If last year’s “Annual Warehouse and Distribution Center (DC) Equipment Survey” reflected the need to quickly ramp up on systems, this year’s survey still indicates a bullish outlook, albeit a more cautious one. With multiple years of strong economic growth, expanding e-commerce, and low unemployment, many DC organizations are weighing their next steps for keeping pace with flush economic times.

Rather than rush forward with investments, this year more respondents seem to be pondering their next best moves, including turning to third-party logistics (3PL) providers for help.

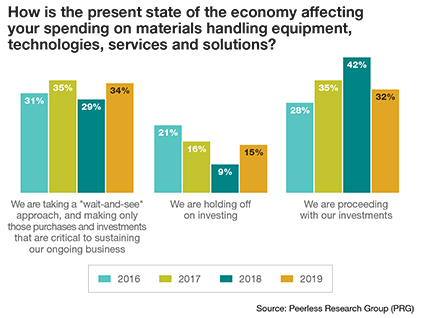

Peerless Research Group’s (PRG) annual survey, conducted in January of 2019, found that 32% of respondents were proceeding with investments given the state of the economy, down from a 42% response to the same question last year. That 32% level is more in line with the 35% for the “proceeding with investments” response in 2017 and above the 28% in 2016.

2019 Respondent Demographics

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of Logistics Management and Modern Materials Handling in December 2018 and January of 2019, yielding 246 qualified respondents. The respondents were from sites whose primary activity is manufacturing (32%), warehousing and distribution (30%), or corporate headquarters (27%), as well as warehousing supporting and other. The median revenue of responding companies is $84 million, while the average is $324 million.

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of Logistics Management and Modern Materials Handling in December 2018 and January of 2019, yielding 246 qualified respondents. The respondents were from sites whose primary activity is manufacturing (32%), warehousing and distribution (30%), or corporate headquarters (27%), as well as warehousing supporting and other. The median revenue of responding companies is $84 million, while the average is $324 million.

Qualified respondents—managers and personnel involved in the purchase decision process for materials handling solutions—hold influence over an average of 130,335 sq. ft. of DC space. Respondents were spread across multiple verticals. The most common were: industrial machinery, food and beverage, wholesale trade, automotive or transportation equipment, retail trade, and warehousing services.

Other 2019 highlights include:

- Those taking a “wait-and-see” approach on materials handling investments and related technologies was at 34% this year, up from 29% last year.

- When asked about spending for the next two years to three years, the outlook remains positive and steady. This year, 42% said they will spend the same amount over the next two years to three years, just 1% less than last year, and 53% expect increased spending, which is 1% higher than last year.

- When asked about specific spending categories under evaluation over the next 12 months, 16% cited 3PL services, up by 6% from last year. Other similar questions about use of 3PLs also showed increased interest in tapping outside help.

In effect, most DC operators know they need to continue to invest in equipment, systems as well as infrastructure to meet growth and fulfillment demands, but more of them are turning to outside help. However, this year’s more hesitant outlook isn’t borne out of business pessimism—it likely reflects a more measured approach to figuring out the right mix of investments to keep pace with requirements, while weighing decisions against uncertainties in areas like global trade.

In effect, most DC operators know they need to continue to invest in equipment, systems as well as infrastructure to meet growth and fulfillment demands, but more of them are turning to outside help. However, this year’s more hesitant outlook isn’t borne out of business pessimism—it likely reflects a more measured approach to figuring out the right mix of investments to keep pace with requirements, while weighing decisions against uncertainties in areas like global trade.

“The climate is mostly optimistic, but there’s some caution out there,” says Donald Derewecki, a senior consultant with St. Onge Company, a supply chain engineering and consulting firm that assists our research team in this annual study. “Overall, there’s continued optimism projected in 2019.”

Both Derewecki and Norm Saenz, a managing director with St. Onge, see findings such as increased interest in 3PLs as mirroring what they see in their client base—companies under pressure to keep up with order volumes, e-commerce fulfilment complexities, and market constraints such as the rising cost of warehouse space and an extremely tight labor market.

Both Derewecki and Norm Saenz, a managing director with St. Onge, see findings such as increased interest in 3PLs as mirroring what they see in their client base—companies under pressure to keep up with order volumes, e-commerce fulfilment complexities, and market constraints such as the rising cost of warehouse space and an extremely tight labor market.

“Companies have been trying their hardest to improve on their systems and efficiencies and they’re spending money, but it just feels like there continues to be an increase in what they’re being asked to be able handle,” says Saenz. “As a result, there’s a bit of hesitancy on what to do next, with more people turning to 3PLs to get service level improvements or reach new markets.”

