Mobile robots and automated lift trucks are increasingly common, but companies also need reliable support and actionable data insights, according to The Raymond Corp. At recent trade shows, the Toyota Industries Company demonstrated how its technologies fit into customer processes.

Raymond provides hardware and software for intralogistics operations. The Greene, N.Y.-based company's high-capacity 5600 Orderpicker this week received a gold award in the actuators, motors, and drives category in Plant Engineering's 2023 “Product of the Year” program.

Robotics 24/7 spoke with Martin Buena-Franco, product marketing manager of automation at Raymond, about the company's lift trucks, telematics, and service strategy.

Areas of customer interest

This past spring, there were plenty of trade shows—what products received the most interest?

Buena-Franco: A big portion of our space at ProMat 2023 was AGVs [automated guided vehicles], which we're very excited about. We've had a pallet truck for some time, but it's enhanced. It's now faster and able to do staging, which is somthing our customers have been asking for.

We're also adding fully automatic autocharging capability to our whole AGV fleet. At Automate in Detroit, we showed our “total systems approach” with local reseller and integration partners. The ability to quickly and easily deliver solutions without disrupting what the customer is doing is an art and a skill.

Our idea of an “end-to-endless solution” is not just a single technology, but a full logistics solution. Materials handling is part of identity, including trucks and automation knowhow, plus lean techniques to optimize facilities.

What else have you been hearing from Raymond's customers?

Buena-Franco: Another theme has been around our robust solution for interconnecting telematics with labor management systems and warehouse management systems [WMS].

The analytics provide visibility into workdays, down to the operator level, such as if a picker is meeting a daily quota. It's a tool for productivity models and for warehouse managers and operations assistants who now have the information to make decisions on the fly.

It provides the agility to decide whether to put robots in this area or that area. Customers are finding more use cases and are connecting it to product flows and performance data. They can get very granular data about what our trucks are doing.

Several customers have told us that before they ask about automation, they want to know if it's a Raymond truck. They already know that our products are reliable, which makes it easier for new automated versions.

Customers are a bit more cautious with spending this year, but they're very interested in products that fit into their wider processes.

Speaking of use cases, do customers drive product development?

Buena-Franco: We're always looking at different product types in our roadmap. Some enhancements are driven by what the industry is asking for. Customer trends in e-commerce include higher SKU counts, higher bays, and smaller quantities.

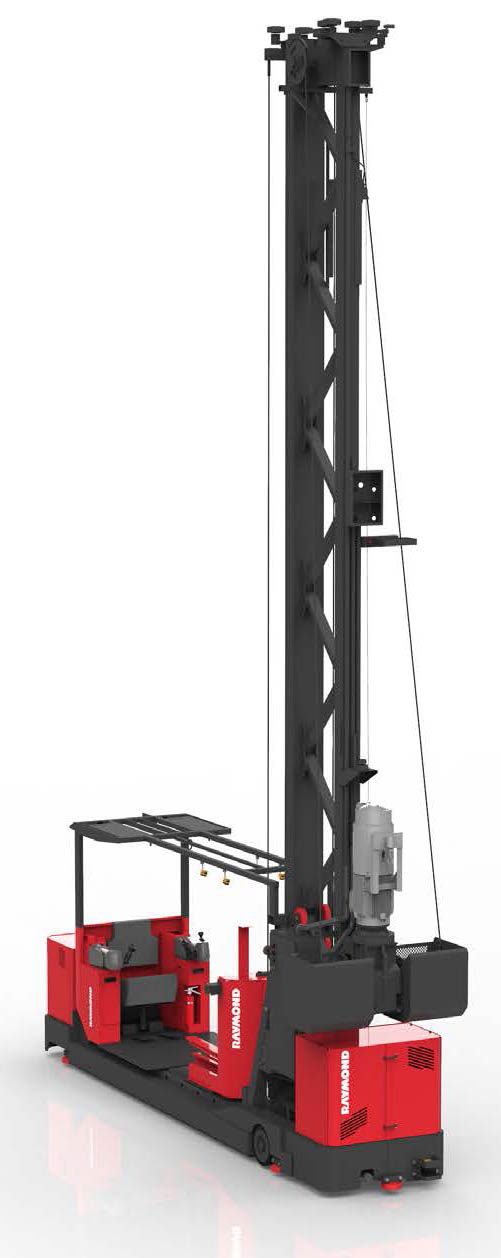

Why are there more VNA [very narrow aisle] solutions? Automated VNA trucks can go higher, rather than forcing companies to expand their facilities.

We do formal studies of where the market is going, and we have customers that help us. There are several use cases that they proposed and investigated.

Even before introducing automation, our account manager first walks around a customer's facility to learn about its pain points and identify KPIs [key performance indicators]. It's not just about the trucks; there are also training, workflow, and data components.

