In today’s business world, the majority of successful parcel shippers aggregate various forms of reportable data, but that’s no longer enough.

To keep up with an ever-changing and competitive market, those businesses need to utilize actionable intelligence - a deep level of analytics that can only come from real-time intelligence.

Empowered with that data, the results will be in line with the desired outcome; but without it, things can go from good to bad to ugly.

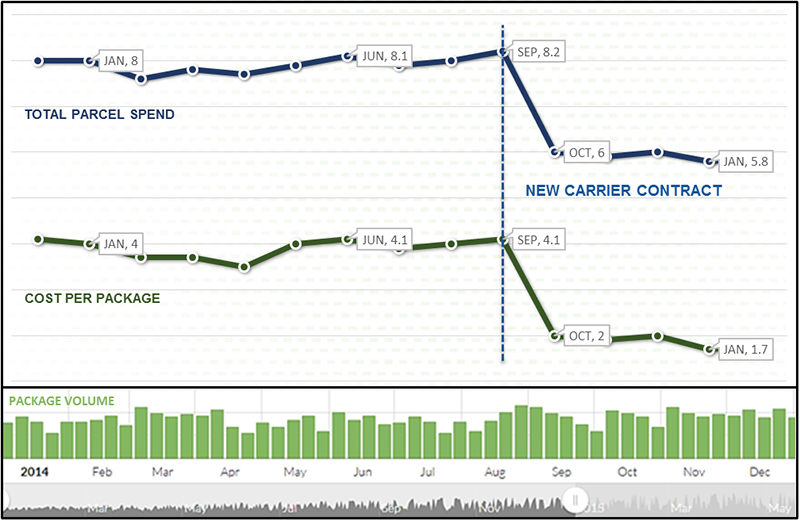

The Good Result: Cost per package and overall parcel spend both decrease.

The diagram below illustrates a parcel shipper experiencing an optimal outcome. This parcel shipper targeted and negotiated better contractual rates in areas that matched their specific shipping profile.

The results were dramatic; cost per package decreased sharply once the new terms went into effect, thus driving hard dollar savings and directly impacting their bottom line. With thousands of negotiable elements within a carrier agreement, knowing which to target was key. That knowledge empowered the parcel shipper below to succeed in executing sustained savings derived from a data-driven approach to negotiation.

Finally, the customer experience between the shipper and the carrier was not negatively impacted.

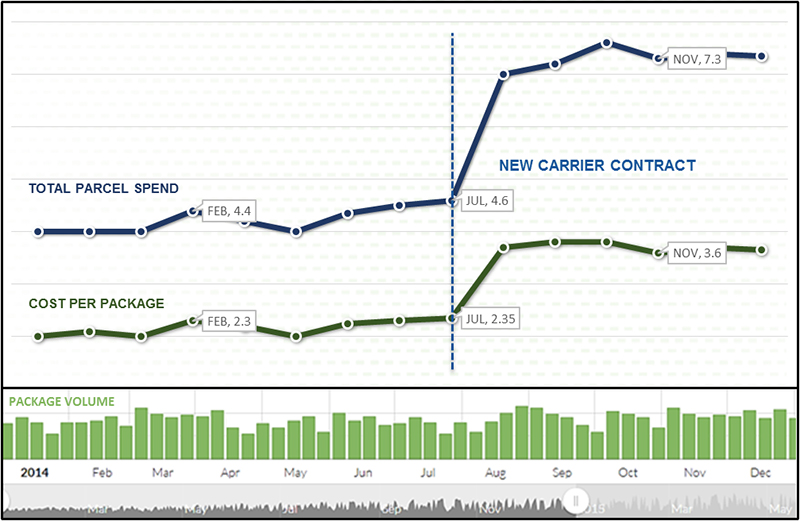

The Bad Result: Cost per package and overall parcel spend both go up.

In this case, the parcel shipper lost the shell game. Based on a discussion with the carrier vs. analyzing their own data against that of their peers (benchmarking), they walked away from the negotiating table feeling like they received favorable rates; however, the business did not target discounts based on data derived from their specific shipping profile.