Overall spend

Spend-related findings from the 2019 survey were generally more guarded than 2018; however, last year was an extremely strong year for spending. For example, those “proceeding with investments”—at 32%—was back to the level of two or three years ago, while those saying they are “holding off on investments” this year stood at 15%—higher than last year’s 9%, but 1% lower than 2017 and 6% lower than 2016.

Similarly, this year’s 34% that are taking a “wait-and-see” approach is 5% higher than in 2018, but lower than the 35% in 2017.

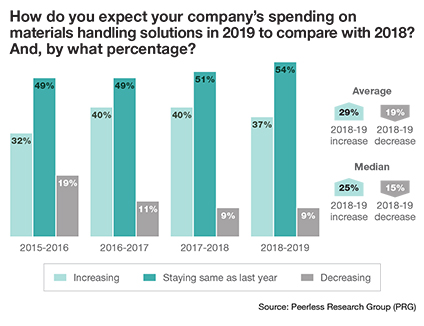

When asked how spending on materials handling for the year that just ended compared to the previous year (2018 vs. 2017), 42% said it increased, up from 38% the year before, while 46% said it stayed about the same (down from 51%) and 12% said it decreased (up from 11%).

Regarding 2019 spending on materials handling vs. 2018, 37% expect an increase, whereas last year (2018 vs. 2017) 40% expected an increase. Additionally, 54% expect spending to stay level, which is 3% higher than last year. When those who indicated an increase or decrease in 2019 were asked how much the change would be, the median increase was 25%, while the median decrease was 15%.

It may be that last year was just a particularly bullish year for the survey’s spending outlook, and now a bit more caution is taking hold. Possible reasons for a more cautious outlook, notes Derewecki, include factors like the unsettled global trade picture. “Recent stock market volatility, questions about trade policies, and change in the political climate are likely causing some uncertainties around the future direction of the economy,” he says.

For spending trends in dollar ranges, average anticipated spending over the next 12 months is $400,000, up from $350,000 in 2018’s survey, with a median spend of $82,485, up from $68,750. However, both average and median annual revenue were higher for 2019 respondents compared to respondents last year. The median annual revenue size for respondent companies in 2019 was $84 million, up from $67 million in 2018.

Larger companies are represented, as seen in the size of anticipated spend. When asked to pick ranges for annual spend in dollars over the next 12 months, 9% said that their company will spend $2.5 million or more on materials handling and information system (IS) solutions, with a total of 8% between $999,000 and $2.5 million in spend and another 12% expecting to spend between $250,000 and $499,000.

Hot categories

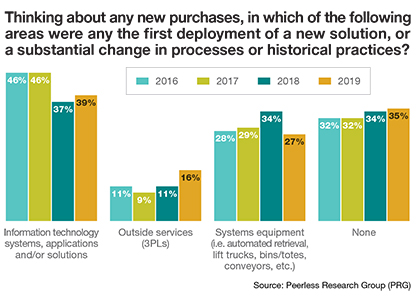

There were several bright spots to be found in spending trends. Companies continue to invest in technology, and new technologies are ascendant.

When those “proceeding with investments” were asked what they would be spending on, the biggest growth was for robotics, which drew a 40% response, up from 25% last year. Technology information systems (IS), including enterprise resource planning (ERP) and warehouse management system (WMS) solutions, are at 55%, up from 49% in 2018. Also on the upswing for “proceeding” respondents was materials handling equipment, up to 71% in 2019 from 64% in 2018, with spend on lift trucks fairly steady (2% higher this year than last).

The survey also asked respondents what percentage of their spending falls under materials handling equipment, IS, or “other” during the next 12 months. That split was 40% on equipment, 31% on IS, and 29% on other, very similar to last year’s split of 43% on equipment, 27% on IS, and 29% on other.

The survey also asked respondents what percentage of their spending falls under materials handling equipment, IS, or “other” during the next 12 months. That split was 40% on equipment, 31% on IS, and 29% on other, very similar to last year’s split of 43% on equipment, 27% on IS, and 29% on other.

When asked what type of equipment would be evaluated during the next 12 months, most categories stayed close to the previous year’s percentages, with increases for radio frequency identification (RFID), systems solutions and controls. Here is where interest in 3PL services grew 16% this year from 10% in 2018.

For IS solutions, categories on the upswing during the next 12 months include distributed order management (DOM) systems, rising from just 8% last year to 13% this year, ERP, at 25% this year compared to 22% last year, and voice recognition/picking solutions, up 3%.

Last year, both warehouse execution system (WES) solutions—which have only been on the survey three years—and warehouse control system (WCS) software were on the upswing. This year, WCS held steady at 18%, but WES was down 3% to 13%. Still, these two closely related categories of software (they both sit between traditional WMS and machine control) attracted a combined response of more than 30%.

