The Netherlands is home to a large number of robotics companies developing new technologies aimed at making a wide range of industries more productive. They include farming and milking robots for Dutch agriculture, mobile robots for warehouses, drones for surveillance, and countless other applications.

HowToRobot.com recently published a study of the nation's 350 robotics and automation suppliers in collaboration with High Tech NL Robotics, the Dutch cluster of robotics companies. What many of these companies have in common is that they have developed promising technologies that they have yet to commercialize, said Thijs Dorssers, manager at High Tech NL Robotics.

“There are a lot of robotics companies with very good ideas and products, but they are lacking the commercial side of the business,” he said. Dorssers added that the Dutch robotics industry is facing a “funding gap” as a result.

Robotics startups often spin out of universities, where they have ample access to funding, often in the form of grants, for researching and developing their first products, said Dorssers. But when it comes to further commercializing the products and scaling the business, funding is scarce—as can be seen by the level of venture capital investments in the industry, he noted.

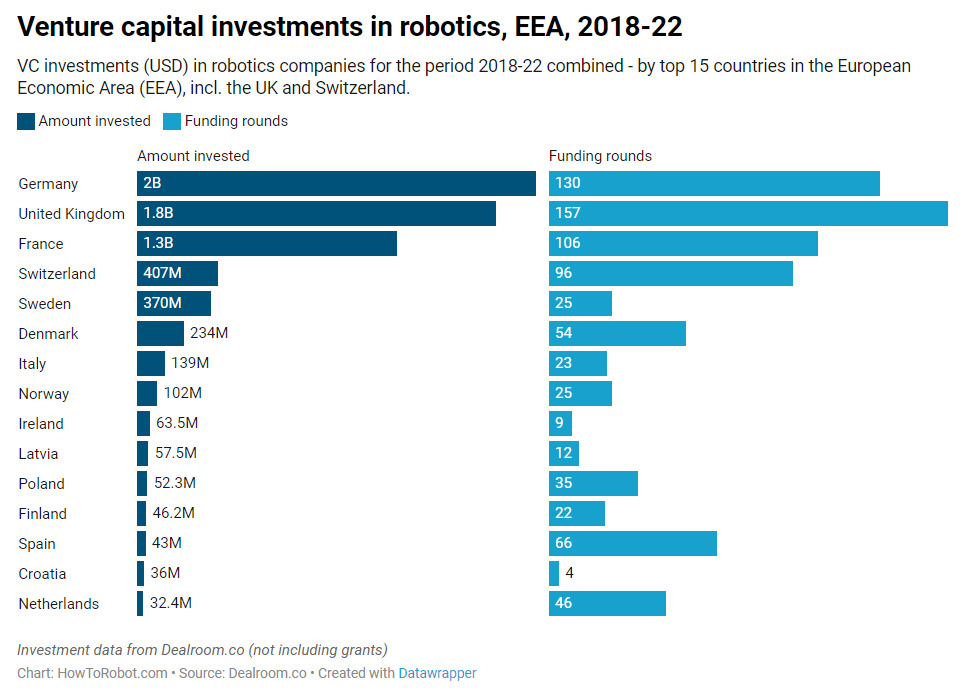

Over the past five years, a total of $32.4 million (U.S.) was invested in robotics companies in the Netherlands, according to data from Dealroom.co. This places the Netherlands in the 15th place among countries in the European Economic Area (EEA, including the U.K. and Switzerland) by total amount invested, excluding grants.

“The lack of funding for robotics startup growth is an issue,” Dorssers said. “The investors are there, but they are not willing to invest before the companies become more market driven and change focus to its potential customers.”

High Tech NL Robotics: 'Commercial co-founders needed'

One of the primary obstacles for robotics companies to grow further is a lack of commercial people on the team, Dorssers observed.

“Many companies have CEOs with technical backgrounds and are missing co-founders with a commercial background,” he said.

This influences how some companies prioritize their funding. They often allocate most of it to developing new products and comparably less on sales and marketing, found the study.

“Marketing and sales are relatively underfunded in the growth stages of the startups,” said Dorssers. “The awareness of the industry must change to include other aspects of the business such as sales and marketing, finance, and human capital.”

He encouraged robotics companies to seek out and talk to potential clients “in the hundreds” to get a better understanding of product-market fit. HowToRobot's marketplace offers information on what automation buyers are looking for.

Dutch labor shortages increase automation demand

There is a good reason for robotics companies to build out their commercial capabilities, observed Dorssers: The need for automation is growing fast, both in the Netherlands and abroad.

The Netherlands is already a fairly automated country, ranking 13th globally by robot density, with 224 robots per 10,000 workers in the manufacturing industry, according to the International Federation of Robotics (IFR). And there is plenty of room for further growth, asserted Dorssers.

“There is a lot of potential for the manufacturing industry and other industries such as agriculture to increase robot adoption,” he said. “Most sectors have a shortage of people and must invest in automation to make up for it.”