The carrier used “smoke and mirrors” to design a contract that provided great discounts in service levels and surcharges that the parcel shipper seldom utilized. Likewise, the parcel shipper was given far less competitive discounts than they previously had for the areas in which they actually shipped.

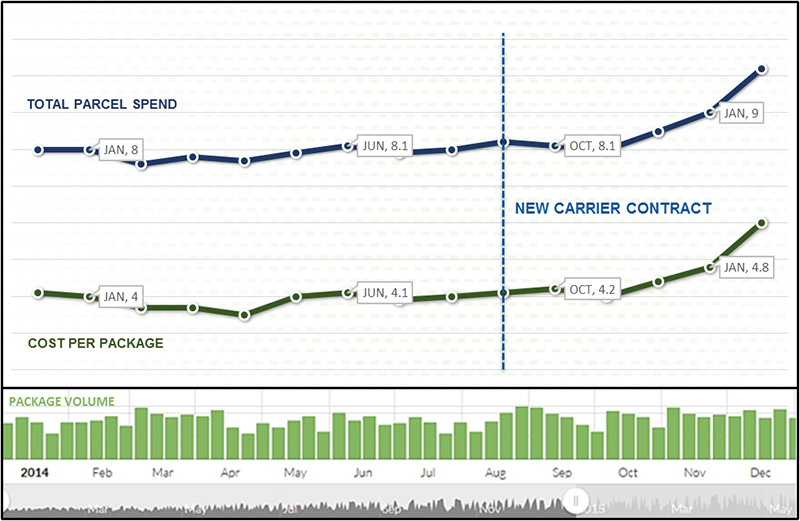

The Ugly Result: Cost per package and overall parcel spend both do nothing. This is potentially the worst outcome of the three.

Why is this worse than the previous example? First, it’s misleading. It creates the illusion that no money is lost, because the parcel shipper is not spending any more or less than they were before.

Unfortunately, the buying process doesn’t come without costs - typically they come in terms of time spent and opportunity costs. Parcel shippers invest weeks and months into this process, with an opportunity cost for those resources being reallocated from core initiatives of that business - and no change, whether good or bad, means the return on that investment is a whopping $0.

Secondly, the chart below is dangerous because it potentially hides bigger problems that simply haven’t materialized yet. In this case, the parcel shipper’s cost per package and overall spend began trending up after 3-4 months on the new contract. By this time, the client had long moved on from the contract negotiation initiative, chalking it up as a non-event. Once the holiday season came, however, their costs began to rise. Why?

The new contract didn’t account for shipping considerations that the old one did. All factors considered, their new contract was worse, but they didn’t realize it. Consequently, once the peak season (typically when a shipper is most reliant on competitive cost per package net rates) hit, this parcel shipper was left looking for the leak, with no insight into meaningful data that would provide that answer.

Clearly, none of these parcel shippers set out to negotiate a contract that would have a negative outcome. Each of these, on the day they executed the agreement, probably believed they were saving money.

So how can a company enter negotiations confident that the outcome will be positive? With thousands of unique points to negotiate, it starts with information and insight. Data-driven intelligence applied to a client’s unique shipping characteristics will inform the process, allowing the client the confidence that they are targeting negotiable components that will have the greatest impact on the contract. Rest assured, the carriers have the data and they will be using that data - your data - to negotiate in their favor.

Information, in this case, is best accomplished by benchmarking the contract components against a field of peers. This can be accomplished through trade associations, extensive research of competitor’s costs, interviews, or third party logistics firms, offering benchmarking information and consulting.

However one manages their benchmarking, one thing is certain: once a parcel shipper has executed a new contract, a key tenet of successfully managing their parcel ecosystem is to monitor that contract on an ongoing basis through continuous benchmarking.

Playing poker with the carriers can be dangerous; they know every card in your hand, making it a difficult game to win. With no visibility into the strength of your own hand, the game simply becomes a game of chance - and as we all know, the house always wins in the end.

Unfortunately, this is often the reality of today’s parcel contract negotiating landscape, which is why it is so important for parcel shippers to empower themselves with the necessary data and analysis they need before sitting down at the table.

Source: VeriShip

To learn more about the benefits of optimizing your parcel spend, download our e-book:

Article topics

Email Sign Up