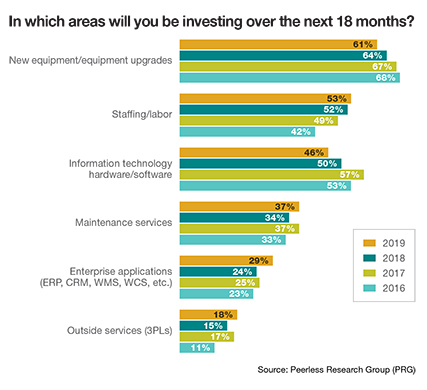

When asked about broader areas of spending over the next 18 months, areas that were on the increase included staffing/labor (up by 1%) maintenance services (up 3%), enterprise applications including (up 5%) and outside services/3PLs, up by 3%.

There are various reasons why an enterprise might tap a 3PL, observes Saenz, including quickly extending into new markets, or taking on e-commerce fulfillment work. It also reduces the challenge of dealing with labor shortages directly or figuring out what systems to outlay capital spending for, he adds.

“The attractive part about using a 3PL is that you can avoid higher amounts of capex spend while still achieving the added reach or capacity you need,” say Saenz. “You can turn to a 3PL, adjust your operating costs, leverage their labor pool, and in most cases, their advanced technology capabilities.”

Of course, 3PLs are also feeling the labor crunch, but because many 3PLs spread their labor across multiple clients, they tend to be well plugged into sources of labor and temporary staffing. “Turning to 3PLs is understandable in a tight labor market,” says Saenz. “It’s becoming harder and harder to find labor, especially for second and third shift operators,”

The tight labor market also tends to increase interest in technology, Saenz notes, because it becomes imperative to make the people you can find as productive as possible. Thus, a company might use robotics to fully automate certain tasks, but also invest in software applications like WMS and WES to avoid bottlenecks and wasted labor time in DCs. “Software that can further enhance productivity is a next step for many of these companies that have spent time improving processes and adding new storage and handling equipment,” adds Saenz.

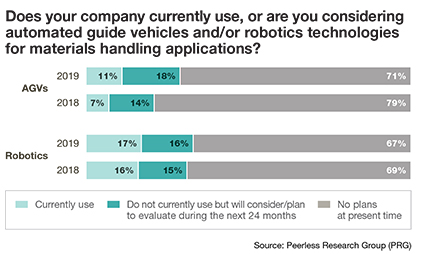

Robots welcome

More companies are beginning to adopt or evaluate robotics, the survey found. For 2019, 17% currently use robots, up 1% from last year, and 16% are evaluating them, also up 1%. That’s a combined one-third of respondents either using or evaluating robotics.

Growth applications for robotics included bin picking (up 11%), part-to-picker (up 7%) and picker-to-part applications (up 6%), as well as mobile autonomous pick to cart (up 3%) solutions. Respondents also said they increasingly use robots for palletizing and depalletizing.

The survey also asked about automated guided vehicles (AGVs), a more established category in which the vehicles typically use guidance infrastructure like tape to navigate. AGV interest also climbed, from 7% using in 2018 to 11% in 2019, and 18% evaluating vs. 14% last year. In another bright spot for AGVs, their applications range is expanding into areas beyond materials transport. For instance, this year 29% are using or evaluating AGVs for bin picking, up from just 17% last year.

When it comes to devices and mobile solutions, there were some mixed results. Overall, those using or with plans for mobile solutions declined 2% from last year, but 52% still use or have plans to use mobile technologies.

When it comes to devices and mobile solutions, there were some mixed results. Overall, those using or with plans for mobile solutions declined 2% from last year, but 52% still use or have plans to use mobile technologies.

Use or interest in newer types of devices did well this year. For example, 5% report that they use drones now to some extent, but in 12 months, drone use is expected to be 18%. Use of smart glasses now stands at 5%, but in 12 months, 8% plan to be using or deploying them. RFID devices are also on the upswing, with RFID reader use now at 23% and increasing to 28% within the next 12 months.

To keep any type of equipment running requires maintenance expertise. Given the labor availability challenge, it’s not surprising that respondents are increasingly looking to vendors and maintenance suppliers for help. In fact, outsourcing of maintenance grew from 13% last year to 16% this year. While the most commonly tapped maintenance roles for third parties are general maintenance (53%) and upkeep/upgrades on systems (42%), this year saw more respondents tapping providers for data analysis—up from 15% last year to 19% this year.