There's so much going on with AGVs and AMRs [autonomous mobile robots] and new developments in perception. Some use cases, like packing, are easier for us to develop. There's a lot of velocity in development on that front.

Telematics data to aid managers

How is warehouse telematics a differentiator for Raymond?

Buena-Franco: Sometimes with implementing automation, it's easier for customers to start with telematics and make some adjustments. It's a backbone that provides connectivity among all smart nodes—the trucks and software are all connected. It's all about waste mitigation, and we follow a disciplined road map.

When telematics are connected with a labor management system, now you can enforce policies to make sure that OSHA guidelines are being followed, such as a driver walking around a truck to make sure its wheels are in good shape.

Our system can collect infrastructure data. We found at a customer site cracks in the floor after investigating a shock and vibration report suggesting that a driver was dropping pallets. Telematics is about risk mitigation and training operators.

Another aspect is visualization at a higher level, to equipment and facility utilization. We describe it as a financial solution, since it includes the number of trucks for purchasing, leasing, or renting. Users can come up with a customized format.

What are more examples of how this data can be used?

Buena-Franco: For instance, based on cyclicality, we can do dynamic positioning. If you expect certain SKUs or parts to move faster, they can be placed where it's easiest for the pickers. If we have pallets, they can be placed low versus high up in back of storage, or we can put them lower on the rack if we know the weight of the finished goods. Dynamic slotting is important for seasonality.

Because trucks are reporting their status, we know their location within the facility, so we can set up zones. These zones throughout the warehouse could include slow-speed zones for congested areas near offices or break areas.

Keep-out zones could be for a pick or pack line with people, and you want to ensure that no fork truck gets in there. No-lift zones would avoid infrastructure damage; maybe we're driving underneath a suspended conveyor, a water or steam line, or an air handler. All these systems add redundance to mitigate risk in the operation of your facilities.

It allows us to keep bolting on solutions. All data is in the cloud if customers want more customized solutions for analytics.

The more sophisticated customers can look at the data and use it to improve their operations, and we're getting better at offering professional services for those who don't have the time to analyze their data.

Raymond incorporates some interoperability

How does Raymond handle multi-vendor setups and interoperability?

Buena-Franco: We're pretty agnostic. The navigation package and automation equipment could be from different vendors, but we want to make [data management] very transparent.

We've been around for 100 years, and we work with particular technology partners for AGVs, tow trucks, and palletizers, and different ones for storage or high racks. We work with sister company Bastian, integrating middleware for navigation, bulk handling, and third-party integration.

There are more sophisticated “handshakes” between autonomous systems such as a palletizer arm. We can handle all that integration, from the WMS taking orders down to different navigation and mission packages. The Bastian suite can make it work.

The last thing people want is a partitioned solution. We deploy a courier of different navigation packages and third-party equipment so you don't have to see a facility layout in one software and robots in another.

Gone are the days when you deliver a pallet of technology and tell the customer to do all the installation. Even when our systems are bought outright, there's an expectation of service.

What kinds of customers are seeking the latest automation? Is it all e-commerce?

Buena-Franco: We're seeing 3PLs [third-party logistics providers] that would like to have remote capabilities and have labor constraints.

We can increase the autonomy level of a fleet by assigning an experienced operator to manage it. He or she can respond to an AGV calling for help and manually operate it, then switch it back to automatic mode after the assist.

But we don't stop there; we're also investigating remote operation, so a robot can be rescued from a remote station.

We're also hearing more from general industry. Unloading trucks is something we're investigating.

Another area is automating low-level order picking. How do we optimize movement? We have some functions, such as horizontal movement and directed picking. This way, the operator only has to focus on doing the right pick. This increase the number of picks and reduces errors at the same time.

Then, what if we were to remove the operator and do the pick also? Finding labor is still a problem, so finding a solution to automate the pick makes economic sense. This is a field where highly selective vision systems are still being developed, but it looks promising.

Data analytics and AI still developing

What technology improvements would you like to see?

Buena-Franco: We share with our sister companies and engage with technology providers for vision and motion control. We facilitate networking and R&D to improve components.

Machine vision is not just useful for pallet and case detection or autonomy, it could also help tell if pallets of different sizes are damaged.

There's some interest in artificial intelligence and machine learning. It takes a long time to create a library for perception, and it would be great to do learning faster for staging, loading, and unloading. It's still early yet for AI technologies.

We collect so much information, it would good to automatically turn more of it into actionable insights with analytics. We're evaluating simulation and digital twins, which we already use at an early stage, for training systems.

There has been a lot of talk about Chat GPT benefitting human-machine interaction. What do you think?

Buena-Franco: The most successful implementations of automation have been when we can ensure that labor is integrated into the process upstream and downstream for materials flow.

It's about good change management and making robotics and automation more user-friendly, more collaborative. There's definitely an opportunity.

In the latter half of this year, we're investing in hiring and training people, increasing manufacturing capacity, and making it even easier for dealers and customers to work with us.

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up