Desktop Metal Inc. and The ExOne Co. today announced that they have entered into a definitive agreement in which Desktop Metal will acquire all of the issued and outstanding shares of ExOne common stock for $575 million.

“Today is a game-changing moment for the additive manufacturing community,” stated Kent Rockwell, chairman of ExOne. “I see incredible opportunity for our customers in working with Desktop Metal and look forward to supporting this new and combined business.”

More and more businesses turning to additive manufacturing expect systems that address their requirements across speed, cost, resolution, and part size, said the companies. Desktop Metal said its acquisition of ExOne will create a comprehensive portfolio combining throughput, flexibility, and materials breadth while allowing customers to optimize production based on their specific application needs.

Desktop Metal, ExOne both 3D printing pioneers

“We are thrilled to bring ExOne into the DM family to create the leading additive manufacturing portfolio for mass production,” said Ric Fulop, founder and CEO of Desktop Metal. “We believe this acquisition will provide customers with more choice as we leverage our complementary technologies and go-to-market efforts to drive continued growth. This transaction is a big step in delivering on our vision of accelerating the adoption of Additive Manufacturing 2.0.”

Experts in advanced manufacturing, metallurgy, and robotics founded Desktop Metal in 2015. The Burlington, Mass.-based company said it is addressing the challenges of speed, cost, and quality to make additive manufacturing an essential tool for engineers and manufacturers around the world. It offers 3D printing for rapid prototyping to mass production.

“We are excited to join forces with Desktop Metal to deliver a more sustainable future through our shared vision of additive manufacturing at high production volumes,” said John Hartner, CEO of ExOne. “We believe our complementary platforms will better serve customers, accelerate adoption of green technologies, and drive increased shareholder value. Most importantly, our technologies will help drive important innovations at meaningful production volumes that can improve the world.”

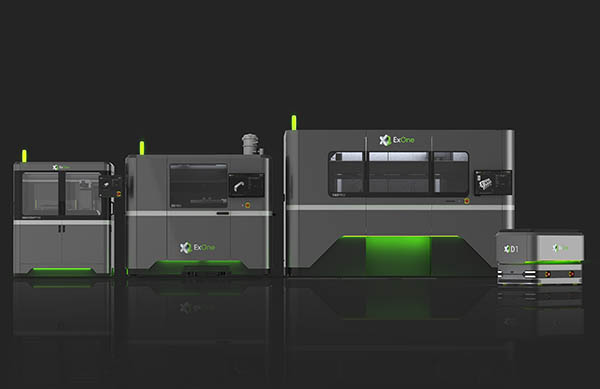

Since 1995, ExOne has delivered binder-jet 3D-printing technology. The North Huntingdon, Pa.-based company claimed that its systems can quickly transform powder materials — including metals, ceramics, composites and sand — into precision parts, metalcasting molds and cores, and tooling.

ExOne added that its industrial customers can use its technology to save time and money, reduce waste, increase their manufacturing flexibility, and deliver designs and products that were once impossible. The company also provides specialized 3D-printing services, including on-demand production of mission-critical parts, as well as engineering and design consulting.

The companies said they will combine ExOne’s direct sales force with Desktop Metal’s global distribution network of over 200 channel partners. As a result, they will offer broader access to additive manufacturing for businesses of all sizes. Desktop Metal and ExOne also said they will continue materials innovation, provide customers with more choice, and drive new application discovery.

Transaction details

Under the terms of the agreement, at closing, ExOne stockholders will receive total consideration of $575 million, consisting of $192 million in cash consideration and $383 million in share consideration of Desktop Metal common stock.

ExOne shareholders will receive $8.50 in cash and $17.00 in shares of Desktop Metal common stock for each share of ExOne common stock, for a total consideration of $25.50 per share. This represents a transaction value of $575 million, subject to a collar mechanism as described below and implying a 47.6% premium to the closing price of ExOne’s common stock on Aug. 11, 2021 and a 43.9% premium based on the 30-day average closing price of ExOne common stock. The transaction value also implies an acquisition multiple of 6.4x 2021 consensus revenue estimates for ExOne.

The share consideration component is subject to an exchange ratio adjustment if Desktop Metal’s 20-day volume weighted average price (VWAP) 3 days prior to closing is between $7.94 and $9.70. If the 20-day VWAP exceeds the higher end of that range, the exchange ratio will be fixed at 1.7522 per share, and if the 20-day VWAP goes below the lower end of that range, the exchange ratio will be fixed at 2.1416 per share.

The final number of Desktop Metal shares estimated to be issued on a fully diluted basis will range between approximately 39.5 million and 48.3 million shares at closing. Upon closing of the transaction, the company's current shareholders will own between 85 and 88%, and current ExOne shareholders are expected to own between 12% and 15% of the combined company, respectively.

Rockwell, the largest shareholder of ExOne, has entered into a support agreement in which he will vote his 4.2 million shares in favor of the transaction. The deal, which has been unanimously approved by the board of directors of ExOne, is expected to close in the fourth quarter of 2021, subject to the approval of ExOne shareholders and satisfaction of customary closing conditions, including applicable regulatory approvals.

Credit Suisse Securities (USA) LLC is acting as exclusive financial advisor, and Latham & Watkins is acting as legal advisor to Desktop Metal. Stifel is acting as exclusive financial advisor, and McGuireWoods LLP is acting as legal advisor to ExOne.

Article topics

Email Sign Up