“There’s more predictive analytics happening,” notes Derewecki. “Organizations want to know how they can maintain a system or piece of equipment in the way that minimizes cost while maximizing the uptime.”

e-fulfillment trends

For all the talk of using retail stores as mini-warehouses to fill e-commerce orders and buy online pickup in store (BOPIS) strategies, the DC remains the e-fulfillment focus among respondents.

When asked for the most common process for e-fulfillment, “buy online and ship to customer from DC” was it, drawing a 31% response and projected by 36% to be the most common mode in two years. Respondents also expect a slight bump up in the “BOPIS” model (12% now, but 15% in two years) and in the “ship to customer from vendor” (i.e., drop ship) model, going from 12% today to 15% in two years. Ordering in store, ship to customer from DC is projected to decline from 14% today to 8% in two years.

According to Derewecki, these findings are consistent with what he sees in industry, with the DC still central because it usually has to support BOPIS with some level of store replenishment. Drop shipping is growing, even though many distributors feel concerned about loss of control or a reduction in service levels if drop shipping isn’t managed well.

E-commerce can be linked to some of the industry trends asked about in the survey, especially when it comes to issues such as dealing with “e-comm-sized” orders. When asked about top issues making an impact on DCs today and also two years from now, 27% cited smaller, more frequent orders as an important issue today, but that rises to 33% in two years. Similarly, 46% said “cycle times” was a key issue today, and that rises to 49% in two years.

“There’s more predictive analytics happening, organizations want to know

how they can maintain a system or piece of equipment in the way that

minimizes cost while maximizing the uptime.”

While safety, growth, and cost containment were the top three issues of importance, “labor availability” is also highly ranked, with a 66% response, rising to 69% in two years. Respondents also foresee growing importance for environmentally sustainable operations, jumping from 36% today to 46% in two years.

When it comes to DC best practices, the top three practices were continuous improvement, labor productivity management and workload planning. All three are expected to grow in importance in two years, especially workload planning, ranked important by 54% today, rising to 59% in two years.

Other best practices of growing importance include same-day shipping and carrier scheduling. The carrier scheduling discipline is ranked highly by 48% today, while 53% rank it as important in two years. Same-day shipping is ranked important by 49% today, rising to 55% in two years.

“These best practice results are consistent with what we see with our clients—increasing requirements for same-day shipping and the importance of carrier scheduling,” says Derewecki.

Technology increasingly supports performance measurement. For example, to manage order cycle times, today 39% of respondents say that they use an automated process, but that shoots up to 60% in two years. Similarly, those using an automated means to track order fulfillment costs is expected to rise from 36% today to 56% in two years.

What’s top of mind?

While respondents predict steady spending on materials handling solutions over the longer term (two years to three years), many are making plans to try and mitigate the risks that could offset operations. This year, 54% of respondents said that they have a plan for assessing and mitigating risks, up from 45% last year.

The top three risks being planned for were logistics risks, supplier risks and legal liabilities. These last two increased as assessment concerns, with supplier risk rising from 51% last year to 62% this year, and legal liability up to 58% from 45% last year.

Other risk areas on the rise included credit risk, competitive risk, data breaches and economic/financial market volatility. For all the forest fires, hurricanes, and this winter’s Polar Vortex stint of subzero weather, natural disasters held steady as a risk category, again garnering a 45% response. Economic and financial volatility rose from a 30% response last year to 34% this year.

“There is increased concern for risks across several categories, which makes sense,” says Derewecki. “Everybody, including top management, is concerned about a major disruption to the supply chain and to the infrastructure we’ve become so dependent on.”

On a daily operations level, however, the over-riding focus is keeping up with the pace of fulfillment work at a time when it has become very difficult to find additional labor or warehouse space. Continued strength in consumer demand and order volumes continues to drive a healthy pace of materials handling systems investment, even if more companies also have interest in 3PLs to meet objectives.

At the same time, a significant percentage of companies are simply out of capacity. The 2019 survey found that for respondents with standalone DCs, 19% report full (100%) capacity level and another 19% are between 80% and full capacity. The average capacity utilization stood much lower—at 68% average this year, up 2% from last year.

Running over 80% capacity is one key reason to consider 3PLs, but there are others, including e-commerce fulfillment strategy, or serving new markets. With all of these challenges, risks, and investment options, it makes sense to plan the right mix of choices to keep pace with what continues to be a strong overall economy.

“Overall, managers are still optimistic about doing things,” Derewecki says. “The sharper companies are doing intensive planning. The old adage ‘those who fail to plan are planning to fail’ holds very true today. There are many challenges present, and just when we think we have one challenge under control, others will arise.”

About the Author

Follow Robotics 24/7 on Linkedin

About the Author

Follow Robotics 24/7 on Linkedin

Article topics

Email Sign Up