Tesla Inc on Friday got high-profile orders from Wal-Mart Stores Inc, fleet operator J.B. Hunt Transport Services Inc, Grand Rapids, Mich.-based retailer Meijer Inc, and Canada’s largest supermarket chain Loblaw Companies Ltd. for its electric semi-truck.

All would-be customers indicated they are giving the Tesla Semi a test, and not buying in volume at this early stage.

Wal-Mart Stores Inc is planning to test Tesla's electric tractor trailers and has already preordered 15, the retailer told CNBC on Friday.

Five of the preordered vehicles will be for Wal-Mart U.S., and 10 will be for Wal-Mart Canada, the company said.

“We have a long history of testing new technology including alternative-fuel trucks and we are excited to be among the first to pilot Tesla's new heavy-duty electric vehicle,” the company said in a statement.

“We believe we can learn how this technology performs within our supply chain, as well as how it could help us meet some of our long-term sustainability goals, such as lowering emissions.”

The pilot is planned for the U.S. and Canada. Wal-Mart's current fleet has about 6,000 trucks.

J.B. Hunt Transport Services Inc, a leading U.S. carrier, said Friday it “placed a reservation to purchase multiple Tesla Semi trucks,” but declined to specify how many units it ordered.

The vehicles will support West Coast operations of J.B. Hunt’s intermodal unit, where freight is moved long distance by road and rail, and its dedicated contract division, which provides trucking services for companies that have outsourced their private fleet operations.

“Reserving Tesla trucks marks an important step in our efforts to implement industry-changing technology,” said John Roberts, president and chief executive officer at J.B. Hunt.

“We believe electric trucks will be most beneficial on local and dray routes, and we look forward to utilizing this new, sustainable technology.”

Loblaw Companies Ltd., Canada’s largest supermarket chain says it has pre-ordered 25 of the Tesla Semi vehicles.

“It’s part of our long-term commitment to electrify our fleet,” spokeswoman Catherine Thomas said.

Earlier this month, Loblaw committed to having a fully electric fleet as part of the company’s commitment to reduce its carbon footprint by 2030.

That would involve adding 350 zero-emission vehicles and more than 2,500 trailers to the fleet.

The Ontario-based grocer said removing diesel from its transport trucks and refrigerated trailers could reduce more than 94,000 tonnes of carbon dioxide emissions annually, the equivalent of removing more than 20,000 cars from the road.

Meijer Inc, a Midwestern, family-owned based retailer that operates 235 supercenters and grocery stores throughout Michigan, Ohio, Indiana, Illinois, Kentucky and Wisconsin, has reserved four Semi trucks for $5,000 deposits apiece, Dan Scherer, a fleet maintenance manager at Meijer, said after the product’s unveiling last Thursday.

Scherer said the company operates 220 trucks in six states in the Midwest.

“Electric drivetrains are a proven technology,” Scherer said in an interview.

“Electricity is cheaper fuel than diesel, and you are less dependent on the spot pricing of fossil fuel.”

Competitive Market

With Tesla Semi, Elon Musk enters a competitive, demanding market reported the BBC. There are an estimated 3.5 million truck drivers in the US, the vast majority of whom drive diesel-powered engines.

Tesla will not be able to compete on diesel’s range, and battery specialists doubt Tesla can produce a powerful enough battery at a reasonable price.

“A 300-mile-capable battery pack costs about $200,000,” a Carnegie Mellon study concluded.

“Which is much higher than a diesel-powered semi-truck, which costs about $120,000, on average, for the entire vehicle.”

The Cost?

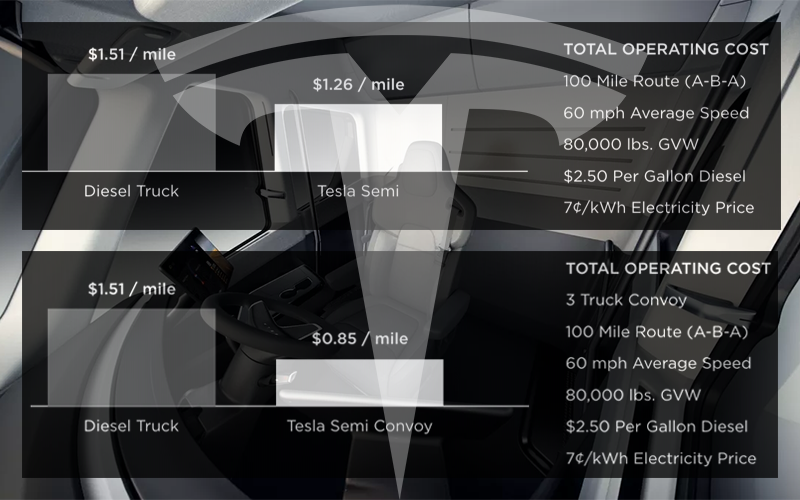

As for cost, the company said that per mile the Tesla Semi would work out cheaper than a diesel equivalent when fuel and other maintenance is taken into consideration - but did not share the cost of an individual truck.

The Diesel Technology Forum, a non-profit trade group that promotes the use of diesel, said Tesla’s announcement needed to be “evaluated in the context of reality”.

“Diesel is the most energy efficient internal combustion engine,” Allen Schaeffer, the forum's executive director.

“It has achieved dominance as the technology of choice in the trucking industry over many decades and challenges from many other fuel types.

“Still, today, diesel offers a unique combination of unmatched features: proven fuel efficiency, economical operation, power, reliability, durability, availability, easy access to fuelling and service facilities, and now near-zero emissions performance.”

As well as coming up against diesel incumbents, Tesla also faces other electric rivals. Concept electric big rigs have been unveiled by Bosch, Cummins, and Daimler. A number of companies such as Siemens have pilot programs already in place to test the viability of electrifying commercial trucks.

And there are a few startups also pursuing some variant of that electric trucking or delivery van goal, including Chanje, Nikola, and Wrightspeed, though all fall short on range, and none are currently on the roads.

The Future of Trucking

Look around you for a moment. Almost everything you see has spent time on a truck, from the beans for your morning coffee, to the screen you’re reading right now.

At the heart of America’s massive trucking industry are 3.5 million drivers. These men and women are behind the wheel for about 10% of the total miles driven across the country, hauling a whopping 14 billion tons of freight every year. That’s almost 250 pounds of goods for each American, every single day.

In the U.S., 66% of the billions of tons of goods shipped domestically each year are carried by over the road trucks, while 9% are moved by rail, 4% by water and 2% by air and other intermodal means. The remaining 19% of tonnage is transported by fixed infrastructure like pipelines.

In the U.S., 66% of the billions of tons of goods shipped domestically each year are carried by over the road trucks, while 9% are moved by rail, 4% by water and 2% by air and other intermodal means. The remaining 19% of tonnage is transported by fixed infrastructure like pipelines.

Uber’s mission is to provide reliable transportation to everyone, everywhere. Our ridesharing network has made billions of connections between riders and drivers. Now we’re investing in trucking, specifically Uber Freight, and we believe the future is bright.

Research Papers

Global Truck Study 2016: The Truck Industry in Transition

This Deloitte study closely examines four global commercial vehicle markets and identifies the trends that will fundamentally transform the global truck markets. Download Now!

Transitioning To Zero-Emission Heavy-Duty Freight Vehicles

In this report, the International Council on Clean Transportation, ICCT, assess zero-emission heavy-duty vehicle technology to support decarbonization of the freight sector. Download Now!

Article topics

Email Sign Up