.

The company’s troubles mirror those of other mall-based retailers in the United States that have shut stores and fired employees in a bid to stay relevant.

More than 8,000 U.S. retail stores closed in 2017, roughly double the average annual store closures in the previous decade, according to data from the International Council of Shopping Centers.

The disappearance of Toys ‘R’ Us leaves a void for hundreds of toy makers that relied on the chain as a top customer alongside Walmart and Target.

7 Retail Management Lessons You Can Learn from Toys ‘R’ Us

While the final reason for the closures may be the debt – the truth of the matter is that Toys ‘R’ Us landed in this predicament for many reasons. Their poor performance, which led to their not being able to afford their debt, can be attributed to many things.

For small and medium-sized businesses, there are several lessons that can be gleaned from the Toys ‘R’ Us shutdowns.

Here are a few other ways, detailed by Kris Hiiemaa of Erply, why Toys R Us contributed to its current condition:

1. They closed down the main store at Times Square

In 2015, the company closed its flagship location in Times Square, without having a new location in mind for the new flagship. This location was more than just another location for the chain – it was a tourist attraction. The giant Empire State Building built of LEGO pieces in the store, as well as the indoor ferris wheel featuring the company’s logo, were frequently photographed by tourists and visitors from all over the world. The reason for shutting down this location was, reportedly, inability to afford the rent at the location any longer.

The problem here is two-fold. First, Toys ‘R’ Us closed down what was their most popular attraction for shoppers. Second, they didn’t reopen that store in any other nearby location. Instead, they simply retired the flagship and let other locations in Brooklyn, Queens, and Union Square take over the retail duties of this store. When you have an attraction that visitors flock to, be sure you have a backup plan if you must move or close down that attraction.

2. They treated their stores like warehouses, rather than experience shops for kids

The biggest reason that the Times Square location was so loved by guests was that it was more than just a warehouse to go to for shopping purposes. It was an experience, with something unique that really made visiting worthwhile. Giving consumers an additional reason to walk through the doors, beyond just buying a product, is essential for building a brand.

One of the best examples of this is Disney’s retail locations, which are located all over the country. These stores are not just simple retail stores but have fully interactive experiences for kids. Most of these locations have a movie area where kids can sit and watch Disney releases while parents shop nearby; a dress-up area with mirrors, a “clubhouse” area, and more. These experience-based additions to the stores make it impossible for kids to resist, which makes it more likely that parents will be in the store longer – and thus, will spend more money. By treating every Toys ‘R’ Us location like a basic retail location, instead of creating an experience to draw kids and adults in, the chain missed a vital opportunity.

Toys ‘R’ Us CEO Dave Brandon has said that plans for the future of the company include adding more experiences to the stores that remain open, such as toy demonstrations and other fun activities.

3. They couldn’t compete with Amazon in logistics

If you are going to treat your business like a warehouse, rather than an experience, then you have to focus on competing with the world’s leading warehouse for just about everything: Amazon. While Toys ‘R’ Us’ failure cannot be totally blamed on Amazon, it’s hard to ignore the way this mega-corporation has changed online shopping. If companies can’t compete with the amazing selection, super-fast shipping, and low prices on Amazon, then they are definitely not going to perform as well.

For many businesses, the problem isn’t necessarily in how much stock they carry, but in getting it to the store or the customer in a timely manner. Managing multiple warehouses and tons of product lines is much easier when you have a POS system that automatically tracks every item in your system. This allows you to give customers accurate estimates in arrival times for products, and also helps you better predict need, so that you can eliminate how often customers are forced to wait on the product in the first place.

One thing that Toys ‘R’ Us CEO Brandon mentioned in plans to revamp the chain is a push for making stores more accessible in smaller towns. That could be one way to compete against Amazon; audiences that haven’t been able to reach your store before may appreciate the ability to see a product in person before buying.

4. Their presentation was hectic, leading to poor customer service

Any customer who had ever shopped in a Toys ‘R’ Us before could report feeling overwhelmed when walking into one of their locations. With too many different products arranged in messy displays, most of the chain’s stores could be described as hectic. This not only led to customers feeling unwelcome but also made for poor customer service. When inventory is all over the place, not neatly or stylishly displayed, and frequently in a jumble, it is hard to help customers find what they are looking for.

