Amid the overall influx of capital to both auto tech and supply chain & logistics tech as a whole, it’s no surprise that trucking tech startups are also drawing a rush of investor interest.

Deals to trucking startups reached a record high in 2016, with 55 deals worth over $750M in aggregate.

Although deal pace in 2017 so far is slightly behind last year, deal sizes are up and total funding is on track to surpass 2016′s total.

Using CB Insights data, we examined investment activity from 2013 to 2017 year-to-date in the trucking tech space.

We define trucking tech broadly as companies developing technology-enabled services and products focused on the freight trucking industry, such as trucking-oriented marketplace platforms, fleet management solutions, onboard monitoring and tracking systems, and trucking-focused ERP systems.

Excluded from our analysis are primarily industrial companies and broad software solutions without a significant trucking emphasis.

Warehousing solutions and robots are also treated separately, as are last-mile logistics and companies working on vehicle electrification.

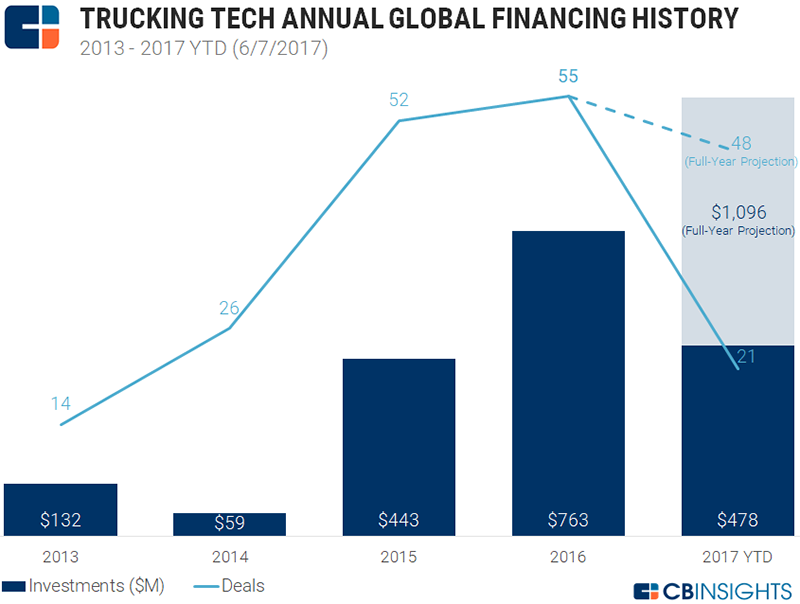

Annual Funding Trends

Trucking startups have raised $478M across 21 deals in 2017 to date (6/7/2017). On an annual basis, although 2017 deal activity is on track to come in slightly behind 2016′s high, total annual funding is on track to surpass last year’s record and top the $1B mark for the first time.

An uptick in larger financings has spurred 2017′s funding figures, including a $156M third tranche of Chinese logistics provider Huochebang‘s Series B led by Baidu Capital. Huochebang raised a substantial $306M in total from Q2’16 to Q2’17. Another notable deal in early 2017 was Peloton Technology‘s $60M Series B, led by Omnitracs.

Quarterly Funding Trends

On a quarterly basis, deal activity reached a high in Q2’16 at 19 deals. Since then, deal activity has fluctuated somewhat, but ticked upwards to 14 in the first quarter of 2017. Deal activity has remained above 10 or more deals for five consecutive quarters. Quarterly funding dollars have also topped $140M every quarter since Q2’16, after eclipsing that mark just once in the quarters prior.

Other notable deals in Q1’17 include G7‘s $45M Series D and BlackBuck‘s $40M second Series C tranche. Despite the decline in deal activity, disclosed funding dollars reached an all-time high in Q4’16. That quarter’s funding dollars were heavily driven by mega-rounds in China such as Huochebang’s $115M financing and Yunmanman‘s $110M Series D.

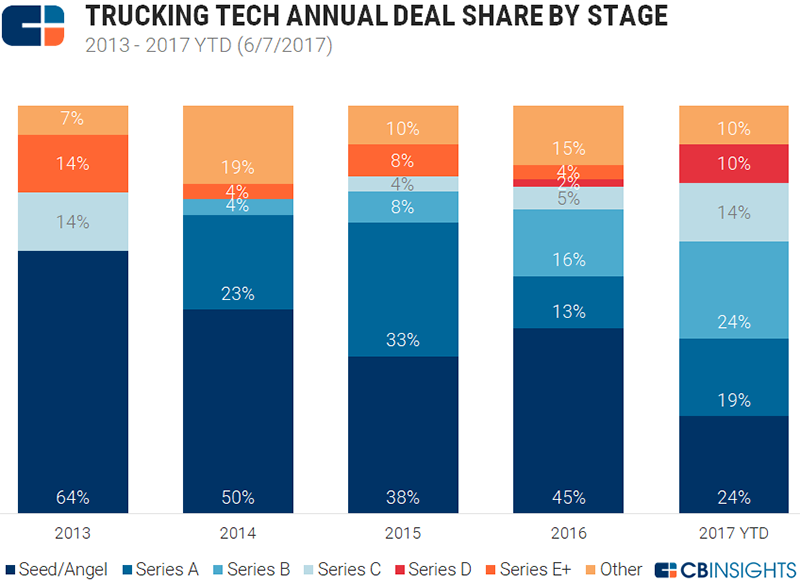

Annual Deal Share by Stage

Early-stage deals (seed & Series A) featured prominently in 2013 and 2014, accounting for over 60% of annual deal activity. Early-stage deal share has dipped since, accounting for 43% of total deal share in 2017 to date. The top early-stage deal in 2017 YTD was a $10M Series A investment to Madrid-based OnTruck and a $10M Series A investment to India-based Fortigo Network Logistics.

Mid-stage (Series B & C) deal share has jumped significantly from 21% in 2016 to 38% in 2017 YTD. Late-stage (Series D+) deals have also featured more prominently in the year so far, including some of the larger financings referenced above. Other deals (including corporate minority and convertible notes) decreased from 15% to 10%.

Related White Papers

2017 Commercial Transportation Trends

As the transportation and logistics industry morphs, traditional rivals will no longer be the sole or even the most threatening competition, incumbents must adapt to keep up with their customers. Download Now!

The Era of Digitized Trucking: Transforming the Logistics Value Chain

The promise of connected trucks combined with the digital supply chain is huge, but so are the risks for those players that don’t move now to begin building the capabilities and business models needed to win in this new world. Download Now!

Industry 4.0: Building the Digital Enterprise

This paper includes a detailed description and definition of Industry 4.0 and how it is being driven by digitisation and integration of vertical and horizontal value chains, digitization of product and service offerings and the development of new digital business models and customer access platforms. Download Now!

Article topics

Email Sign Up