The research follows an online survey we conducted in January of this year when the epidemic had just erupted.

This time, we polled some 730 listeners — mostly supply chain professionals — at a webinar on Thursday, March 5th, moderated by Dr. Alexis Bateman, a Research Scientist at MIT CTL. The live stream was part of CTL’s online MicroMasters program, course SC3x.

As I describe in my post Early Responses to the Coronavirus Crisis, our survey indicated that companies were still in wait-and-see mode in January 2020. This month’s poll suggests that companies are now far more proactive, but there are still areas where more action is needed.

A significant daily toll

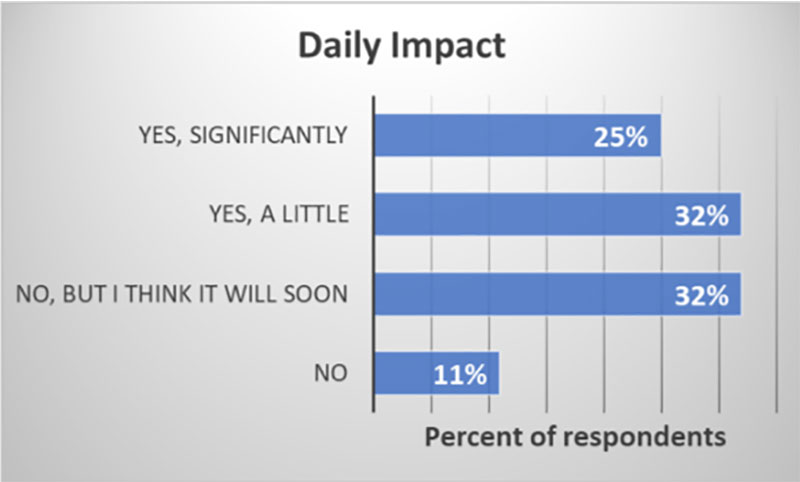

We asked the webinar attendees several questions about the impact of the crisis on their organizations. The first question concerned the daily impact of the pandemic, and was phrased as:

- Is dealing with coronavirus impacting your daily duties significantly?

As can be seen from the histogram in Figure 1, only 11% said that the virus had no significant impact on their daily duties, while close to a third thought that they will be impacted soon. A quarter of the respondents have had their daily work upended significantly.

The next question dealt with the current reaction of the company to the coronavirus spread. The question was phrased as follows:

- How is your company or organization reacting to the coronavirus?

As shown in Figure 2, the first thing companies did was to impose travel restrictions. 21% of the respondents mentioned that their company grounded all non-essential travel. Twelve percent of respondents reported that their company grounded all international travel, as did Google, while 6% reported that their company grounded all travel. However, even after finishing the survey we were getting information that more and more companies are grounding all non-essential travel. Furthermore, many companies, including MIT, have canceled conferences well into April.

Some responses fall short

Only 16% of the respondents mentioned that their company has set up an emergency management center. This is disconcerting as this is one of the most effective ways to focus all the information in a single place and make informed decisions.

One of the most important functions of such a center is to create a plan for shortages of products, parts, and materials. If not all products can be built, how would a company make the decision which ones to build? More importantly, which customer(s) should be served if not all orders can be fulfilled? Only 13% of the respondents reported that their company is working to set such a products/customer priorities plan.

This is a critical question and should not be addressed solely on the basis of how much margin is earned per customer. The decision may have long-term effects on customer relations. During the 2008 financial crisis, many companies had to grapple with this issue. Margins, customer relationships, equity, and customer dependency are a few of the considerations that companies must weigh.

Getting information is, of course, crucial and in many cases, governments may not be the best source. Multinational companies have outposts around the globe so they can get information from the ground, and 12% of respondents reported that their companies are doing that. A similar number reported that their companies are setting up direct lines of communications with key agencies and trusted epidemiologists. Naturally, the last two are not mutually exclusive.

Very few respondents reported in inventory build-up by their companies — only 5%. An even smaller percentage (4%) reported that their companies are starting to think about managing for cash flow rather than profits.

To me, this means that companies still think about the current pandemic in terms of past disasters such as the SARS outbreak, the Fukushima earthquake, Thailand floods, and US hurricanes. I believe that companies should think in terms of the 2008 financial crisis. As fear grips markets, the world may be pushed into a recession, and if it is severe enough, cash will be king as it was in 2008.

The relatively small number of respondents who confirmed that they are boosting inventories in preparation for a prolonged crisis signals that most companies do not see a significant economic downturn on the horizon. I hope they are right.

Future repercussions could be significant

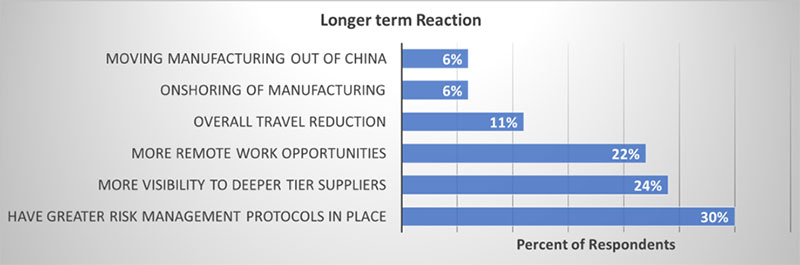

The last survey question asked for the long-term reactions of companies. The question was:

- Do you think this disruption is going to change how your company operates its supply chain in the future?

Almost a third of the respondents felt that their company should have had better risk management protocols in place, and expect the companies to pay more attention to this issue in the future. The perennial challenge of better visibility, which is always important, was raised by 24% of the respondents. Upstream supply chain visibility is particularly important during disruptions, and the current coronavirus epidemic is a perfect example.

With some suppliers’ plants closed and others not working at full capacity, the uncertainty is high. In addition, transportation disruptions in ports and in the air mean that even when parts are manufactured, it is not clear when they will arrive. Consequently, the ability to track and trace inbound movements is at a premium.

11% of respondents felt that the travel reductions they have instituted in the short-term will have a long-term effect, and companies may conduct more and more operations online even after the crisis is over.

Only 6% of respondents felt that the crisis may force companies to move out of China and/or move back onshore. The reason is probably that Chinese manufacturing has become sophisticated, high quality, and reasonably priced. For many products, there may be no alternatives.

Mixed signals make for uncertain outlook

While the poll is not a definitive piece of research, it does offer some valuable insights into how companies are reacting to the coronavirus crisis and highlights areas where they are still ill-prepared.

It is encouraging that companies have implemented concrete measures to protect their employees, and are keeping a very close watch on the situation. However, a lack of preparation in key areas such as inventory is a cause for concern, especially as many of the companies polled appear to acknowledge that the worst is yet to come.

Crossroads 2020 - Understanding Uncertain Futures - April 28, 2020

The year 2020 was less than a month old when the coronavirus outbreak erupted in China. The crisis provides a stark reminder of the uncertainties that supply chains face today – and throughout the new decade. Crossroads 2020 one-day conference will explore these uncertainties, as well as measures that companies can take to prepare for them.

Related: MIT Center for Transportation & Logistics Response to the Coronavirus Crisis

Supply Chain 24/7 Education Resource Center

Find the latest educational resources, degrees, and programs.

Visit: Supply Chain 24/7 Education Resource Center

Article topics

Email Sign Up