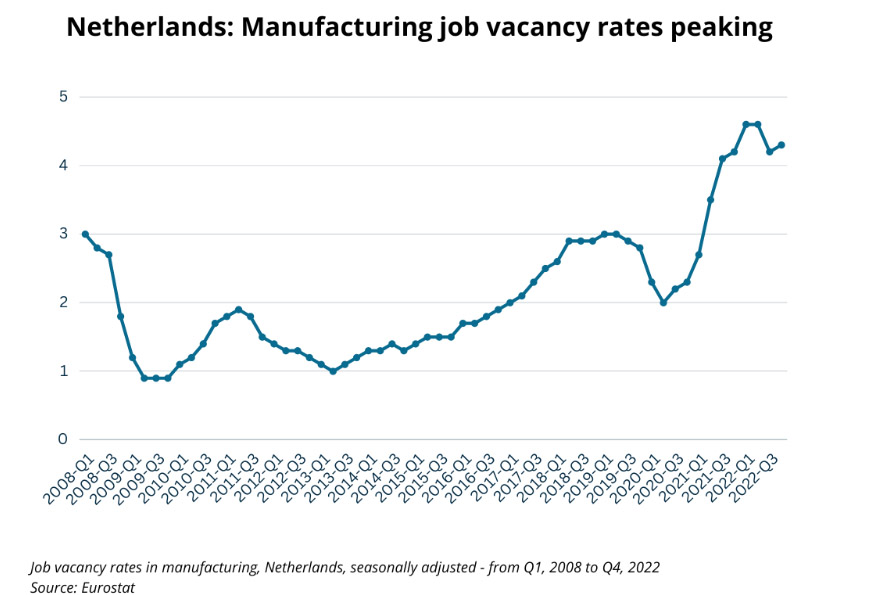

In manufacturing, it has gotten increasingly difficult to find employees over the past couple of years. Since 2020, the job vacancy rates in the Dutch industry have reached record-high levels, peaking at 4.6% during the first two quarters of 2022.

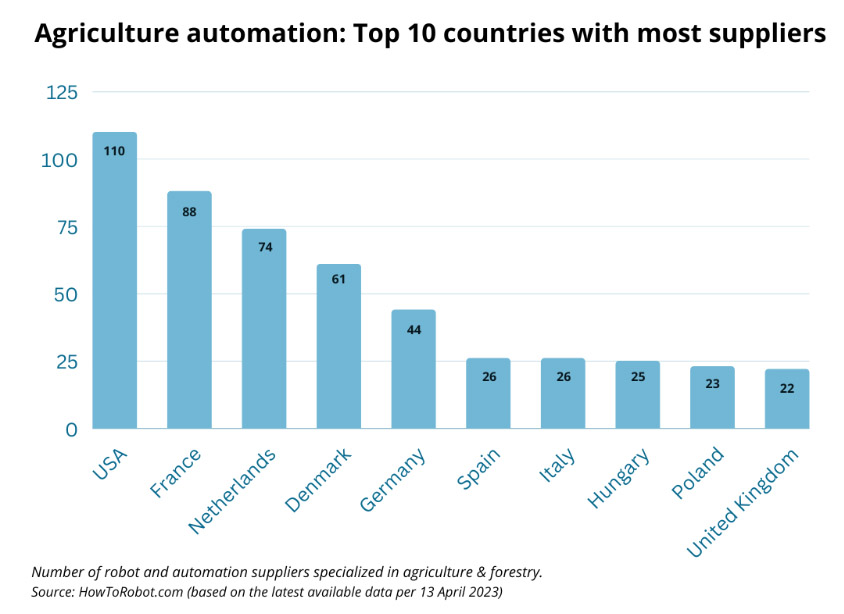

The agricultural industry, although still a niche market, presents a growing opportunity for the Dutch robotics industry. HowToRobot predicted that the global market for autonomous agriculture robots will experience a compound annual growth rate (CAGR) of 19% between 2022 and 2027.

The Netherlands ranks third globally in terms of the number of robot and automation suppliers to the industry, according to data from HowToRobot.

“The Netherlands is a country of agriculture, which also shows in our robotics industry that is developing many new solutions for farmers,” said Dorssers. “With the labor shortages within agriculture in Europe and the U.S., automation is needed.”

Robotics growth requires new business models

In order to tap into the growing demand for automation, robotics companies must find ways to adapt existing business models and build new ones catering to end users with different needs than traditional automation customers, said Dorssers.

Within agriculture, for example, the shortage of labor is typically temporary and happens during peak season, he said. This also limits the need for certain types of systems to those periods and makes farmers hesitant to make large capital investments in equipment that could go unused for most of the year.

“These types of robotics end users would be more interested in leasing the solution during peak season,” Dorssers said. “Adapting to this type of business model could increase robot adoption, but it is still very difficult to find robotics companies that are offering it.”

Dorssers suggested that the robotics industry has a lot to gain by understanding end users better and helping them understand in their own terms the value that automation can provides.

“Even though many companies have a high potential for automation, they are not always aware of it, especially smaller companies,” he concluded. “But if you can explain what can be achieved by automating and what the return on investment will be, they are more likely to invest.”

About the author

Elías Lundström handles corporate communcation and public affairs at HowToRobot.com.

The company claimed that it is the world's leading matchmaking platform for robotic automation, connecting businesses with over 16,000 robot and automation suppliers globally—over 1,100 in the U.S.—and a range of services for quotes on robots, leasing options, and more.

Article topics

Email Sign Up