This is one of the biggest lessons that any small or medium-sized business can take from the Toys ‘R’ Us debacle. In many cases, limiting the variety of your in-store inventory, and making sure it is displayed in organized and stylish ways, can be more inviting than having all your inventory out in view. Additionally, giving employees access to inventory in a mobile POS system can ensure that they are better equipped to offer great customer service.

CEO Brandon mentioned that Toys ‘R’ Us stores will begin carrying fewer products in the future to cut back on this problem, which would also help simplify operations and customer service.

5. Their inventory management wasn’t well-planned or executed

Something that Toys ‘R’ Us could have benefited from was a better inventory management system. Customers frequently reported that the newest products being advertised weren’t available – in fact, there was an iconic Christmas movie made about toy stores running out of the latest and greatest toys that closely mirrored many people’s real-life experience with Toys ‘R’ Us. By not having great inventory management and poor attention to detail when ordering stock, many of the stores left customers no choice but to head to Amazon or other online retailers to find things they wanted.

The lesson here? If you are a niche retailer, it is your job to carry the most popular items in that niche. You need to know what your customers want, and when they want it. A great inventory management system for planning and executing restocks is vital for keeping your business operating smoothly. A system like Erply can help you learn your customers’ buying habits, predict what types of products will be selling when, and automatically handle orders for you so that you don’t run out of popular items during crucial sale time periods.

6. They didn’t carry original products

One of the biggest reasons that Toys ‘R’ Us struggles to compete against the likes of Amazon and Wal-Mart is that they don’t carry any exclusive product lines. Their products are the same products that you can find at other big chain retailers, and often at more savings and in more convenient ways. Customers can get the same products online without having to venture into stores where they can’t be sure that the product will even be in stock.

The lesson here? Stores must give customers a specific reason to visit them over shopping elsewhere. It isn’t enough to offer a good selection of products, great customer service, or even an experience-based sales strategy. Stores need an exclusive line of products, whether they are house products or an agreement to exclusively sell a third-party product. This ensures that customers must come to you because they can’t get what you offer anywhere else.

7. They lacked a modern strategy for customer engagement

Finally, Toys ‘R’ Us lacked an engagement strategy when it came to their customers. Customer engagement means building and nurturing relationships with customers to promote brand loyalty. Without it, customers feel no connection to the company, and that gives them even fewer reasons to return. Today’s modern customer expects to connect with a brand online (via social media and email); through loyalty programs; through personalized content; and more.

A better loyalty program and a bigger focus on engaging through the Babies ‘R’ Us registry program are two of the things that CEO Brandon said the chain would be doing in the future to improve in this area.

For small businesses, the message here is very clear: engaging with current customers to nurture long-lasting loyalty is vital to the success of a company. A strong online presence and a focus on keeping customers engaged after a sale will both be a big part of keeping a business afloat. This is why it’s important to collect customer data at the point of sale. Information like a customer’s name, birthday, what they tend to buy, what social media they prefer to use – can all help you to better connect with them in the future. A POS system that gathers some of this information at each transaction can help you build a customer database that you can use for valuable information when building your engagement strategy.

Source: ERPLY

Supply Chain 24/7 Related Articles

- Logistics to Circumvent the Toys R Us Trauma

- How Out-of-Stock Inventory is Killing Toys’‘R’‘Us

- Behind the Breakneck Unraveling of Toys ‘R’ Us (Bloomberg)

Related Resources

Don’t Let Data Silos Disrupt Your Digital Transformation

How to eliminate choke points in your supply chain once and for all. Download Now!

Putting Your Supply Chain First

Why it's important for Mid-Market Companies to improve their supply chain technology ahead of ERP upgrades. Download Now!

Leading the Way to Mid-Market Supply Chain Efficiency

The strategic advantage of a well managed and integrated supply chain continues to grow in influence as mid-market organizations become increasingly globally competitive. Download Now!

Must Read: Changing the Status Quo to Stay Ahead of the Amazon Effect

Article topics

Email Sign Up